What is Eclectic Paradigm?

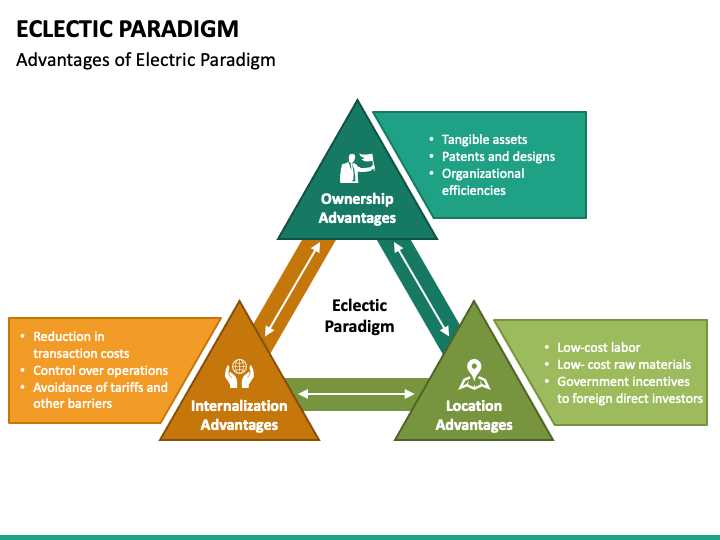

Ownership advantages refer to the unique resources, capabilities, or knowledge that a company possesses, which give it a competitive edge over other firms. These advantages can include brand reputation, patented technology, managerial expertise, or access to distribution networks.

Location advantages refer to the benefits that a company can gain by locating its operations in a particular country or region. These advantages can include access to raw materials, proximity to key markets, favorable government policies, or a skilled labor force.

