Burn Rate: Types, Formula, and Examples

Burn rate is a crucial metric for businesses to understand their financial health and sustainability. It refers to the rate at which a company is spending its available funds or capital. By calculating the burn rate, businesses can determine how long they can sustain their operations before running out of money.

There are different types of burn rate that businesses should be aware of:

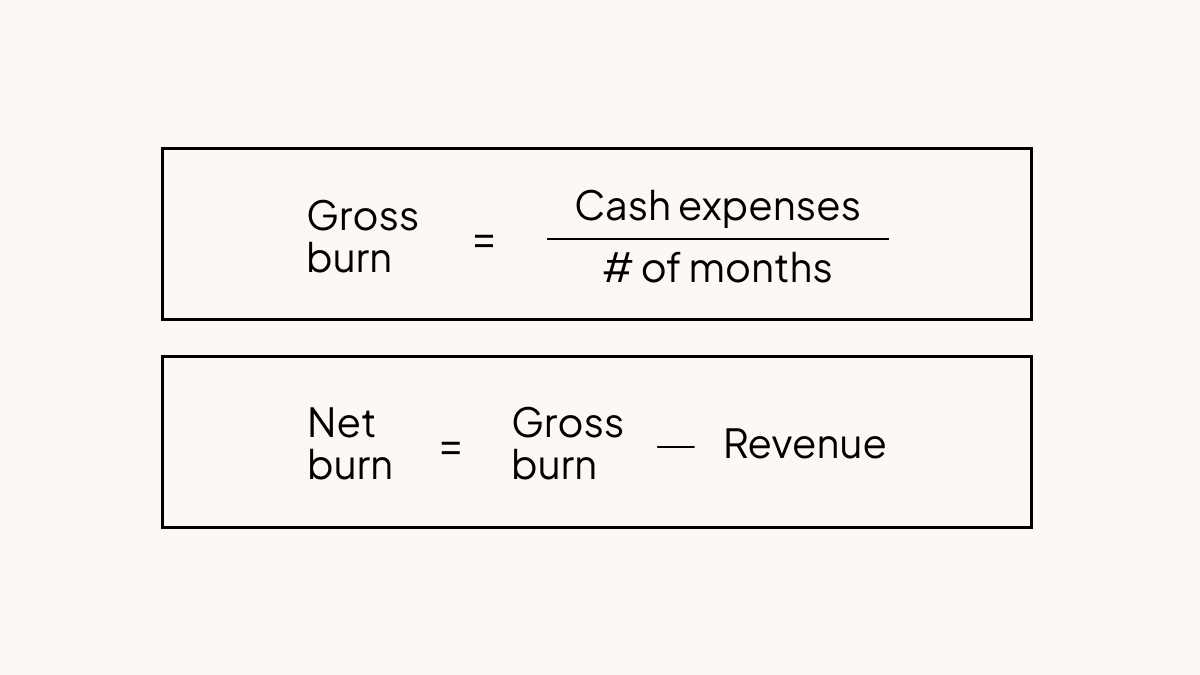

1. Gross Burn Rate: This is the total amount of money a company is spending on its operating expenses, such as salaries, rent, utilities, and marketing. It does not include any revenue generated by the business.

2. Net Burn Rate: Net burn rate takes into account the revenue generated by the business. It subtracts the revenue from the gross burn rate to determine the actual rate at which the company is spending its funds.

3. Monthly Burn Rate: This is the burn rate calculated on a monthly basis. It helps businesses understand their short-term financial situation and plan accordingly.

4. Annual Burn Rate: Annual burn rate is the burn rate calculated over a year. It provides a more comprehensive view of the company’s financial health and sustainability.

Calculating the burn rate is relatively simple. The formula is:

For example, if a company has $500,000 in starting cash and $300,000 in ending cash after 6 months, the burn rate would be:

Here are a few examples of burn rate in real businesses:

1. Startup Company: A startup company may have a high burn rate initially as it invests in product development, marketing, and hiring. However, the goal is to eventually reach a point where the revenue generated exceeds the expenses, resulting in a positive burn rate.

2. Established Company: An established company with a stable revenue stream may have a lower burn rate as it focuses on maintaining its operations and investing in growth opportunities. The goal is to have a burn rate that aligns with the company’s long-term financial goals.

3. E-commerce Business: An e-commerce business may have a variable burn rate depending on factors such as seasonality, marketing campaigns, and inventory management. It is important for the business to closely monitor its burn rate and adjust its strategies accordingly.

