What is a Discretionary Order?

A discretionary order is a type of trading order that gives an investment manager the authority to make investment decisions on behalf of a client without obtaining their prior approval for each transaction. This type of order allows the investment manager to act quickly and efficiently in response to market conditions and investment opportunities.

How Does a Discretionary Order Work?

When a client gives their investment manager discretionary authority, they are essentially granting them the power to make investment decisions on their behalf. This means that the investment manager can buy, sell, or trade securities without having to consult the client for approval before each transaction.

However, it is important to note that the investment manager must still adhere to certain guidelines and objectives set by the client. These guidelines may include risk tolerance, investment objectives, and any specific restrictions or preferences the client may have.

By giving the investment manager discretionary authority, the client is entrusting them with the responsibility of making investment decisions that align with their overall investment strategy. This allows the investment manager to act quickly and take advantage of market opportunities without delay.

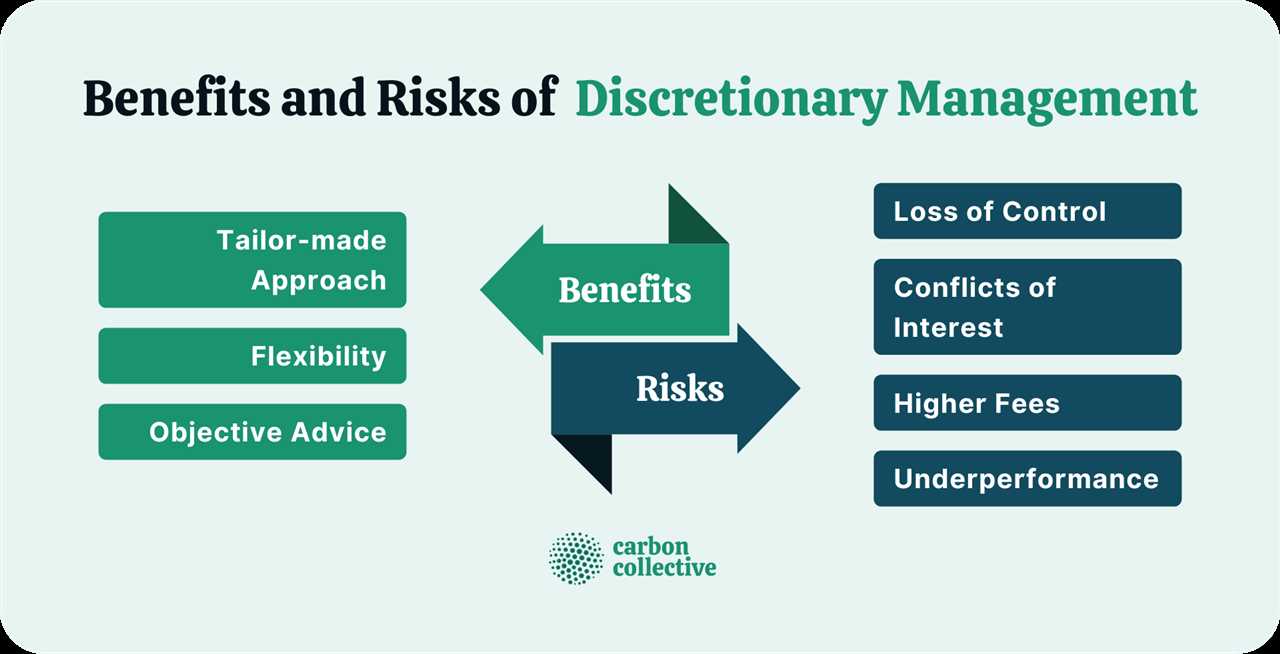

Benefits of Discretionary Orders

There are several benefits to using discretionary orders in investment management:

- Efficiency: Discretionary orders allow investment managers to act quickly in response to market conditions, which can help take advantage of investment opportunities.

