What are Noncallable Bonds?

Noncallable bonds are often considered less risky than callable bonds because investors have the certainty of receiving the full face value at maturity. This makes them attractive to conservative investors who prioritize capital preservation.

Noncallable bonds can be issued by governments, municipalities, and corporations. They are typically issued with fixed interest rates, meaning that the coupon payments remain the same throughout the life of the bond. This provides investors with a predictable stream of income.

| Advantages of Noncallable Bonds | Disadvantages of Noncallable Bonds |

|---|---|

| Guaranteed full face value at maturity | Lower potential for higher returns compared to callable bonds |

| Predictable stream of income | Less flexibility for the issuer |

| Lower risk compared to callable bonds | May have lower yields compared to callable bonds |

Overall, noncallable bonds offer investors the security of knowing they will receive the full face value of the bond at maturity. While they may have lower potential returns compared to callable bonds, they can be a suitable option for conservative investors who prioritize capital preservation and a stable income stream.

How do Noncallable Bonds Work?

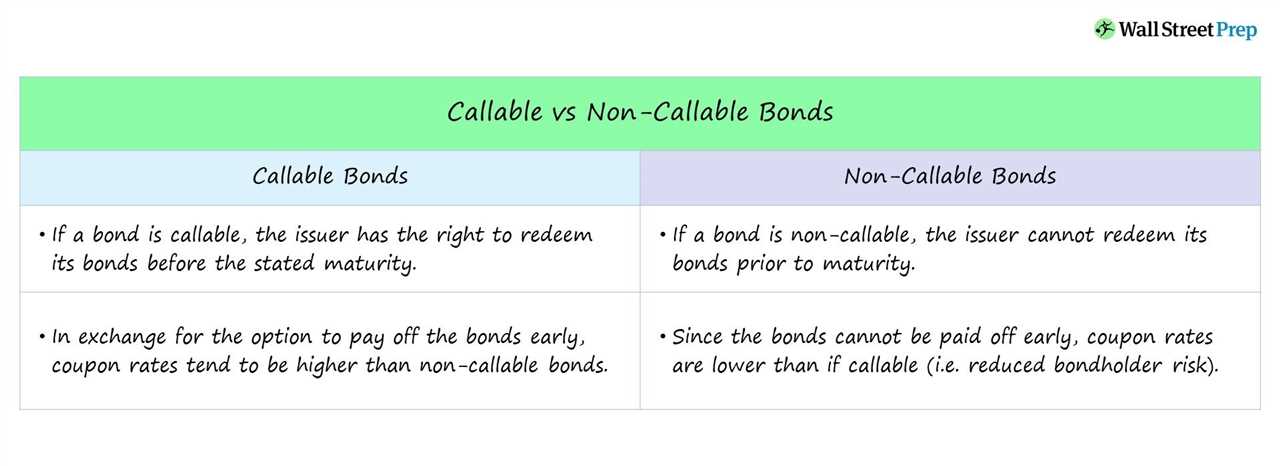

Unlike callable bonds, which give the issuer the option to redeem the bond before its maturity, noncallable bonds provide investors with more certainty and stability. This is because the issuer is obligated to make interest payments and return the principal to the bondholder according to the terms of the bond agreement.

Noncallable bonds can have various maturity dates, ranging from a few years to several decades. The maturity date is the date on which the bond reaches its full term, and the issuer is required to repay the bondholder the full principal amount.

Investors who purchase noncallable bonds are attracted to their stability and predictable income stream. Since the issuer cannot call back the bond, investors can rely on receiving interest payments on a regular basis until the bond matures.

In summary, noncallable bonds are a type of bond that cannot be redeemed by the issuer before its maturity date. They provide investors with stability and a predictable income stream, but may have a lower yield compared to callable bonds. Investors should carefully consider their investment goals and risk tolerance before investing in noncallable bonds.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.