What is an ECN Broker?

An ECN (Electronic Communication Network) broker is a type of forex broker that uses a computerized system to connect traders directly to liquidity providers, such as banks and other financial institutions. This allows for transparent and direct trading without the need for a middleman.

ECN brokers provide traders with access to the interbank market, where large financial institutions trade currencies. They act as a bridge between the trader and the liquidity providers, ensuring that trades are executed at the best available prices.

Unlike traditional brokers, ECN brokers do not make money from spreads. Instead, they charge a small commission for each trade. This means that traders can often get better pricing and tighter spreads compared to dealing with a market maker or a traditional broker.

One of the key advantages of using an ECN broker is the transparency it offers. Since trades are executed directly with liquidity providers, there is no conflict of interest between the broker and the trader. This reduces the risk of price manipulation and ensures fair trading conditions.

Another benefit of using an ECN broker is the ability to trade during news events and volatile market conditions. ECN brokers typically have deep liquidity pools, which means that traders can execute trades quickly and at the best available prices, even during periods of high market volatility.

However, there are also some disadvantages to using an ECN broker. One of the main drawbacks is the higher cost of trading. While ECN brokers offer competitive spreads, they charge a commission for each trade, which can add up for frequent traders. Additionally, ECN brokers may require higher minimum deposit amounts compared to traditional brokers.

Definition, Working Mechanism, Advantages, and Disadvantages of ECN Brokers

An ECN (Electronic Communication Network) broker is a type of forex broker that uses electronic systems to match buy and sell orders from traders. Unlike traditional brokers who act as intermediaries between traders and the market, ECN brokers provide direct access to the interbank market, where large financial institutions trade currencies.

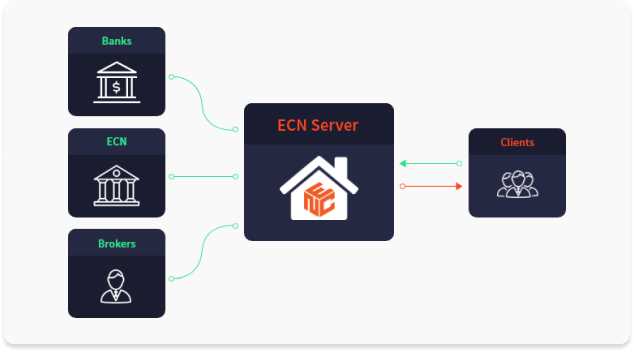

The working mechanism of an ECN broker involves connecting traders to a network of liquidity providers, such as banks, hedge funds, and other traders. When a trader places an order, it is sent to the ECN broker’s network, where it is matched with the best available price from multiple liquidity providers. This ensures that traders get the most competitive spreads and fast execution of their orders.

However, there are also some disadvantages of using an ECN broker. One of the main drawbacks is the commission fees charged by ECN brokers. Unlike traditional brokers who make money from the spread, ECN brokers charge a fixed commission per trade. This can increase trading costs, especially for traders who execute a large number of trades. Additionally, ECN brokers may have higher minimum deposit requirements compared to traditional brokers, which can be a barrier for beginner traders with limited capital.

Definition of ECN Broker

An ECN (Electronic Communication Network) broker is a type of forex broker that uses an electronic system to connect traders directly with liquidity providers, such as banks, financial institutions, and other traders. Unlike traditional brokers who act as intermediaries between traders and the market, ECN brokers provide a direct link to the market, allowing traders to access real-time prices and execute trades with minimal delay.

ECN brokers operate on a no-dealing desk (NDD) model, which means they do not take the opposite side of their clients’ trades. Instead, they match buy and sell orders from different market participants, ensuring transparent and fair trading conditions. This eliminates the potential for conflicts of interest that may arise when brokers act as market makers.

ECN brokers also provide access to advanced trading tools, such as order types, charting capabilities, and algorithmic trading options. These features enable traders to implement various trading strategies and automate their trading activities.

An ECN (Electronic Communication Network) broker is a type of forex broker that operates using an electronic communication network to connect traders directly with liquidity providers, such as banks and other financial institutions. This direct connection allows for faster and more efficient trade execution, as well as access to deeper liquidity and tighter spreads.