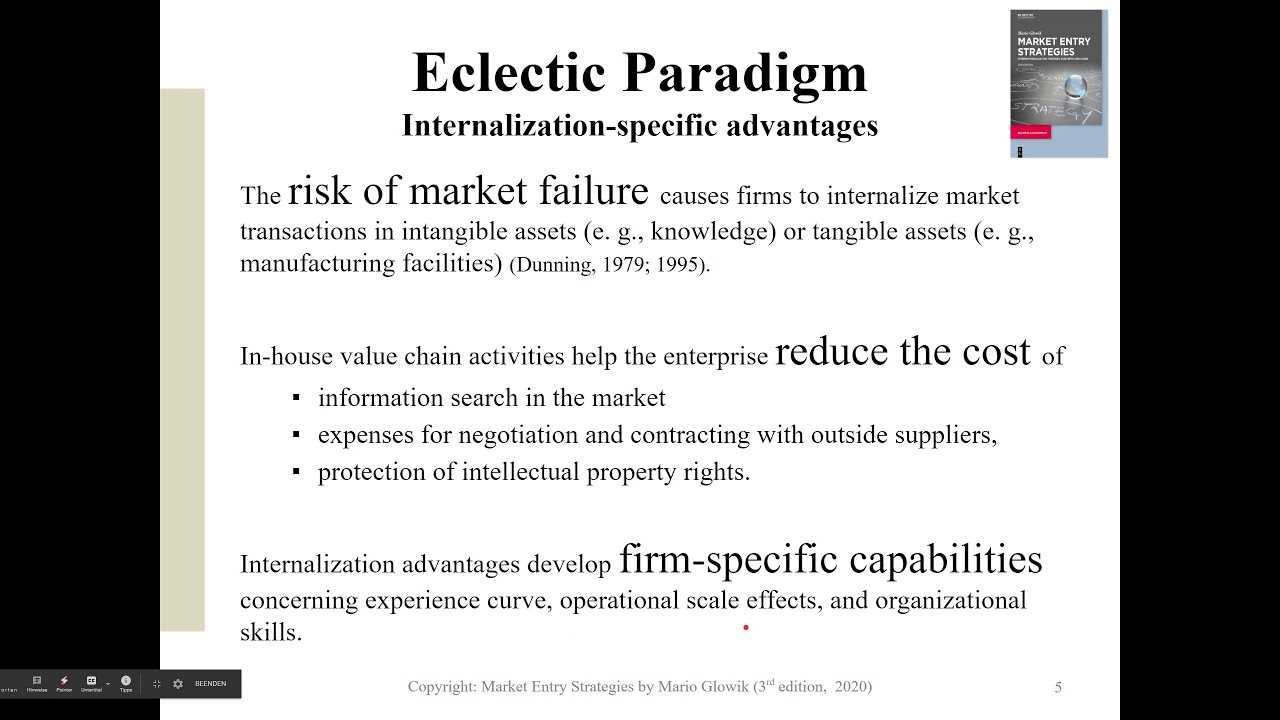

Internalization advantages refer to the benefits that a company can gain by directly controlling its foreign operations, rather than relying on external partners or intermediaries. By internalizing its operations, a company can have greater control over its resources, protect its proprietary knowledge, and capture a larger share of the profits.

The eclectic paradigm suggests that companies will engage in FDI when the benefits of combining ownership advantages, location advantages, and internalization advantages outweigh the costs and risks associated with operating in a foreign market. By leveraging their unique advantages and strategically selecting the right locations, companies can expand their global presence, access new markets, and achieve sustainable competitive advantage.

Definition and Explanation

The eclectic paradigm is a theory in international business that seeks to explain why firms choose to engage in foreign direct investment (FDI) and how they choose the location for their investments. It was developed by economist John Dunning in the late 1970s and has since become one of the most influential theories in the field of international business.

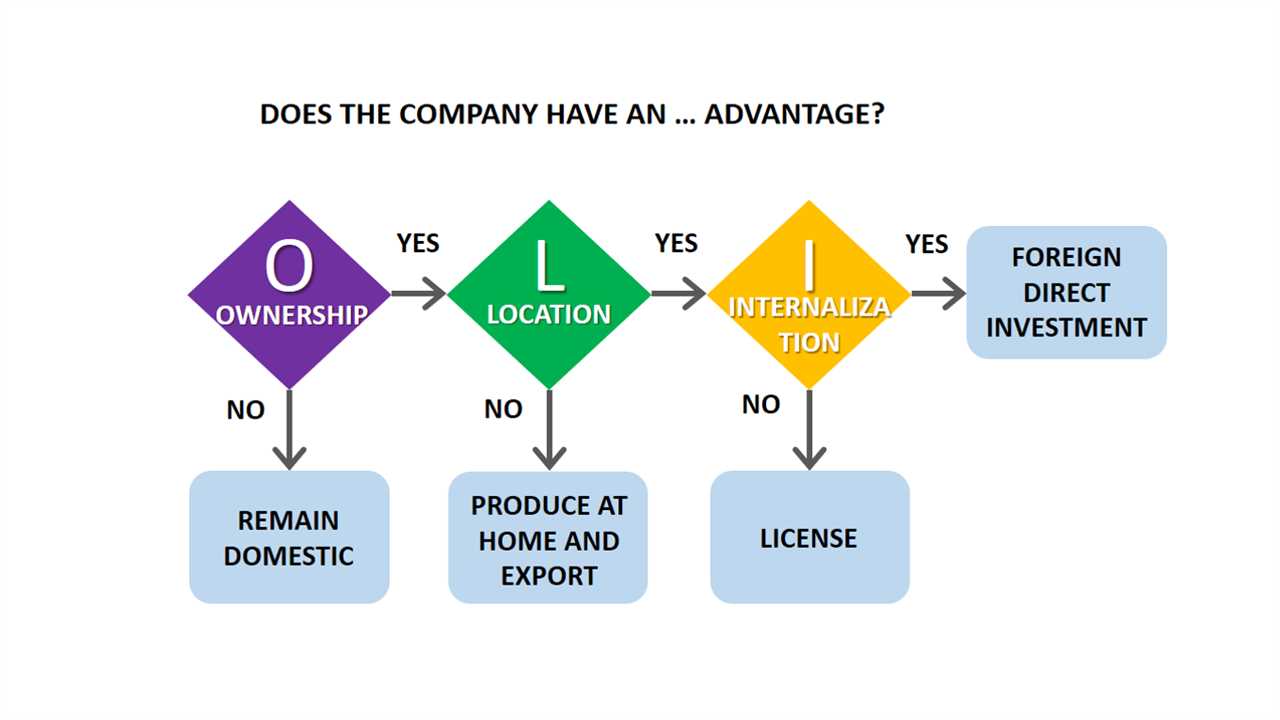

The eclectic paradigm is based on the idea that firms engage in FDI when they possess three types of advantages: ownership advantages, location advantages, and internalization advantages. Ownership advantages refer to the firm’s unique assets, such as technology, brand reputation, or managerial expertise, that give it a competitive advantage over local firms in the foreign market. Location advantages refer to the attractiveness of a particular country or region as a destination for FDI, such as its market size, natural resources, or political stability. Internalization advantages refer to the firm’s ability to exploit its ownership advantages more effectively through direct control over foreign operations, rather than relying on licensing or exporting.

