What is a Blended Rate?

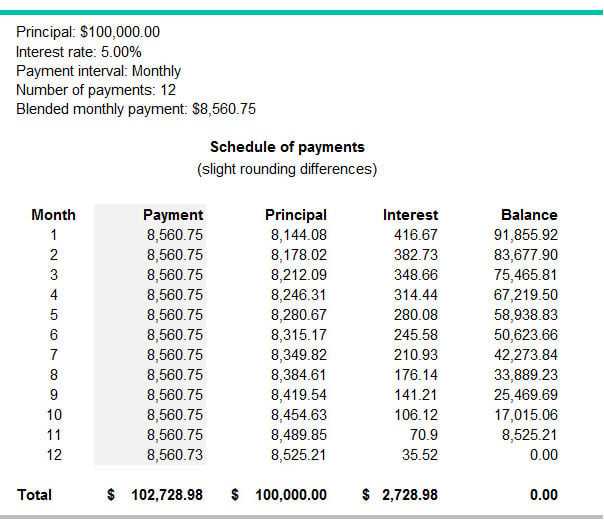

A blended rate is a weighted average interest rate that combines multiple interest rates into a single rate. It is commonly used in financial calculations to determine the overall cost or return of a loan or investment that has different interest rates at different times or for different portions of the principal amount.

The blended rate takes into account the size or duration of each interest rate component, giving more weight to the rates that have a larger impact on the overall calculation. This allows for a more accurate representation of the true cost or return of the loan or investment.

The formula for calculating the blended rate is:

Blended Rate = (Principal 1 * Rate 1 + Principal 2 * Rate 2 + … + Principal n * Rate n) / Total Principal

Where Principal 1, Principal 2, …, Principal n are the principal amounts subject to each interest rate, and Rate 1, Rate 2, …, Rate n are the corresponding interest rates.

The blended rate is an important tool for borrowers and investors to evaluate the overall cost or return of a loan or investment. By considering the different interest rates and their impact on the total amount, it provides a more accurate picture of the financial outcome.

Definition and Explanation

A blended rate is a weighted average interest rate that is calculated by combining multiple interest rates into a single rate. This rate takes into account the different interest rates and their corresponding loan amounts or investment amounts. It is commonly used in financial calculations to determine the overall interest rate for a portfolio or a combination of loans or investments.

The blended rate is calculated by multiplying each interest rate by its corresponding loan or investment amount, summing up these values, and then dividing the total by the sum of the loan or investment amounts. This calculation gives a more accurate representation of the overall interest rate, as it takes into account the proportion of each loan or investment in the total portfolio.

For example, let’s say you have two loans: Loan A with an interest rate of 5% and a loan amount of $10,000, and Loan B with an interest rate of 7% and a loan amount of $5,000. To calculate the blended rate for these two loans, you would multiply the interest rate of Loan A by its loan amount (5% * $10,000 = $500) and the interest rate of Loan B by its loan amount (7% * $5,000 = $350). Then, you would sum up these values ($500 + $350 = $850) and divide by the sum of the loan amounts ($10,000 + $5,000 = $15,000). The blended rate would be $850 divided by $15,000, which equals approximately 5.67%.

The blended rate is useful in situations where you have multiple loans or investments with different interest rates. By calculating the blended rate, you can determine the overall interest rate for your portfolio and make more informed financial decisions. It allows you to compare different loan options or investment opportunities based on their overall cost or return.

Examples of Blended Rate Calculation

Calculating a blended rate involves combining multiple interest rates into a single rate. This can be useful when dealing with loans or investments that have different interest rates at different times.

Here are a few examples to illustrate how blended rates are calculated:

-

Example 1:

You have a loan with an interest rate of 5% for the first year and 7% for the second year. The loan amount is $10,000.

So, the blended rate for this loan is 6%.

-

Example 2:

You have an investment that earns 3% interest for the first six months and 4% interest for the next six months. The initial investment amount is $5,000.

So, the blended rate for this investment is 1.75%.

-

Example 3:

You have a mortgage with an interest rate of 4% for the first five years, 5% for the next three years, and 6% for the remaining two years. The mortgage amount is $200,000.

So, the blended rate for this mortgage is 4.7%.

Formula for Calculating Blended Rate

The blended rate is a weighted average of different interest rates or discount rates. It is commonly used in financial calculations to determine the overall interest rate or discount rate for a portfolio or a combination of different financial instruments. The formula for calculating the blended rate is as follows:

Blended Rate = (Rate1 * Amount1 + Rate2 * Amount2 + … + Raten * Amountn) / (Amount1 + Amount2 + … + Amountn)

Where:

- Rate1, Rate2, …, Raten are the interest rates or discount rates for the respective financial instruments.

- Amount1, Amount2, …, Amountn are the corresponding amounts or weights for each financial instrument.

The formula calculates the weighted average by multiplying each interest rate or discount rate by its corresponding amount or weight, summing up these values, and then dividing by the total sum of the amounts or weights. This gives the overall blended rate for the portfolio or combination of financial instruments.

For example, let’s say we have two financial instruments: Instrument A with an interest rate of 5% and an amount of $10,000, and Instrument B with an interest rate of 3% and an amount of $5,000. The blended rate would be calculated as follows:

Blended Rate = (5% * $10,000 + 3% * $5,000) / ($10,000 + $5,000) = (0.05 * $10,000 + 0.03 * $5,000) / ($10,000 + $5,000) = ($500 + $150) / $15,000 = $650 / $15,000 = 0.0433 or 4.33%

Therefore, the blended rate for this portfolio would be 4.33%.

The blended rate formula can be used in various financial scenarios, such as calculating the overall interest rate for a loan portfolio, determining the discount rate for a combination of cash flows, or finding the weighted average cost of capital for a company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.