- Expertise: Clients can benefit from the expertise and knowledge of their investment manager, who has experience and insights into the financial markets.

- Time-saving: By granting discretionary authority, clients can save time by not having to review and approve each individual investment decision.

- Diversification: Investment managers can use discretionary orders to diversify a client’s portfolio by making investments across different asset classes and sectors.

Overall, discretionary orders provide flexibility and efficiency in investment management, allowing investment managers to make informed decisions on behalf of their clients while considering their investment objectives and risk tolerance.

Meaning of Discretionary Order

However, it is important to note that the investment manager still has a fiduciary duty to act in the best interests of the client when exercising discretion. They must adhere to the client’s investment objectives and follow any guidelines or restrictions set by the client. The investment manager should also provide regular reports and updates to the client regarding the performance of their portfolio and any changes made.

Advantages of Discretionary Orders

There are several advantages to using discretionary orders in investment management:

- Efficiency: Discretionary orders allow investment managers to make timely decisions and execute trades without the need for constant client approval, which can help to take advantage of market opportunities and react to changing market conditions.

- Expertise: Clients can benefit from the expertise and experience of the investment manager, who can use their knowledge of the market to make informed investment decisions on their behalf.

- Convenience: Discretionary orders relieve the client of the burden of having to make individual investment decisions and monitor the market on a regular basis. They can trust that their investment manager is actively managing their portfolio.

Disadvantages of Discretionary Orders

While discretionary orders offer certain advantages, there are also potential disadvantages to consider:

- Loss of Control: By giving the investment manager discretion, the client relinquishes some control over their investment decisions. They must trust that the investment manager will act in their best interests and adhere to their investment objectives.

- Risk of Poor Performance: If the investment manager makes poor investment decisions or fails to properly manage the portfolio, it can result in subpar performance and potential financial losses for the client.

- Higher Fees: Investment managers who have discretion over client portfolios may charge higher fees compared to those who only provide advisory services. This is because they are taking on more responsibility and actively managing the client’s investments.

Examples of Discretionary Orders

A discretionary order is a type of trading order that gives an investment manager the authority to make decisions on behalf of a client without obtaining their prior approval for each transaction. Here are some examples of discretionary orders:

1. Buy and Hold Strategy

2. Stop-Loss Orders

3. Sector Rotation Strategy

4. Market Timing Orders

These are just a few examples of discretionary orders in investment management. The specific types of discretionary orders used may vary depending on the investment manager’s strategy, client’s objectives, and market conditions. It is important for clients to understand the terms and conditions of discretionary orders and have trust in their investment manager’s expertise and judgment.

Investment Management and Discretionary Orders

Discretionary orders are particularly useful in situations where clients trust their investment managers to make informed decisions based on their investment objectives and risk tolerance. By giving investment managers discretion, clients can benefit from the expertise and knowledge of professionals who are well-versed in the intricacies of the financial markets.

One example of a discretionary order in investment management is when a client gives their investment manager the authority to trade on their behalf within certain parameters. For instance, a client may specify that the investment manager can buy or sell a particular stock as long as it stays within a certain price range. This allows the investment manager to take advantage of market opportunities without having to seek permission for each trade.

Another example of a discretionary order is when a client grants their investment manager the authority to make investment decisions based on a specific investment strategy. For example, a client may want their investment manager to focus on growth stocks or value stocks. By giving the investment manager discretion, the client allows them to make investment decisions based on their expertise and knowledge of the chosen investment strategy.

Investment management firms often have a team of professionals who specialize in different areas of the financial markets. By utilizing discretionary orders, these professionals can work together to create a diversified investment portfolio that aligns with the client’s investment goals and risk tolerance.

Overall, discretionary orders are an essential tool in investment management. They allow investment managers to act quickly and make informed decisions on behalf of their clients. By giving investment managers discretion, clients can benefit from the expertise and knowledge of professionals who are dedicated to helping them achieve their financial goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.