Back-End Ratio Calculation Formula Vs Front End

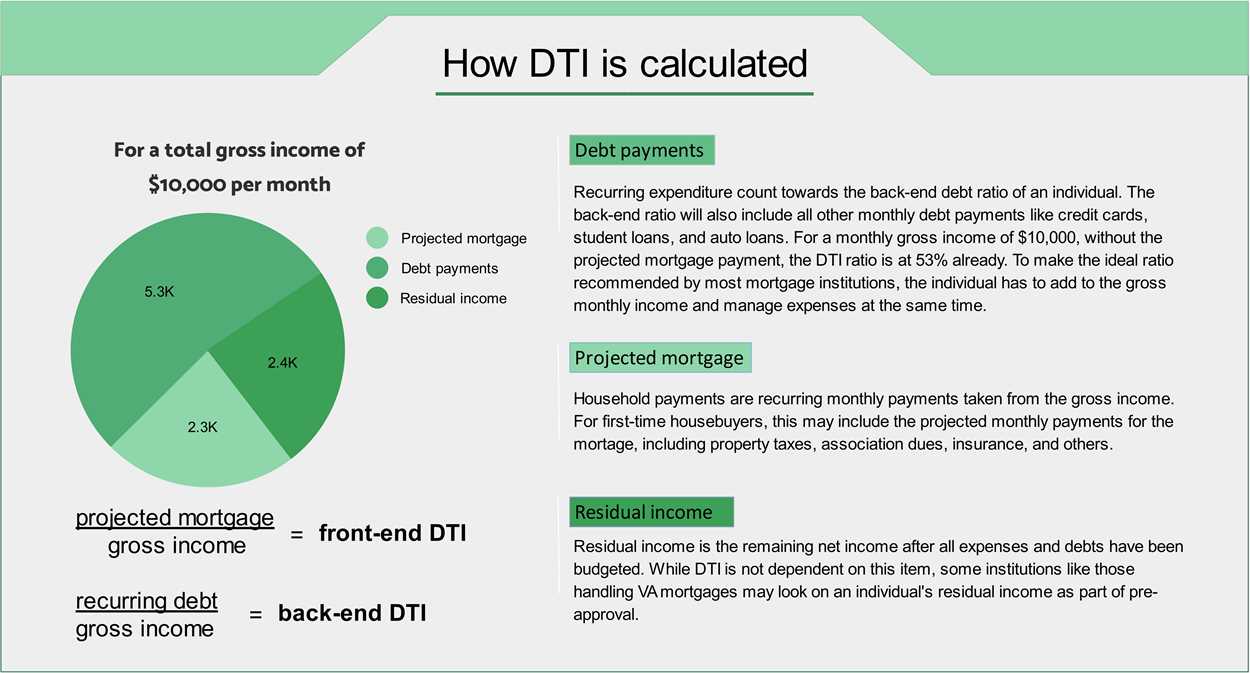

To calculate the back-end ratio, lenders add up all of the borrower’s monthly debt payments and divide it by their gross monthly income. The result is expressed as a percentage, with a lower percentage indicating a lower level of debt and a higher percentage indicating a higher level of debt.

For example, if a borrower has a total monthly debt payment of $1,500 and a gross monthly income of $5,000, their back-end ratio would be 30% ($1,500 / $5,000 = 0.30).

Exploring the Front End in Mortgage Lending

To calculate the front-end ratio, lenders divide the borrower’s monthly housing expenses by their gross monthly income. The result is expressed as a percentage, with a lower percentage indicating a lower level of housing expenses and a higher percentage indicating a higher level of housing expenses.

For example, if a borrower has monthly housing expenses of $1,200 and a gross monthly income of $5,000, their front-end ratio would be 24% ($1,200 / $5,000 = 0.24).

Comparing Back-End and Front-End Ratios

While both the back-end and front-end ratios are important in mortgage lending, they serve different purposes. The back-end ratio provides a comprehensive view of a borrower’s overall debt load, including both housing and non-housing expenses. On the other hand, the front-end ratio focuses solely on the borrower’s housing expenses.

