Purpose of a Deposit Slip

A deposit slip is a form that is used to deposit money into a bank account. It serves several important purposes:

1. Record Keeping:

2. Accuracy:

By using a deposit slip, the account holder can ensure that the money being deposited is credited to the correct account. The slip includes the account number, which acts as a reference to ensure that the funds are allocated correctly.

3. Proof of Deposit:

A deposit slip also serves as proof that the money was deposited. It includes a unique transaction number or deposit receipt that can be used as evidence in case of any discrepancies or disputes.

4. Convenience:

Using a deposit slip makes the deposit process more convenient for both the bank and the account holder. It provides a standardized format for entering the necessary information, making it easier and faster to process the transaction.

5. Compliance:

Deposit slips also help banks comply with regulatory requirements. They provide a paper trail of all deposits made, which can be useful for auditing purposes and ensuring that all transactions are properly recorded.

Process of Filling Out a Deposit Slip

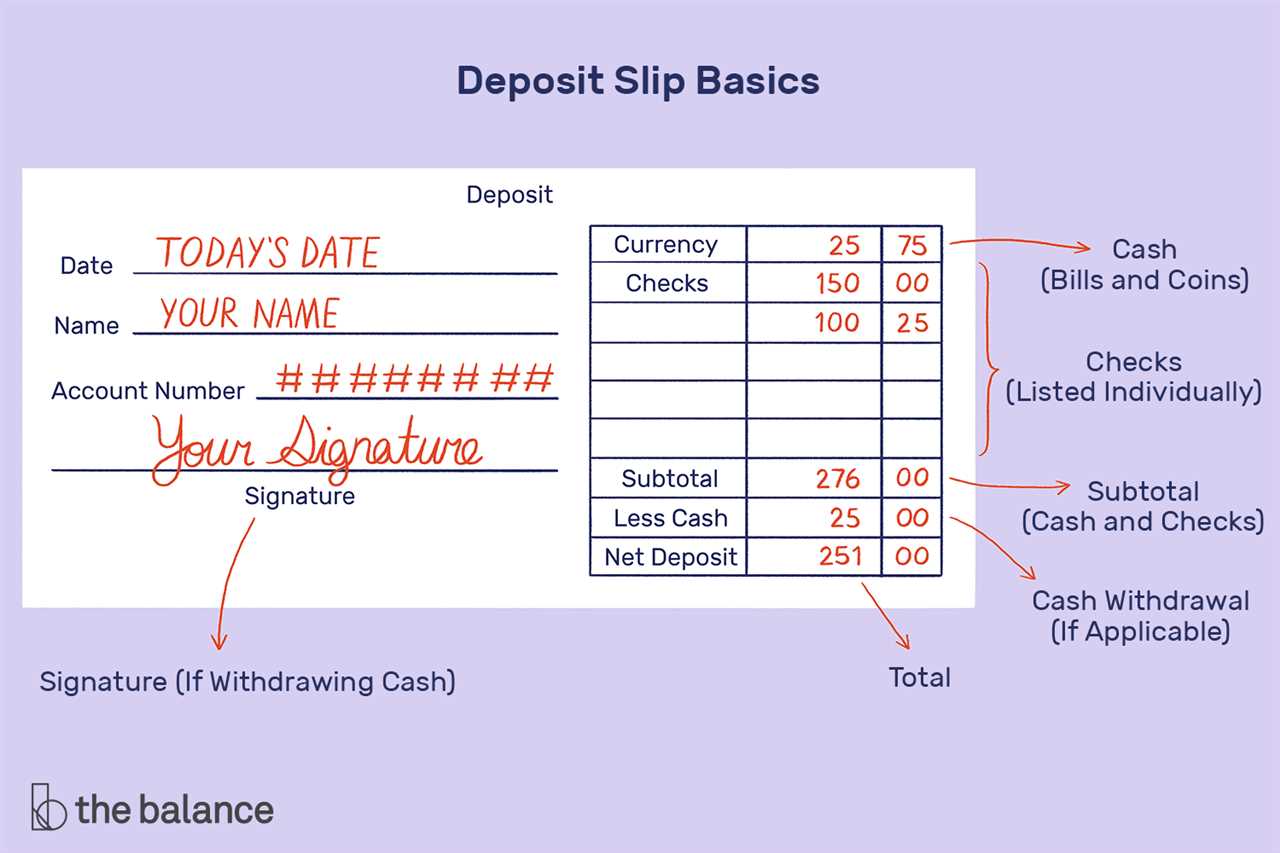

Step 1: Write the Date

The first step in filling out a deposit slip is to write the date of the deposit. This helps the bank identify when the deposit was made and keep track of transactions.

Step 2: Fill in Your Account Information

Next, you need to provide your account information. This includes writing your account number, which is unique to your bank account. Make sure to double-check the number to avoid any errors.

Step 3: Enter the Total Amount of Cash

If you are depositing cash, count the bills and coins and enter the total amount in the “Cash” section of the deposit slip. Be careful to write the amount clearly to avoid any confusion.

Step 4: List the Amount of Checks

If you have any checks to deposit, list each check individually. Write the check number, the name of the issuing bank, and the amount of the check. Make sure to double-check the information to ensure accuracy.

Step 5: Calculate the Total Deposit

Add up the total amount of cash and checks to calculate the overall deposit amount. Write this total in the “Total Deposit” section of the deposit slip. Again, be sure to write the amount clearly and double-check for accuracy.

Step 6: Sign the Deposit Slip

Finally, sign the deposit slip to authorize the transaction. Your signature confirms that the information provided is accurate and that you authorize the bank to deposit the funds into your account.

Once you have completed filling out the deposit slip, you can submit it along with your cash and checks to the bank teller. They will process the deposit and provide you with a receipt for your records.

By following these steps and properly filling out a deposit slip, you can ensure that your funds are deposited accurately and efficiently. This helps streamline the banking process and provides a clear record of your transactions.

Advantages of Using a Deposit Slip

Using a deposit slip offers several advantages for both banks and customers. Here are some of the key benefits:

1. Accuracy:

By using a deposit slip, you can ensure the accuracy of your deposit. The slip provides a structured format for recording the amount of cash and checks being deposited, reducing the chances of errors or discrepancies.

2. Record keeping:

3. Efficiency:

Using a deposit slip can help streamline the deposit process. It allows you to organize your cash and checks in a systematic manner, making it easier for the bank teller to process your deposit quickly and accurately. This can save you time and effort when making deposits.

4. Security:

Deposit slips often include security features such as unique serial numbers or barcodes. These features help prevent fraud and ensure that your deposit is securely processed. By using a deposit slip, you can have peace of mind knowing that your funds are being handled securely.

5. Documentation:

Having a deposit slip provides a paper trail for your deposit. In case of any disputes or discrepancies, you can refer to the deposit slip as evidence of your deposit. This can be especially useful when dealing with larger deposits or when making deposits for business purposes.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.