Tax-Deductible Interest: Definition and Qualifying Types

Definition of Tax-Deductible Interest

Tax-deductible interest refers to the interest that you can deduct from your taxable income, reducing the amount of tax you owe. This deduction is available for certain types of interest payments that you make throughout the year.

Qualifying Types of Tax-Deductible Interest

There are several types of interest that may qualify for a tax deduction. Here are some common examples:

- Mortgage Interest: If you have a mortgage on your primary residence or a second home, the interest you pay on the loan may be tax-deductible. However, there are limits on the amount of mortgage debt that qualifies for the deduction.

- Student Loan Interest: If you are repaying student loans, the interest you pay on those loans may be tax-deductible. This deduction can be especially beneficial for recent graduates who are still paying off their student loans.

- Business Loan Interest: If you have taken out a loan for your business, the interest you pay on that loan may be tax-deductible. This can include loans for equipment, vehicles, or other business-related expenses.

- Investment Interest: If you have borrowed money to invest in stocks, bonds, or other investments, the interest you pay on that loan may be tax-deductible. However, there are certain limitations and requirements for this deduction.

- Home Equity Loan Interest: If you have a home equity loan or a home equity line of credit (HELOC), the interest you pay on that loan may be tax-deductible. However, there are limits on the amount of home equity debt that qualifies for the deduction.

When claiming a tax deduction for interest, it’s crucial to keep accurate records and consult with a tax professional to ensure that you meet all the requirements and guidelines set by the Internal Revenue Service (IRS).

Tax-deductible interest refers to the interest that you pay on certain types of loans or debts that can be deducted from your taxable income. This means that the amount of interest you pay reduces the total amount of income that is subject to taxation.

It is important to note that not all types of interest are tax-deductible. The Internal Revenue Service (IRS) has specific guidelines and requirements for what types of interest can be deducted. Generally, interest on loans used for personal expenses, such as credit card debt or personal loans, is not tax-deductible. However, there are several types of interest that may qualify for tax deductions.

Mortgage Interest

One of the most common types of tax-deductible interest is mortgage interest. If you have a mortgage on your primary residence or a second home, the interest you pay on that mortgage may be tax-deductible. This can include both the interest on your primary mortgage as well as any additional mortgages or home equity loans you may have.

However, there are certain limitations and restrictions on the amount of mortgage interest that can be deducted. For example, the mortgage must be secured by the property, and there are limits on the total amount of debt that can be used to calculate the deduction.

Student Loan Interest

Another type of tax-deductible interest is student loan interest. If you have student loans, you may be able to deduct the interest you pay on those loans. This can provide significant savings for individuals who are repaying student loans.

There are certain requirements for student loan interest to be tax-deductible. The loans must have been used for qualified education expenses, and there are income limitations that determine the eligibility for the deduction.

Other types of tax-deductible interest may include business loan interest, investment loan interest, and certain types of home improvement loan interest. It is important to consult with a tax professional or refer to the IRS guidelines to determine if the interest you are paying qualifies for a tax deduction.

Qualifying Types of Tax-Deductible Interest

1. Mortgage Interest

One of the most common types of tax-deductible interest is mortgage interest. If you have a mortgage on your primary residence or a second home, you can deduct the interest paid on the loan. This deduction applies to both fixed-rate and adjustable-rate mortgages.

2. Home Equity Loan Interest

If you have taken out a home equity loan or a home equity line of credit (HELOC), the interest paid on these loans may also be tax-deductible. However, there are certain limitations and restrictions on the amount of interest that can be deducted.

3. Student Loan Interest

If you have student loans, you may be eligible to deduct the interest paid on those loans. This deduction applies to both federal and private student loans. However, there are income limitations and other criteria that must be met in order to qualify for this deduction.

4. Business Loan Interest

If you have taken out a loan for business purposes, the interest paid on that loan may be tax-deductible. This includes loans used to start a new business, expand an existing business, or finance business-related expenses. Keep in mind that personal expenses cannot be deducted.

