Wrap-Up Insurance: Definition, Types, and Coverage Example

Wrap-Up insurance is a specialized type of insurance that provides coverage for large construction projects. It is designed to protect all parties involved in the project, including owners, contractors, subcontractors, and suppliers, from potential risks and liabilities.

Definition

Types of Wrap-Up Insurance

There are two main types of wrap-up insurance: Owner Controlled Insurance Program (OCIP) and Contractor Controlled Insurance Program (CCIP).

1. Owner Controlled Insurance Program (OCIP): In an OCIP, the project owner takes responsibility for obtaining the wrap-up insurance policy. The coverage extends to all contractors, subcontractors, and suppliers working on the project. This type of wrap-up insurance is commonly used for large-scale projects such as stadiums, airports, or government buildings.

2. Contractor Controlled Insurance Program (CCIP): In a CCIP, the general contractor takes responsibility for obtaining the wrap-up insurance policy. The coverage extends to all subcontractors and suppliers working on the project. This type of wrap-up insurance is commonly used for smaller projects or when the project owner does not want to take on the responsibility of obtaining the insurance.

Benefits of Wrap-Up Insurance

Wrap-Up insurance provides several benefits for all parties involved in a construction project:

1. Cost Savings: By consolidating insurance coverage under a single policy, wrap-up insurance can often result in cost savings for all participants. It eliminates the need for each party to purchase separate insurance policies, which can be expensive.

2. Streamlined Claims Process: In the event of a claim, the wrap-up insurance policy simplifies the claims process. Instead of multiple parties filing separate claims with their individual insurance companies, all claims are handled under the wrap-up policy, reducing administrative burden and potential delays.

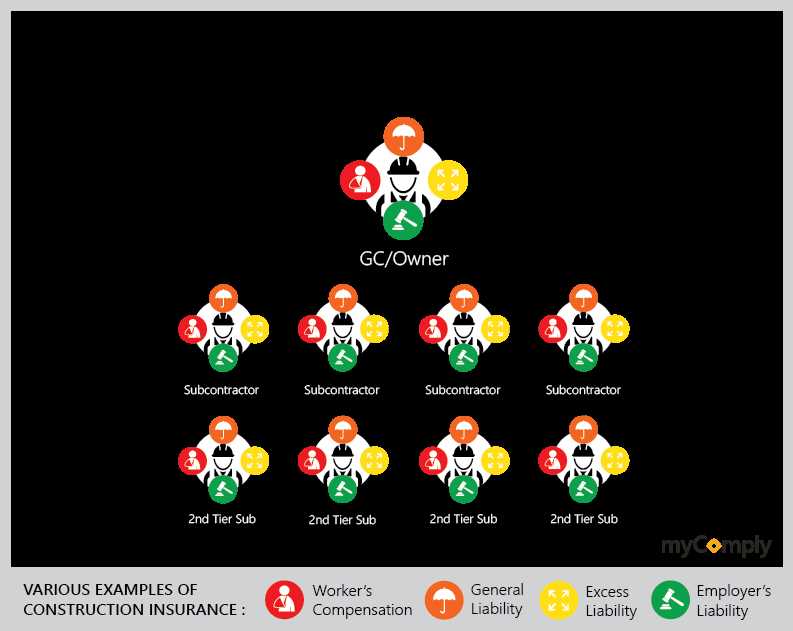

3. Enhanced Coverage: Wrap-up insurance policies typically provide broader coverage than individual policies. They can include coverage for general liability, workers’ compensation, excess liability, and other types of insurance, depending on the specific needs of the project.

4. Improved Risk Management: With a wrap-up insurance policy in place, all parties can benefit from a coordinated approach to risk management. The policy may include risk mitigation measures, safety protocols, and loss control programs that help prevent accidents and minimize potential liabilities.

Overall, wrap-up insurance offers a comprehensive solution for managing risks and protecting all parties involved in a construction project. It provides cost savings, streamlined claims process, enhanced coverage, and improved risk management, making it an essential tool for large-scale construction projects.

What is Wrap-Up Insurance?

Wrap-Up Insurance is typically purchased by the project owner or general contractor and covers a specific construction project from start to finish. It combines various types of insurance coverage, such as general liability, workers’ compensation, and excess liability, into a single policy.

One of the key features of Wrap-Up Insurance is that it provides coverage for all parties involved in the project, including subcontractors and their employees. This helps to streamline the insurance process and ensures that all parties are adequately protected.

Wrap-Up Insurance is particularly beneficial for large construction projects, as it allows for centralized control and coordination of insurance coverage. It eliminates the need for each subcontractor to obtain separate insurance policies, which can be time-consuming and costly.

Overall, Wrap-Up Insurance provides comprehensive coverage for construction projects and helps to mitigate potential risks and liabilities. It offers peace of mind to all parties involved and ensures that the project can proceed smoothly without any insurance-related obstacles.

Types of Wrap-Up Insurance and Their Benefits

Wrap-Up insurance policies come in various types, each designed to meet the specific needs of a construction project. Here are some common types of wrap-up insurance:

Owner-Controlled Insurance Program (OCIP): This type of wrap-up insurance is obtained and controlled by the project owner. It provides coverage for all contractors and subcontractors working on the project. OCIPs are typically used for large construction projects and offer benefits such as cost savings, improved risk management, and streamlined claims handling.

Contractor-Controlled Insurance Program (CCIP): In contrast to OCIP, CCIP is obtained and controlled by the general contractor. It covers all subcontractors working on the project and provides comprehensive coverage for various risks. CCIPs offer benefits such as increased control over insurance coverage, reduced administrative burden, and potential cost savings.

Project-Specific Insurance: This type of wrap-up insurance is tailored to a specific construction project. It provides coverage for all contractors and subcontractors involved in the project and is designed to address the unique risks associated with that particular project. Project-specific insurance offers benefits such as customized coverage, improved risk management, and better coordination among project participants.

Rolling Wrap-Up Insurance: Rolling wrap-up insurance is a type of policy that covers multiple construction projects under a single insurance program. It is particularly useful for large construction companies that undertake multiple projects simultaneously. Rolling wrap-up insurance offers benefits such as cost savings, streamlined administration, and consistent coverage across projects.

Owner-Controlled Insurance Program (OCIP): This type of wrap-up insurance is obtained and controlled by the project owner. It provides coverage for all contractors and subcontractors working on the project. OCIPs are typically used for large construction projects and offer benefits such as cost savings, improved risk management, and streamlined claims handling.

Each type of wrap-up insurance has its own set of benefits, but they all share the common goal of providing comprehensive coverage and reducing the insurance-related complexities of construction projects. By opting for wrap-up insurance, project owners and contractors can ensure that all parties involved are adequately protected and can focus on completing the project successfully.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.