Burn rate is a crucial metric that measures the rate at which a company is spending its cash reserves. It is an essential indicator for investors and stakeholders to evaluate the financial health and sustainability of a business.

Second, the burn rate can provide insights into the efficiency of a company’s operations. A high burn rate may suggest that the company is spending excessively or inefficiently, while a low burn rate may indicate effective cost management.

There are different types of burn rate that businesses can calculate. The most common types include gross burn rate, net burn rate, and monthly burn rate. Each type provides a different perspective on the company’s financial situation and can be used to make informed decisions.

Gross Burn Rate

Net Burn Rate

Net burn rate takes into account the revenue generated by the company. It is calculated by subtracting the total revenue from the total expenses in a given period. Net burn rate provides a more accurate picture of the company’s financial health, as it considers the balance between expenses and revenue.

Monthly Burn Rate

Monthly burn rate is a simplified version of the gross burn rate. It represents the total expenses incurred by the company in a month. Monthly burn rate is often used as a quick reference to assess the financial situation of a business.

Types of Burn Rate

- Gross Burn Rate: This type of burn rate refers to the total amount of money a company is spending in a given period, without taking into account any revenue or income. It provides a clear picture of the company’s overall spending habits and can be used to assess its financial stability.

- Net Burn Rate: Unlike gross burn rate, net burn rate takes into account the revenue or income generated by a company during a specific period. By subtracting the revenue from the total expenses, net burn rate shows whether a company is spending more than it is earning. This type of burn rate is particularly useful for startups and early-stage companies.

- Operating Burn Rate: Operating burn rate focuses specifically on the expenses related to a company’s day-to-day operations. It includes costs such as employee salaries, rent, utilities, and other overhead expenses. By calculating the operating burn rate, a company can assess the efficiency of its operations and identify areas where cost-cutting measures can be implemented.

- Investment Burn Rate: Investment burn rate refers to the rate at which a company is spending its investment capital. It is commonly used by startups and companies that rely heavily on external funding. By tracking the investment burn rate, investors and stakeholders can evaluate the company’s ability to effectively utilize the funds and achieve its growth objectives.

- Product Burn Rate: Product burn rate focuses on the expenses associated with developing and launching a specific product or service. It includes costs such as research and development, marketing, production, and distribution. By calculating the product burn rate, a company can determine the profitability and viability of a particular product or service.

Calculating Burn Rate: The Formula

Burn rate is a crucial metric for businesses to understand their financial health and sustainability. It measures the rate at which a company is spending its available funds or capital. Calculating burn rate is relatively simple and can be done using the following formula:

The starting balance refers to the amount of money a company has at the beginning of a specific period, such as a month or a quarter. The ending balance is the amount of money the company has at the end of that period. The number of months represents the duration of the period.

For example, let’s say a company has a starting balance of $100,000 at the beginning of the month and an ending balance of $80,000 at the end of the month. The duration of the period is one month. Using the burn rate formula, we can calculate the burn rate as follows:

This means that the company is burning $20,000 of its available funds per month.

Importance of Calculating Burn Rate

Calculating burn rate is essential for businesses for several reasons:

- Financial Planning: By knowing the burn rate, companies can plan their finances accordingly. They can estimate how long their available funds will last and make strategic decisions to ensure their sustainability.

- Investor Confidence: Investors often consider burn rate when evaluating a company’s financial health. A low burn rate indicates that a company is efficiently managing its funds and has a higher chance of success.

- Growth Strategy: Calculating burn rate can help companies determine if they need to secure additional funding to support their growth plans. It provides insights into whether the company’s current revenue streams are sufficient to cover its expenses.

Examples of Burn Rate in Real Businesses

Example 1: Startup Company

A startup company with initial funding of $1 million has a monthly burn rate of $100,000. This means that the company is spending $100,000 per month on expenses such as salaries, rent, marketing, and other operational costs. With a burn rate of $100,000, the startup company can sustain its operations for 10 months before running out of funds.

However, if the startup is not generating enough revenue or attracting new investors, the burn rate can become a concern. If the burn rate exceeds the company’s ability to generate income, it may need to seek additional funding or make significant cost-cutting measures to extend its runway.

Example 2: Established Company

If the burn rate increases significantly without a corresponding increase in revenue, it may indicate that the company is overspending or not effectively utilizing its resources. Monitoring the burn rate allows the company to make informed decisions about its financial strategy and adjust its spending accordingly.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.