Repurchase Agreement Definition Examples and Risks

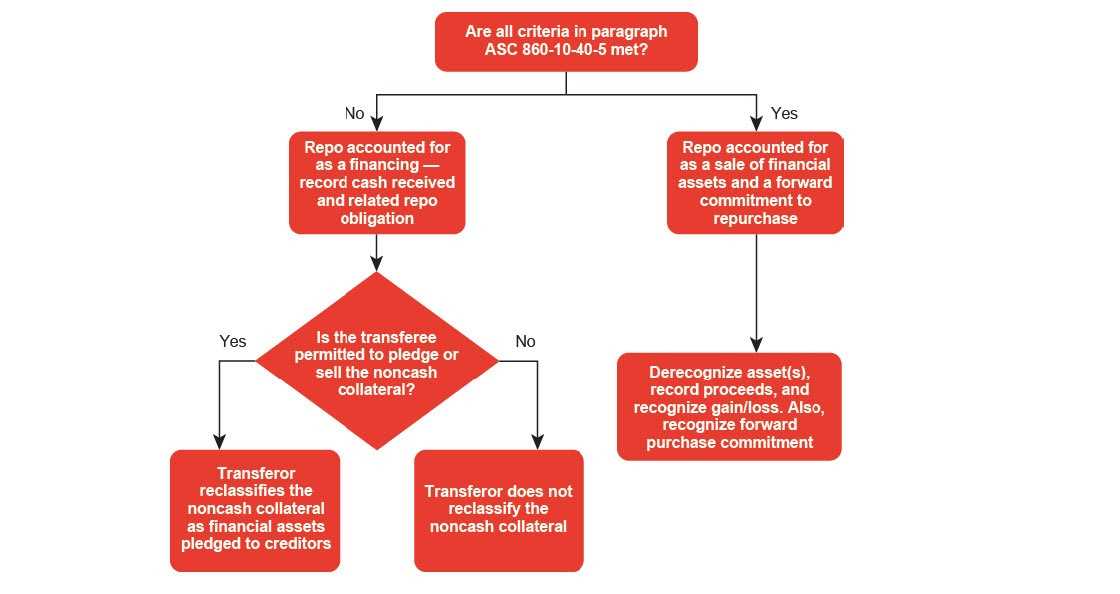

What is a Repurchase Agreement? Repurchase agreements are commonly used in the financial markets to raise short-term funds. They are particularly popular among banks, hedge funds, and other financial institutions. These agreements provide liquidity and allow market participants to manage their short-term cash needs or invest excess cash. Definition, Examples, … …