What is Vesting?

Vesting is a term used to describe the process by which an employee becomes entitled to receive certain benefits or assets over time. It is commonly used in the context of retirement plans and employee benefits.

When an employee is said to be “vested” in a retirement plan or benefit, it means that they have earned the right to receive the full value of those benefits, even if they leave the company before reaching retirement age. Vesting is a way for employers to incentivize employees to stay with the company for a certain period of time, as it ensures that they will receive the benefits they have earned.

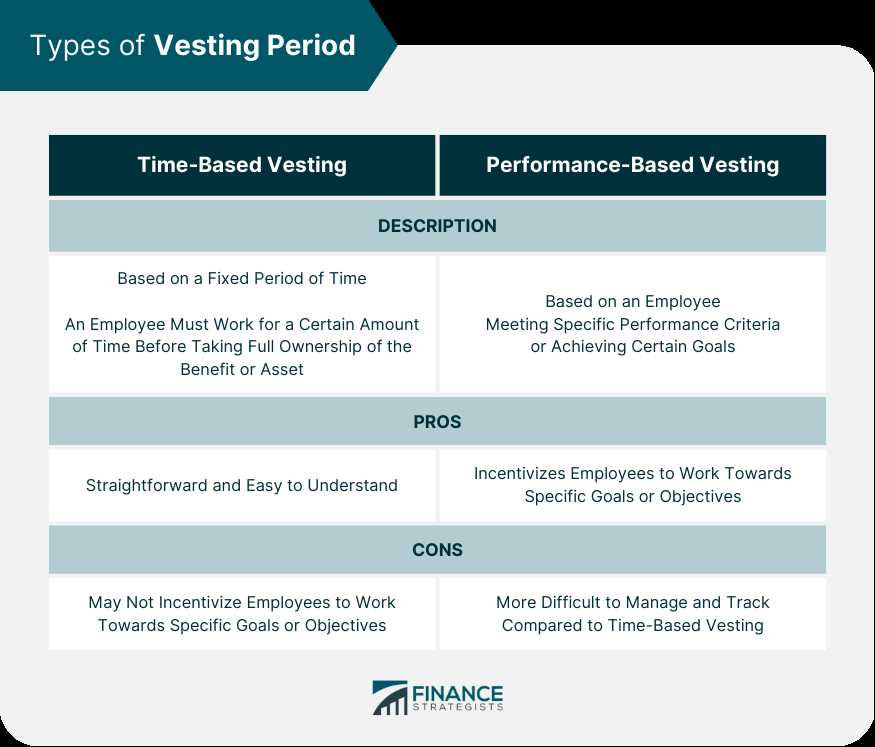

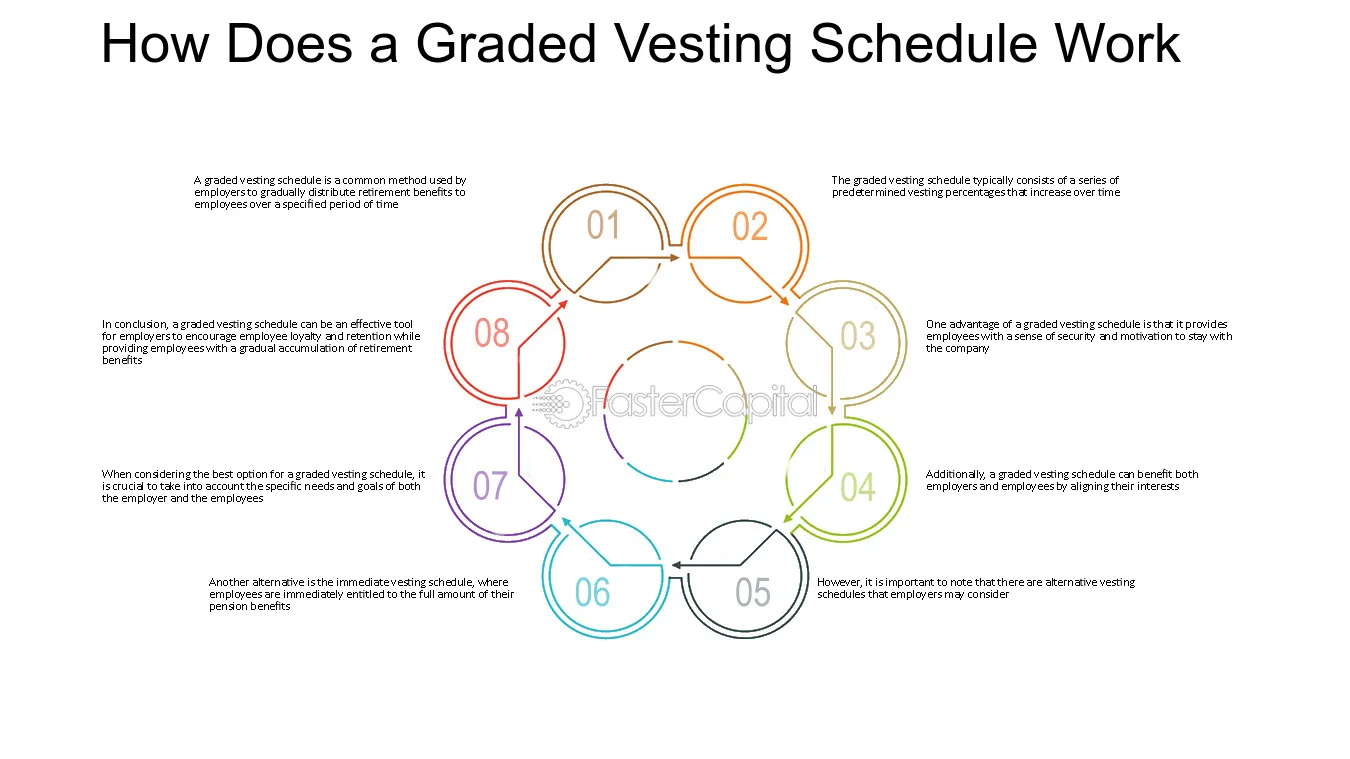

There are different types of vesting schedules, including cliff vesting and graded vesting. Cliff vesting means that an employee becomes fully vested in their benefits after a certain number of years, while graded vesting allows for partial vesting over a period of time.

Vesting is an important concept for employees to understand, as it can have a significant impact on their retirement savings and overall financial well-being. By knowing the vesting schedule and requirements of their employer’s retirement plan, employees can make informed decisions about their career and financial future.

| Benefits of Vesting | Considerations |

|---|---|

| Provides employees with a sense of security and stability | Some vesting schedules may be longer or more restrictive |

| Encourages employee loyalty and retention | Employees may need to stay with the company for a certain period of time to fully vest |

| Allows employees to build retirement savings over time | Employees may lose some or all of their vested benefits if they leave the company before reaching retirement age |

| Provides a valuable benefit that can attract and retain top talent | Vesting rules and requirements can be complex and vary between employers |

How Does Vesting Work?

Vesting is a process that determines how much control and ownership an employee has over their retirement and benefits plans. It is a crucial aspect of any retirement plan, as it determines when and how an employee can access their funds.

When an employee participates in a retirement or benefits plan, they are often required to meet certain criteria before they can fully access the funds. This is where vesting comes into play. Vesting schedules are put in place to ensure that employees stay with the company for a certain period of time before they can claim full ownership of their retirement and benefits.

There are typically two types of vesting schedules: cliff vesting and graded vesting. In cliff vesting, an employee becomes fully vested after a specific period of time, such as three years. This means that if they leave the company before the cliff vesting period is over, they will not be entitled to any of the employer’s contributions to their retirement or benefits plan.

