What Are Intangible Assets Examples and How to Value

Intangible assets are non-physical assets that have value to a company. They are not tangible, meaning they cannot be touched or seen, but they can still be valuable and contribute to a company’s success. Examples of intangible assets include patents, trademarks, copyrights, brand names, customer lists, and software.

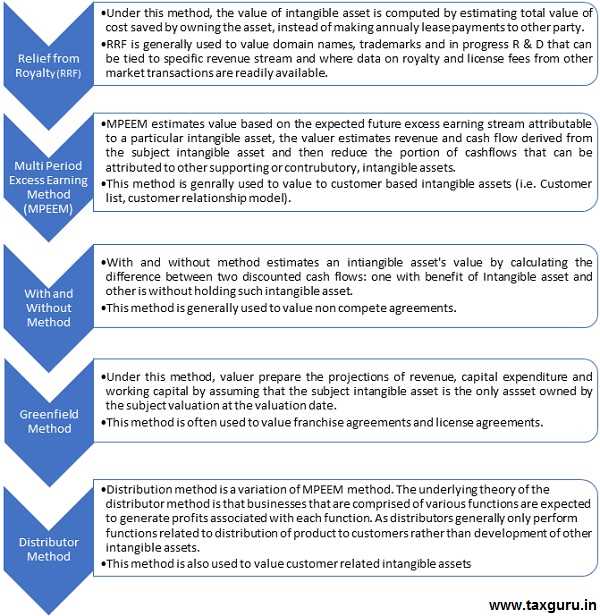

Valuing intangible assets can be challenging because they do not have a clear market value like tangible assets. However, there are several methods that can be used to estimate the value of intangible assets:

| Method | Description |

|---|---|

| Cost approach | This method estimates the value of an intangible asset based on the cost to create or replace it. It takes into account the expenses incurred to develop or acquire the asset. |

| Market approach | This method compares the intangible asset to similar assets that have been bought or sold in the market. It looks at the prices at which similar assets have been transacted to determine the value. |

| Income approach | This method estimates the value of an intangible asset based on the income it generates. It takes into account the future cash flows that the asset is expected to generate and discounts them to their present value. |

Each method has its own advantages and disadvantages, and the choice of method depends on the specific circumstances and nature of the intangible asset. It is common to use multiple methods to get a more accurate estimate of the value.

Intangible Assets Examples

Intangible assets are non-physical assets that provide value to a company. Unlike tangible assets such as buildings or equipment, intangible assets are not physical in nature and cannot be touched or seen. However, they can still have a significant impact on a company’s financial performance and overall value.

1. Brand Names

2. Patents

Another example of an intangible asset is a patent. Patents provide legal protection for inventions and innovations, giving the owner exclusive rights to use and profit from the invention for a certain period of time. Patents can be highly valuable, especially in industries with high levels of innovation and technological advancements.

3. Copyrights

Copyrights are another type of intangible asset. They provide legal protection for original works of authorship, such as books, music, or software. Copyrights give the owner exclusive rights to reproduce, distribute, and display the work, allowing them to generate revenue from licensing or selling the rights to others.

4. Trademarks

Trademarks are symbols, logos, or phrases that distinguish a company’s products or services from those of its competitors. They play a crucial role in brand recognition and can significantly impact a company’s reputation and customer loyalty. Trademarks can be registered and protected by law, making them valuable intangible assets.

5. Customer Lists

6. Goodwill

Goodwill is an intangible asset that represents the reputation and relationships a company has built with its customers, suppliers, and other stakeholders. It is often associated with the excess value of a company’s assets over its liabilities in an acquisition. Goodwill can be a significant contributor to a company’s overall value and can be difficult to quantify.

How to Value Intangible Assets

1. Cost Approach

The cost approach is one method that can be used to value intangible assets. This approach involves determining the cost to recreate or replace the intangible asset. It takes into account the costs associated with research and development, marketing, and other expenses incurred to create the asset. However, this method does not consider the market value or the income generated by the asset.

2. Market Approach

The market approach is another method that can be used to value intangible assets. This approach involves comparing the intangible asset to similar assets that have been sold in the market. By analyzing the prices at which similar assets have been bought or sold, an estimate of the value of the intangible asset can be determined. However, finding comparable assets can be challenging, especially for unique or specialized intangible assets.

Additionally, the market approach may not accurately reflect the true value of the intangible asset if there is a lack of market activity or if the market conditions have changed significantly since the comparable assets were sold.

3. Income Approach

The income approach is a commonly used method to value intangible assets. This approach involves estimating the future income or cash flows that the intangible asset is expected to generate. The value of the intangible asset is then determined by discounting these future cash flows to their present value. This method takes into account the income-generating potential of the asset and is often used for intangible assets such as patents, trademarks, and copyrights.

However, the income approach relies on making assumptions about future cash flows, which can be uncertain and subjective. It also requires determining an appropriate discount rate to calculate the present value of the cash flows.

Conclusion

Valuing intangible assets is a complex task that requires careful consideration of various factors. The cost approach, market approach, and income approach are three common methods used to value intangible assets. Each method has its advantages and limitations, and the choice of method depends on the specific circumstances and characteristics of the intangible asset being valued.

It is important to note that valuing intangible assets is not an exact science, and the value assigned to these assets can vary depending on the assumptions and methods used. Therefore, it is recommended to seek the expertise of professionals such as appraisers or financial analysts to ensure an accurate and reliable valuation of intangible assets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.