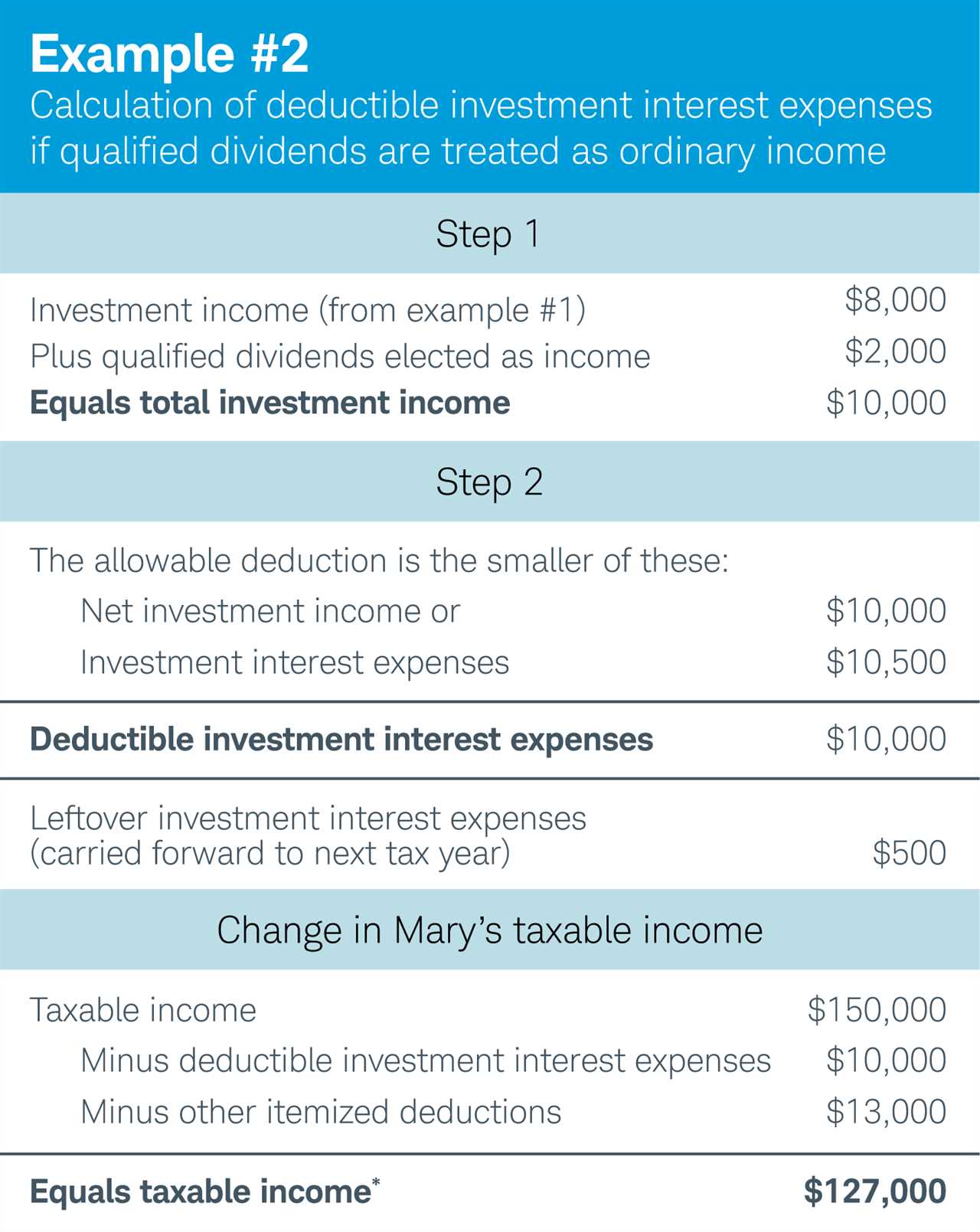

5. Investment Interest

If you have borrowed money to invest in stocks, bonds, or other investment opportunities, you may be able to deduct the interest paid on those loans. However, there are certain limitations and requirements that must be met in order to qualify for this deduction.

6. Qualified Education Loan Interest

In addition to student loan interest, you may also be able to deduct the interest paid on qualified education loans. These loans are used to pay for qualified higher education expenses, such as tuition, fees, and books. There are income limitations and other criteria that must be met to qualify for this deduction.

Maximizing Your Tax Deductions

- Keep track of all your interest payments: It’s crucial to maintain accurate records of all the interest you pay throughout the year. This includes mortgage interest, student loan interest, and any other types of interest that may be tax-deductible. By keeping detailed records, you’ll have the necessary documentation to support your deductions when filing your taxes.

- Understand the limits and restrictions: While many types of interest are tax-deductible, there are often limits and restrictions that apply. For example, there may be a cap on the amount of mortgage interest you can deduct, or certain income thresholds that determine your eligibility for certain deductions. Make sure you familiarize yourself with these rules to ensure you’re taking full advantage of the deductions available to you.

- Bundle your deductions: If you have multiple tax-deductible expenses, such as mortgage interest and property taxes, consider bundling them together in a single tax year. By doing so, you may be able to exceed the standard deduction and itemize your deductions, resulting in greater tax savings.

- Consult with a tax professional: Maximizing your tax deductions can be complex, especially if you have multiple sources of tax-deductible interest. It’s always a good idea to consult with a tax professional who can provide personalized advice based on your specific financial situation. They can help you navigate the intricacies of the tax code and ensure you’re taking advantage of all available deductions.

By following these strategies, you can maximize your tax deductions and potentially save a significant amount of money. Remember to stay informed about changes to the tax laws and take advantage of any new deductions that may become available. With careful planning and attention to detail, you can make the most of your tax-deductible interest and keep more money in your pocket.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.