What is Deleverage?

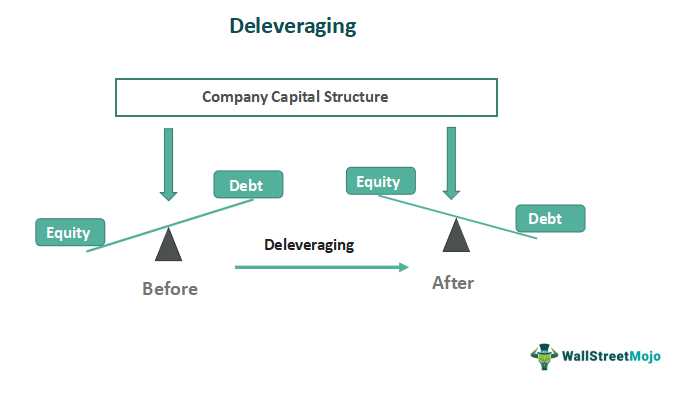

Deleverage is a financial term that refers to the process of reducing or eliminating debt in order to improve a company’s financial position. It involves decreasing the amount of debt relative to equity, which can help to reduce financial risk and increase the company’s ability to withstand economic downturns.

When a company deleverages, it typically does so by using its profits to pay down debt, rather than taking on additional debt. This can be done through a variety of methods, such as selling assets, cutting costs, or increasing revenue. By reducing debt, a company can lower its interest expenses and improve its cash flow, which can lead to increased profitability and a stronger balance sheet.

Deleveraging is often seen as a positive step for companies that have taken on too much debt and are struggling to meet their financial obligations. It can help to restore investor confidence, as it demonstrates a commitment to improving the company’s financial health and reducing risk.

However, deleveraging is not without its challenges. It can be a difficult and time-consuming process, particularly for companies with a large amount of debt. It may require making tough decisions, such as selling off valuable assets or cutting back on expenses, which can impact the company’s operations and growth potential.

Illustrations and Equations of Deleverage

One way to illustrate the concept of deleverage is through a simple equation. The equation is as follows:

Deleverage Ratio = Total Debt / Equity

This equation represents the ratio of a company’s total debt to its equity. A higher deleverage ratio indicates that a company has more debt relative to its equity, while a lower ratio indicates less debt and more equity. By reducing its debt, a company can lower its deleverage ratio and improve its financial position.

Let’s consider an example to further illustrate the concept. Company XYZ has a total debt of $1,000,000 and equity of $500,000. Using the deleverage ratio equation, we can calculate the ratio as follows:

Deleverage Ratio = $1,000,000 / $500,000 = 2

This means that Company XYZ has a deleverage ratio of 2, indicating that its total debt is twice the size of its equity. To reduce its debt and improve its financial position, Company XYZ decides to pay off $200,000 of its debt. After the debt repayment, the company’s total debt is reduced to $800,000. We can recalculate the deleverage ratio as follows:

Deleverage Ratio = $800,000 / $500,000 = 1.6

By reducing its debt, Company XYZ has successfully lowered its deleverage ratio from 2 to 1.6. This indicates that the company now has less debt relative to its equity, which can improve its financial stability and flexibility.

Another illustration of deleverage can be seen through the concept of leverage. Leverage refers to the use of borrowed funds to finance investments or operations. When a company has a high level of debt, it is said to be highly leveraged. By deleveraging, a company reduces its reliance on borrowed funds and decreases its financial risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.