Importance of Managing Economic Exposure

Managing economic exposure is crucial for businesses operating in the global marketplace. Economic exposure refers to the potential impact of fluctuations in exchange rates on a company’s financial performance. It is important to manage economic exposure because it can significantly affect a company’s profitability and competitiveness.

Here are some reasons why managing economic exposure is important:

- Minimize Financial Losses: By managing economic exposure, companies can minimize the financial losses that may arise from unfavorable exchange rate movements. Fluctuations in exchange rates can impact a company’s revenue, costs, and profits. By implementing effective risk management strategies, companies can protect themselves from potential losses.

- Enhance Competitiveness: Managing economic exposure can help companies maintain their competitiveness in the global market. Fluctuations in exchange rates can affect the relative prices of goods and services, making them more or less expensive for customers in different countries. By managing economic exposure, companies can adjust their pricing strategies to remain competitive and attract customers.

- Expand Global Operations: Managing economic exposure can enable companies to expand their global operations with confidence. Fluctuations in exchange rates can create uncertainties and risks for companies operating in foreign markets. By effectively managing economic exposure, companies can mitigate these risks and seize opportunities for growth and expansion.

- Build Investor Confidence: Managing economic exposure can help companies build investor confidence. Fluctuations in exchange rates can impact a company’s financial performance and its ability to generate returns for investors. By demonstrating effective risk management practices and a proactive approach to managing economic exposure, companies can attract and retain investors.

Factors Affecting Economic Exposure

Economic exposure refers to the potential impact that changes in exchange rates can have on a company’s financial performance. It is important for businesses to understand the factors that can affect their economic exposure in order to effectively manage and mitigate risks.

1. Foreign Currency Transactions

2. Competitive Environment

The competitive environment in which a company operates can also affect its economic exposure. Companies that operate in highly competitive industries may face increased pressure to maintain competitive pricing, even in the face of unfavorable exchange rate movements. This can impact profit margins and overall financial performance.

3. Macroeconomic Factors

4. Political and Regulatory Factors

Political and regulatory factors can also play a role in economic exposure. Changes in government policies, trade agreements, or regulations can impact exchange rates and create uncertainty for businesses operating in foreign markets. Companies need to closely monitor and assess the potential impact of such factors on their economic exposure.

5. Hedging Strategies

The use of hedging strategies can also affect economic exposure. Hedging involves using financial instruments, such as forward contracts or options, to mitigate the impact of exchange rate fluctuations. Companies that effectively hedge their foreign currency exposures can reduce their economic exposure and minimize the potential negative impact on their financial performance.

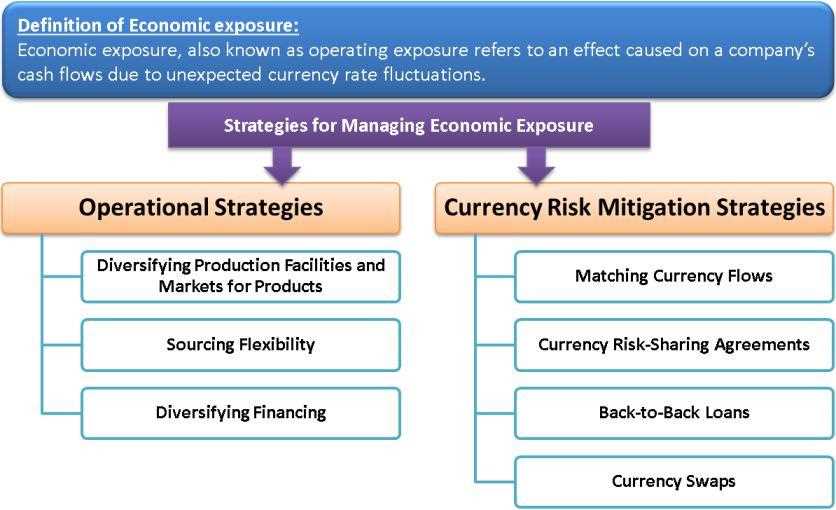

Strategies for Managing Economic Exposure

Managing economic exposure is crucial for businesses operating in the global market. Here are some effective strategies to mitigate the risks associated with economic exposure:

1. Diversification

Diversification is a strategy that involves spreading investments across different currencies, countries, and industries. By diversifying their operations and investments, companies can reduce the impact of economic fluctuations in a specific market or currency. This strategy helps to minimize the potential losses caused by exchange rate movements and other economic factors.

2. Hedging

Hedging is a risk management technique that involves using financial instruments to offset potential losses. Companies can use various hedging instruments, such as forward contracts, futures contracts, options, and swaps, to protect themselves against adverse currency movements. By hedging their currency exposures, businesses can lock in exchange rates and reduce the uncertainty associated with economic fluctuations.

3. Netting

Netting is a strategy that involves offsetting payables and receivables denominated in different currencies. By consolidating their currency exposures and settling the net amount, companies can reduce the impact of exchange rate fluctuations. This strategy helps to simplify currency management and minimize transaction costs.

4. Pricing and Cost Management

Companies can manage economic exposure by adjusting their pricing and cost structures. By pricing their products or services in the local currency of the target market, businesses can reduce the impact of exchange rate fluctuations on their revenues. Additionally, optimizing cost structures, such as sourcing inputs from different countries or negotiating favorable contracts, can help mitigate the impact of economic exposure.

5. Financial Risk Management

Implementing effective financial risk management practices is essential for managing economic exposure. This includes regularly monitoring and analyzing economic indicators, exchange rates, and market trends. By staying informed about the economic conditions in different markets, companies can make informed decisions and take appropriate actions to mitigate risks.

| Benefits | Challenges |

|---|---|

| Reduced vulnerability to economic fluctuations | Complexity of managing multiple currencies and markets |

| Enhanced competitiveness in global markets | Costs associated with hedging and diversification |

| Improved financial stability | Uncertainty in predicting future economic conditions |

By implementing these strategies and continuously monitoring economic conditions, businesses can effectively manage their economic exposure and minimize the risks associated with operating in the global market.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.