Definition

Buy-sell agreements are commonly used in partnerships, LLCs, and closely held corporations, where there are multiple owners who want to establish a plan for the future of the business.

Overall, a buy-sell agreement provides clarity and peace of mind for business owners, as it establishes a framework for the future of the business and ensures that all parties are treated fairly in the event of a sale.

Types of Buy-Sell Agreements

A buy-sell agreement is a legally binding contract that outlines what should happen to a business in the event that one of the owners wants to sell their share, becomes disabled, or passes away. There are several different types of buy-sell agreements that can be used, depending on the specific needs and circumstances of the business owners.

1. Cross-Purchase Agreement

In a cross-purchase agreement, each business owner agrees to buy the shares of the other owners if they want to sell. This type of agreement is commonly used in small businesses with a limited number of owners. It allows the remaining owners to maintain control of the business by purchasing the shares of the departing owner.

2. Stock Redemption Agreement

A stock redemption agreement is the opposite of a cross-purchase agreement. Instead of the owners buying each other’s shares, the business itself agrees to buy the shares of a departing owner. This type of agreement is often used in larger businesses where there are many owners and it would be impractical for each owner to buy the shares of the others.

3. Wait-and-See Agreement

Key Considerations for Buy-Sell Agreement

When entering into a buy-sell agreement, there are several key considerations that should be taken into account to ensure the agreement is fair and effective for all parties involved.

1. Valuation Method

One of the most important considerations is how the business will be valued in the event of a buyout. There are several methods that can be used, including book value, market value, or a predetermined formula. It is essential to choose a valuation method that accurately reflects the true value of the business.

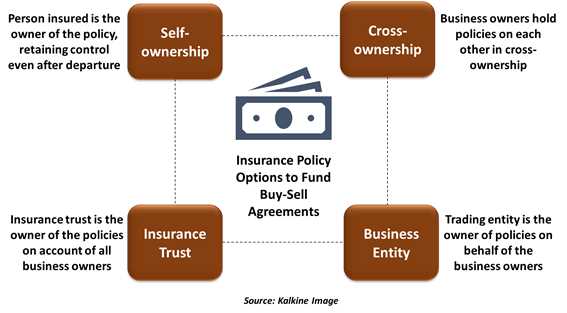

2. Funding the Buyout

Another important consideration is how the buyout will be funded. There are several options available, including cash payments, installment payments, or the use of insurance policies. It is crucial to determine the most suitable funding method that ensures the smooth transfer of ownership without causing financial strain on the remaining owners.

3. Triggering Events

It is essential to clearly define the triggering events that will activate the buy-sell agreement. Common triggering events include the death, disability, retirement, or voluntary departure of an owner. By clearly defining these events, the agreement can provide a roadmap for the smooth transition of ownership in various scenarios.

4. Dispute Resolution

In the event of a dispute between owners or a disagreement regarding the terms of the buy-sell agreement, it is crucial to have a clear process for resolving conflicts. This can include mediation, arbitration, or other alternative dispute resolution methods. By establishing a dispute resolution process in advance, potential conflicts can be addressed efficiently and effectively.

5. Updating the Agreement

| Key Considerations | Description |

|---|---|

| Valuation Method | Determine how the business will be valued in the event of a buyout. |

| Funding the Buyout | Decide on the most suitable method for financing the buyout. |

| Triggering Events | Clearly define the events that will activate the buy-sell agreement. |

| Dispute Resolution | Establish a process for resolving disputes between owners. |

| Updating the Agreement | Regularly review and update the buy-sell agreement to ensure its relevance. |

Business Essentials for Buy-Sell Agreement

A buy-sell agreement is a legally binding contract that outlines what will happen to a business in the event that one of the owners wants to sell their share or is forced to leave the business due to death, disability, or retirement. It is an essential tool for businesses with multiple owners, as it helps to ensure a smooth transition of ownership and protect the interests of all parties involved.

Why is a Buy-Sell Agreement Important?

Having a buy-sell agreement in place is crucial for several reasons:

- Ownership Transition: A buy-sell agreement provides a clear plan for how ownership will be transferred in the event of a triggering event. This helps to avoid disputes and confusion among the owners and ensures a smooth transition.

- Protection of Interests: The agreement protects the interests of all parties involved by establishing a fair valuation method for the business and ensuring that the departing owner receives a fair price for their share.

- Tax Planning: The agreement can also include provisions for tax planning, such as allowing the remaining owners to buy out the departing owner’s share using life insurance proceeds, which can help to minimize tax liabilities.

Key Considerations for a Buy-Sell Agreement

When creating a buy-sell agreement, there are several key considerations to keep in mind:

- Triggering Events: Clearly define the triggering events that will activate the buy-sell agreement, such as death, disability, retirement, or voluntary sale.

- Valuation Method: Determine a fair and objective method for valuing the business, such as using an independent appraiser or a predetermined formula.

- Funding Mechanism: Decide how the buyout will be funded, whether through cash reserves, bank financing, or insurance policies.

- Restrictions on Transfers: Consider including restrictions on transfers to ensure that the ownership remains within a specific group of individuals or entities.

- Dispute Resolution: Establish a process for resolving disputes that may arise during the implementation of the buy-sell agreement.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.