On the other hand, graded vesting allows employees to gradually become vested in their retirement and benefits plans over a period of time. For example, an employee may become 20% vested after one year, 40% vested after two years, and so on. This ensures that employees are rewarded for their loyalty and commitment to the company.

Once an employee is fully vested, they have complete ownership and control over their retirement and benefits plans. They can choose to leave the company and take their funds with them, or they can continue to contribute and grow their retirement savings.

It is important for employees to understand the vesting schedule of their retirement and benefits plans, as it can greatly impact their financial future. By staying with a company for a longer period of time, employees can maximize their benefits and ensure a secure retirement.

The Importance of Vesting

Retention of Employees

One of the primary reasons why vesting is important is that it helps employers retain their employees. When employees know that they have a vested interest in their retirement or benefits plan, they are more likely to stay with the company for a longer period. This can reduce turnover rates and save employers the time and money associated with hiring and training new employees.

Employee Motivation

Vesting also plays a significant role in motivating employees. Knowing that they will receive the employer’s contributions to their retirement or benefits plan after a certain period encourages employees to work hard and stay committed to the company. It provides them with a sense of security and financial stability, which can boost their productivity and loyalty.

Financial Security

Another important aspect of vesting is that it provides employees with financial security for their future. By accumulating employer contributions over time, employees can build a substantial retirement fund or have access to valuable benefits. This can help them maintain their standard of living after retirement or during times of need, such as medical emergencies or unexpected expenses.

Furthermore, vesting allows employees to take advantage of the power of compound interest. The longer an employee stays with a company and continues to contribute to their retirement or benefits plan, the more their savings can grow over time. This can significantly enhance their financial well-being in the long run.

Employer Branding and Reputation

Vesting can also contribute to an employer’s branding and reputation. Companies that offer attractive vesting options and generous retirement or benefits plans are more likely to attract top talent. Potential employees often consider the vesting terms and benefits packages when evaluating job offers. By offering competitive vesting options, employers can enhance their image as an employer of choice and attract skilled and motivated individuals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.