Lenders typically have maximum allowable ratios for both the back-end and front-end ratios. These ratios may vary depending on the type of loan and the lender’s guidelines. Borrowers with lower ratios are generally considered less risky and may have an easier time qualifying for a loan.

The back-end ratio is an important factor in determining a borrower’s ability to repay a mortgage loan. It is a calculation that takes into account the borrower’s monthly debt payments in relation to their gross monthly income. This ratio is used by lenders to assess the borrower’s financial stability and determine if they can afford the mortgage payments.

The back-end ratio calculation formula is relatively simple. It is calculated by dividing the borrower’s total monthly debt payments by their gross monthly income and multiplying the result by 100 to get a percentage. The formula can be expressed as:

| Back-End Ratio | = | (Total Monthly Debt Payments / Gross Monthly Income) * 100 |

|---|

The total monthly debt payments include all recurring debts such as credit card payments, car loans, student loans, and any other monthly obligations. The gross monthly income refers to the borrower’s total income before any deductions or taxes are taken out.

For example, if a borrower has total monthly debt payments of $1,500 and a gross monthly income of $5,000, the back-end ratio would be calculated as:

| Back-End Ratio | = | ($1,500 / $5,000) * 100 | = | 30% |

|---|

It is important for borrowers to understand their back-end ratio and how it affects their ability to obtain a mortgage loan. By managing their debt payments and maintaining a low back-end ratio, borrowers can improve their chances of getting approved for a mortgage and securing favorable loan terms.

Exploring the Front End in Mortgage Lending

The front-end ratio is a calculation that compares a borrower’s monthly housing expenses to their gross monthly income. It takes into account the principal and interest payments on the mortgage loan, as well as any property taxes and homeowner’s insurance premiums. This ratio helps lenders assess a borrower’s ability to afford their monthly mortgage payments.

To calculate the front-end ratio, lenders divide the borrower’s total monthly housing expenses by their gross monthly income. The result is expressed as a percentage, with a lower percentage indicating a lower risk for the lender.

For example, if a borrower has a monthly income of $5,000 and their total monthly housing expenses amount to $1,500, their front-end ratio would be 30% ($1,500 divided by $5,000 multiplied by 100). Lenders typically have specific front-end ratio requirements that borrowers must meet in order to qualify for a mortgage loan.

The front-end ratio is an important consideration for borrowers as well. It helps them determine how much they can afford to spend on housing each month and guides their decision-making process when searching for a home. By calculating their front-end ratio, borrowers can assess whether their income is sufficient to cover their monthly housing expenses.

Comparing Back-End and Front-End Ratios

What is the Back-End Ratio?

To calculate the back-end ratio, the lender adds up all the monthly debt payments and divides it by the borrower’s gross monthly income. The resulting percentage is a measure of how much of the borrower’s income is already allocated towards debt obligations.

What is the Front-End Ratio?

The front-end ratio is another important metric used by lenders to assess a borrower’s ability to afford a mortgage. Unlike the back-end ratio, the front-end ratio focuses solely on housing-related expenses.

Key Differences and Considerations

While both ratios are essential in evaluating a borrower’s financial capacity, there are several key differences and considerations to keep in mind:

1. Inclusion of Other Debts: The back-end ratio takes into account all monthly debt payments, providing a comprehensive view of the borrower’s overall financial obligations. The front-end ratio, on the other hand, only considers housing-related expenses.

2. Loan Eligibility: Lenders typically have specific requirements for both the back-end and front-end ratios. Meeting these requirements is crucial for loan approval. If a borrower’s ratios exceed the lender’s limits, they may be deemed ineligible for the loan.

3. Flexibility: The front-end ratio is often more flexible than the back-end ratio. Lenders may be willing to accept a higher front-end ratio if the borrower has a strong credit history or a sizable down payment. However, exceeding the back-end ratio limit is generally seen as a higher risk for lenders.

4. Affordability: The front-end ratio provides insight into whether a borrower can comfortably afford the mortgage payment alone. The back-end ratio, on the other hand, considers all debts, giving a more comprehensive view of the borrower’s overall financial situation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.