First Notice of Loss (FNOL) Definition

When filing a First Notice of Loss, there are certain requirements that the policyholder must fulfill. These requirements may vary depending on the insurance company and the specific policy, but generally include the following:

- Prompt Notification: The policyholder must notify the insurance company as soon as reasonably possible after the occurrence of the loss or damage. Prompt notification is essential to ensure a smooth claims process and to prevent any delays or complications.

- Complete and Accurate Information: The policyholder must provide all the necessary details and information related to the loss or damage. This includes the date and time of the incident, a description of what happened, any relevant documents or evidence, and contact information for any involved parties or witnesses.

- Policy Information: The policyholder must provide their policy number and any other relevant policy details to facilitate the claims process. This information allows the insurance company to verify coverage and determine the applicable terms and conditions.

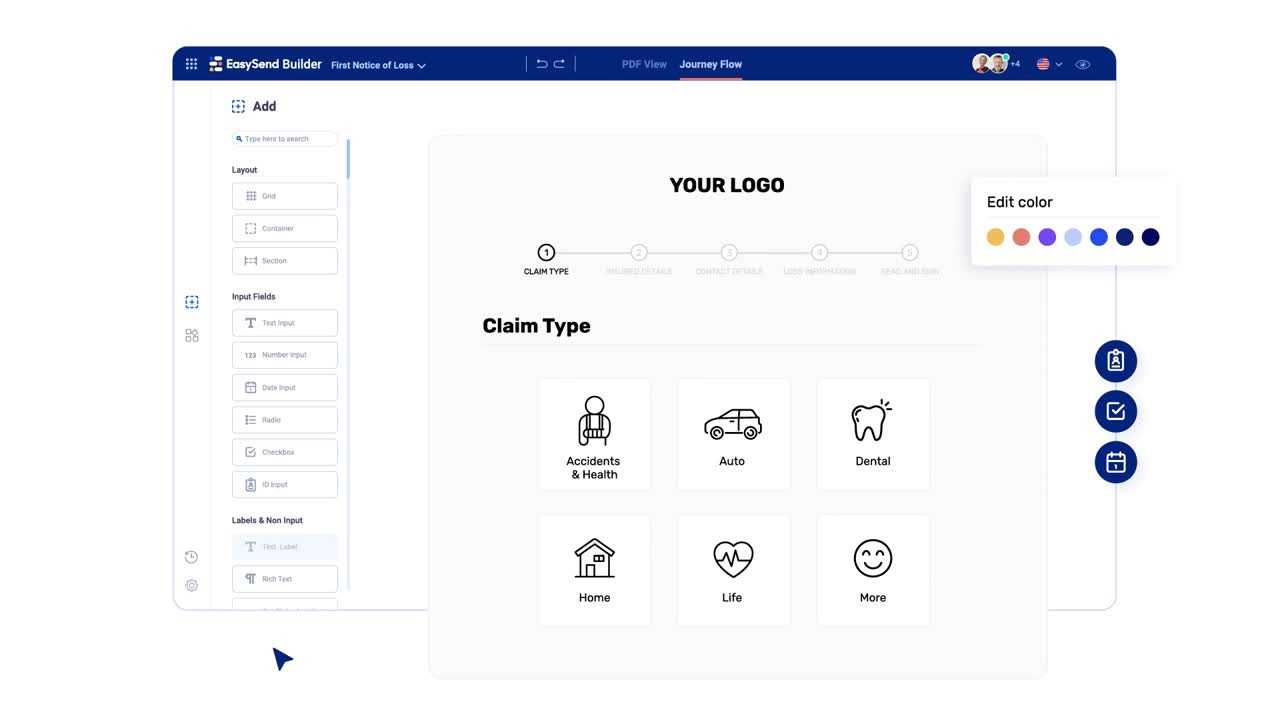

An Example of FNOL Process

To better understand how the First Notice of Loss process works, let’s consider an example:

The claims adjuster requests additional documentation, such as photos of the damage and repair estimates, to support the claim. John promptly provides the requested information. The claims adjuster reviews the documentation and determines that the damage is covered under John’s policy. They then work with John to arrange for the necessary repairs and coordinate any additional assistance, such as temporary housing if needed.

1. Timeliness

One of the key requirements of FNOL is timeliness. Policyholders are expected to report the loss or damage to their insurance company as soon as possible. This is important because delays in reporting can lead to complications in the claims process and may even result in denial of the claim. It is recommended to report the loss within a specified time frame, which is usually mentioned in the insurance policy.

2. Detailed Information

When reporting a loss or damage, it is important to provide detailed information to the insurance company. This includes the date and time of the incident, a description of what happened, and any relevant supporting documentation such as photographs or police reports. The more information provided, the better the insurance company can assess the claim and determine the appropriate course of action.

3. Accurate and Complete Documentation

Accurate and complete documentation is crucial for a successful FNOL. This includes providing accurate contact information, policy details, and any other relevant information requested by the insurance company. Inaccurate or incomplete documentation can lead to delays in the claims process and may even result in the claim being denied.

4. Cooperation and Communication

Policyholders are expected to cooperate with the insurance company throughout the claims process. This includes providing any additional information or documentation requested, attending any necessary meetings or appointments, and keeping the insurance company informed of any changes or developments related to the claim. Good communication between the policyholder and the insurance company is essential to ensure a smooth and efficient claims process.

An Example of FNOL Process

Step 1: Contact the Insurance Company

As soon as an insured event occurs, such as a car accident or property damage, the policyholder should contact their insurance company to initiate the FNOL process. This can typically be done through a dedicated phone number or online portal.

Step 2: Provide Necessary Information

During the initial contact, the policyholder will be asked to provide important details about the loss. This may include the date and time of the incident, a description of what happened, and any relevant documentation or photos.

Step 3: Assess the Claim

Once the insurance company receives the FNOL, they will assign a claims adjuster to assess the claim. The adjuster will review the provided information, investigate the incident if necessary, and determine the coverage and potential payout for the claim.

Step 4: Communicate with the Policyholder

Throughout the FNOL process, the insurance company will maintain communication with the policyholder. This may include updates on the claim’s progress, additional information or documentation required, and any decisions made regarding coverage and payment.

Step 5: Resolve the Claim

Once the claim has been thoroughly assessed and all necessary information has been gathered, the insurance company will make a decision on the claim. This may involve approving the claim and providing the policyholder with the agreed-upon payout, or denying the claim if it does not meet the policy’s coverage criteria.

Step 6: Close the FNOL Process

After the claim has been resolved, the FNOL process is considered closed. The policyholder will be notified of the final decision, and any necessary paperwork or documentation will be provided to complete the process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.