The eclectic paradigm suggests that firms will choose to engage in FDI when the benefits of owning and controlling foreign assets outweigh the costs and risks associated with operating in a foreign market. It also suggests that firms will choose the location for their investments based on the availability and attractiveness of location-specific advantages, such as access to key inputs, proximity to customers, or favorable government policies.

Example of Eclectic Paradigm

The eclectic paradigm is a theoretical framework that seeks to explain the determinants of international production and the choice of foreign direct investment (FDI) by multinational corporations (MNCs). It was first proposed by economist John H. Dunning in the late 1970s and has since become a widely accepted approach in the field of international business.

To illustrate the concept of the eclectic paradigm, let’s consider the example of a multinational automobile company, XYZ Motors, that is considering expanding its operations into a foreign market, Country A. XYZ Motors has identified several potential advantages of investing in Country A, including access to a large consumer market, a skilled labor force, and favorable government policies that support foreign investment.

According to the eclectic paradigm, XYZ Motors will evaluate these advantages based on three key factors: ownership advantages, location advantages, and internalization advantages. Ownership advantages refer to the unique assets and capabilities that XYZ Motors possesses, such as its brand reputation, technological know-how, and production expertise. Location advantages refer to the specific benefits that Country A offers, such as a favorable business environment, infrastructure, and proximity to suppliers or customers. Internalization advantages refer to the benefits of integrating the foreign operations into XYZ Motors’ existing organizational structure, such as cost savings, control over operations, and the ability to transfer knowledge and skills.

Based on these factors, XYZ Motors will assess whether it is more advantageous to enter the foreign market through various modes of entry, such as exporting, licensing, joint ventures, or wholly-owned subsidiaries. For example, if XYZ Motors’ ownership advantages are strong and the location advantages in Country A are significant, it may choose to establish a wholly-owned subsidiary to fully exploit these advantages and maintain control over its operations. On the other hand, if the ownership advantages are not as substantial and the location advantages are moderate, XYZ Motors may opt for a joint venture with a local partner to leverage their knowledge of the local market and share the risks and costs of entry.

Advantages of Eclectic Paradigm in M&A

1. Access to New Markets

One of the main advantages of the Eclectic Paradigm in M&A is the access to new markets. By acquiring a company in a foreign market, a firm can quickly enter and establish a presence in that market. This allows the acquiring firm to tap into new customer bases, distribution channels, and opportunities for growth. With the help of the acquired company’s local knowledge and resources, the acquiring firm can navigate the complexities of the foreign market more effectively.

2. Diversification of Risks

M&A activities based on the Eclectic Paradigm can also help firms diversify their risks. By acquiring companies in different markets, industries, or regions, firms can spread their risks and reduce their dependence on a single market or product. This diversification strategy can help firms mitigate the impact of economic downturns, changes in consumer preferences, or other market-specific risks. It allows firms to have a more balanced portfolio and increase their resilience in the face of uncertainties.

3. Knowledge and Technology Transfer

Another advantage of the Eclectic Paradigm in M&A is the opportunity for knowledge and technology transfer. When a firm acquires another company, it gains access to its intellectual property, expertise, and technological capabilities. This transfer of knowledge and technology can enhance the acquiring firm’s competitiveness and innovation potential. It allows the firm to leverage the acquired company’s resources and capabilities to improve its own operations, products, and services.

4. Economies of Scale and Scope

M&A activities based on the Eclectic Paradigm can also lead to economies of scale and scope. By combining the operations, production facilities, and distribution networks of two companies, firms can achieve cost savings and operational efficiencies. This can result in lower production costs, higher productivity, and improved profitability. Additionally, the combined resources and capabilities of the merged companies can create synergies that enable the development of new products, entry into new markets, or expansion of existing market share.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.