What is High-Frequency Trading?

High-Frequency Trading (HFT) is a type of automated trading strategy that uses powerful computers and complex algorithms to execute a large number of trades in fractions of a second. It is a form of algorithmic trading that aims to take advantage of small price discrepancies in the market and exploit them for profit.

How Does High-Frequency Trading Work?

High-Frequency Trading works by utilizing advanced technology to analyze vast amounts of market data and execute trades at incredibly high speeds. These trades are typically executed based on pre-defined algorithms that are designed to identify patterns and trends in the market.

Traders who engage in high-frequency trading use sophisticated computer programs that are capable of making split-second decisions and executing trades automatically. These programs are often co-located in close proximity to the exchanges to minimize latency and ensure the fastest possible execution.

High-frequency traders rely on speed and efficiency to gain an edge in the market. They aim to exploit small price discrepancies that may only exist for a fraction of a second, profiting from these small price movements by executing a large number of trades within that short time frame.

Benefits of High-Frequency Trading

There are several benefits associated with high-frequency trading:

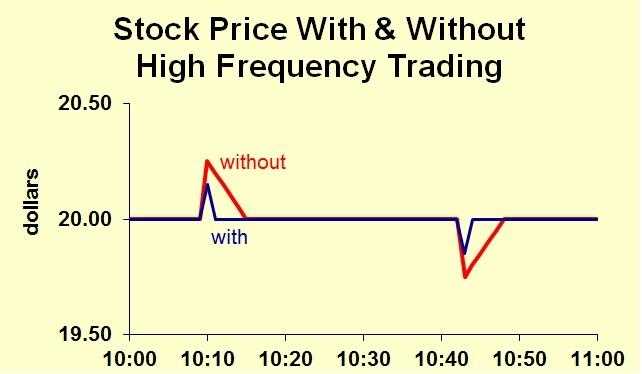

- Liquidity: High-frequency traders provide liquidity to the market by constantly buying and selling securities. This helps to ensure that there is always a buyer or seller available, improving market efficiency.

- Price Efficiency: High-frequency trading can help to improve price efficiency by quickly identifying and exploiting pricing discrepancies. This can lead to more accurate and fair prices for investors.

- Reduced Transaction Costs: High-frequency trading can help to reduce transaction costs for investors by narrowing bid-ask spreads and improving overall market liquidity.

Example of High-Frequency Trading

One example of high-frequency trading is arbitrage, where traders exploit price differences between different markets or exchanges. For instance, if a stock is trading at a slightly higher price on one exchange compared to another, high-frequency traders can quickly buy the stock on the lower-priced exchange and sell it on the higher-priced exchange, making a profit from the price discrepancy.

Overall, high-frequency trading is a complex and controversial practice that has both its proponents and critics. While it can provide benefits such as increased liquidity and price efficiency, it has also been associated with market manipulation and increased market volatility. It is important for regulators to carefully monitor and regulate high-frequency trading to ensure fair and transparent markets.

How Does High-Frequency Trading Work?

High-Frequency Trading (HFT) is a type of algorithmic trading that relies on powerful computers and complex algorithms to execute trades at extremely high speeds. It involves the use of sophisticated trading strategies and advanced technology to take advantage of small price discrepancies in the market.

At its core, HFT involves the following steps:

- Data Collection: HFT firms collect vast amounts of market data from various sources, including stock exchanges, news feeds, and social media platforms. This data includes information about stock prices, order books, and market sentiment.

- Algorithm Development: HFT firms develop complex algorithms that analyze the collected data and identify potential trading opportunities. These algorithms are designed to execute trades within microseconds or even nanoseconds.

- Order Placement: Once a potential trading opportunity is identified, the HFT algorithm sends orders to the market at lightning-fast speeds. These orders are typically small in size and are designed to take advantage of short-term price movements.

- Order Execution: HFT algorithms use various strategies to execute orders, including market making, arbitrage, and statistical arbitrage. Market making involves providing liquidity to the market by continuously quoting bid and ask prices. Arbitrage involves taking advantage of price discrepancies between different markets or instruments. Statistical arbitrage involves exploiting patterns and correlations in historical market data.

- Risk Management: HFT firms employ sophisticated risk management techniques to minimize the impact of market volatility and unforeseen events. These techniques include position limits, stop-loss orders, and real-time monitoring of market conditions.

Benefits of High-Frequency Trading

High-frequency trading (HFT) offers several benefits to market participants and the overall financial system. Here are some of the key advantages:

- Liquidity: HFT firms provide liquidity to the market by constantly buying and selling securities. This helps ensure that there is a continuous flow of buyers and sellers, making it easier for investors to enter and exit positions.

- Reduced costs: HFT can help reduce trading costs for investors. By increasing competition and narrowing bid-ask spreads, HFT firms make it cheaper for investors to execute trades.

- Efficiency: High-frequency trading can improve the efficiency of the financial markets. HFT firms use sophisticated algorithms and high-speed technology to execute trades in milliseconds. This reduces the time it takes for trades to be executed and increases the speed at which information is incorporated into prices.

- Price discovery: HFT firms play a crucial role in price discovery. By constantly monitoring and reacting to market information, they help ensure that prices reflect the most up-to-date information available. This benefits all market participants by providing more accurate and transparent pricing.

- Market stability: Contrary to popular belief, high-frequency trading can contribute to market stability. HFT firms act as market makers, providing liquidity during times of market stress. Their presence helps prevent extreme price movements and reduces the likelihood of market disruptions.

While high-frequency trading has its advantages, it is not without controversy. Critics argue that HFT can create an uneven playing field, as firms with faster technology and better access to market data have a competitive advantage. Additionally, there are concerns about the potential for market manipulation and the impact of HFT on market volatility. Regulators continue to monitor and assess the impact of high-frequency trading on the financial markets.

Example of High-Frequency Trading

To better understand how high-frequency trading (HFT) works, let’s consider an example:

Imagine a trader who uses HFT strategies to profit from small price discrepancies in the stock market. This trader has developed a sophisticated algorithm that can execute trades within microseconds, allowing them to take advantage of even the smallest price movements.

Let’s say that the trader notices a price discrepancy between two exchanges for a particular stock. The stock is trading at $100 on one exchange and $100.10 on another. The trader’s algorithm detects this price difference and automatically executes a buy order on the exchange where the stock is cheaper and a sell order on the exchange where the stock is more expensive.

Since the trader’s algorithm can execute trades within microseconds, they are able to take advantage of this price discrepancy before the market adjusts and the prices equalize. The trader makes a profit of $0.10 per share on this trade, which may not seem like much, but when executed on a large scale and with high trading volumes, it can result in significant profits.

This example demonstrates how high-frequency trading relies on speed and automation to capitalize on small price discrepancies in the market. It highlights the importance of having advanced algorithms and powerful computer systems to execute trades at lightning-fast speeds.

It’s worth noting that high-frequency trading is not without risks. The speed and volume of trades can amplify market volatility and potentially lead to market disruptions. Additionally, the competitive nature of HFT means that traders need to constantly innovate and improve their algorithms to stay ahead of the competition.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.