When a trader places an order with an ECN broker, the order is sent directly to the liquidity providers in the network. The liquidity providers then compete to fill the order at the best available price. This means that traders have access to a transparent market where prices are determined by supply and demand.

Unlike traditional market makers, ECN brokers do not take the opposite side of their clients’ trades. Instead, they act as intermediaries, matching buy and sell orders from different market participants. This eliminates any potential conflict of interest and ensures that traders receive fair and unbiased trade execution.

Advantages of ECN Brokers

There are several advantages to trading with an ECN broker:

- Deep Liquidity: By connecting traders directly with liquidity providers, ECN brokers offer access to deep liquidity. This means that traders can execute large orders without significantly impacting the market.

- Fast Execution: The direct connection to liquidity providers enables ECN brokers to offer fast trade execution. This is especially important for scalpers and day traders who rely on quick market movements.

- Transparent Market: ECN brokers provide a transparent market where prices are determined by supply and demand. This ensures fair and unbiased trade execution.

- No Conflict of Interest: Unlike market makers, ECN brokers do not take the opposite side of their clients’ trades. This eliminates any potential conflict of interest and ensures that brokers are not trading against their clients.

Disadvantages of ECN Brokers

While there are many advantages to trading with an ECN broker, there are also some disadvantages to consider:

- Higher Costs: ECN brokers typically charge a commission for each trade. This can increase the overall cost of trading, especially for high-volume traders.

- Minimum Deposit Requirements: Some ECN brokers have higher minimum deposit requirements compared to other types of brokers. This may limit the accessibility of ECN trading for some traders.

- Complexity: ECN trading can be more complex compared to trading with a traditional market maker. Traders need to understand how the ECN works and how to navigate the platform effectively.

- Market Volatility: Due to the direct connection to liquidity providers, ECN brokers may experience increased volatility during times of market instability. This can result in slippage and wider spreads.

Overall, trading with an ECN broker can offer many benefits, such as tight spreads, deep liquidity, and fast execution. However, it is important for traders to consider the potential disadvantages and determine if ECN trading aligns with their trading style and goals.

Advantages and Disadvantages of ECN Brokers

Advantages of ECN Brokers:

| Advantage | Description |

|---|---|

| Tight Spreads | ECN brokers typically offer tighter spreads compared to traditional brokers. This means traders can potentially save money on transaction costs. |

| Direct Market Access | ECN brokers provide direct market access, allowing traders to interact with liquidity providers and participate in the interbank market. This can result in faster execution and better pricing. |

| No Conflict of Interest | ECN brokers do not act as market makers, which eliminates any conflict of interest. They simply connect buyers and sellers in the market, ensuring transparency and fair trading conditions. |

| Depth of Market | ECN brokers display the depth of market, showing the available liquidity and order sizes at different price levels. This information can be valuable for traders who use order flow analysis. |

| Lower Trading Costs | Due to their direct market access and competitive spreads, ECN brokers can offer lower trading costs overall. This can be especially beneficial for high-volume traders. |

Disadvantages of ECN Brokers:

| Disadvantage | Description |

|---|---|

| Commission Fees | ECN brokers typically charge commission fees for each trade, in addition to the spread. This can increase the overall transaction costs for traders. |

| Minimum Deposit Requirements | Some ECN brokers may have higher minimum deposit requirements compared to traditional brokers. This can be a barrier for beginner traders with limited capital. |

| Complexity | ECN trading can be more complex compared to trading with traditional brokers. Traders need to understand market depth, order types, and liquidity provider relationships. |

| Slippage | Due to the nature of ECN trading, there is a possibility of experiencing slippage. This means that the executed trade price may differ from the expected price, especially during volatile market conditions. |

| Requires Fast and Stable Internet Connection | ECN trading requires a fast and stable internet connection to ensure timely execution of trades. Traders with unreliable internet connections may face difficulties in trading effectively. |

Overall, ECN brokers offer advantages such as tight spreads, direct market access, and transparency, but they also come with disadvantages such as commission fees and complexity. Traders should carefully consider their trading style and preferences before choosing an ECN broker.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.