What is Venture Capital?

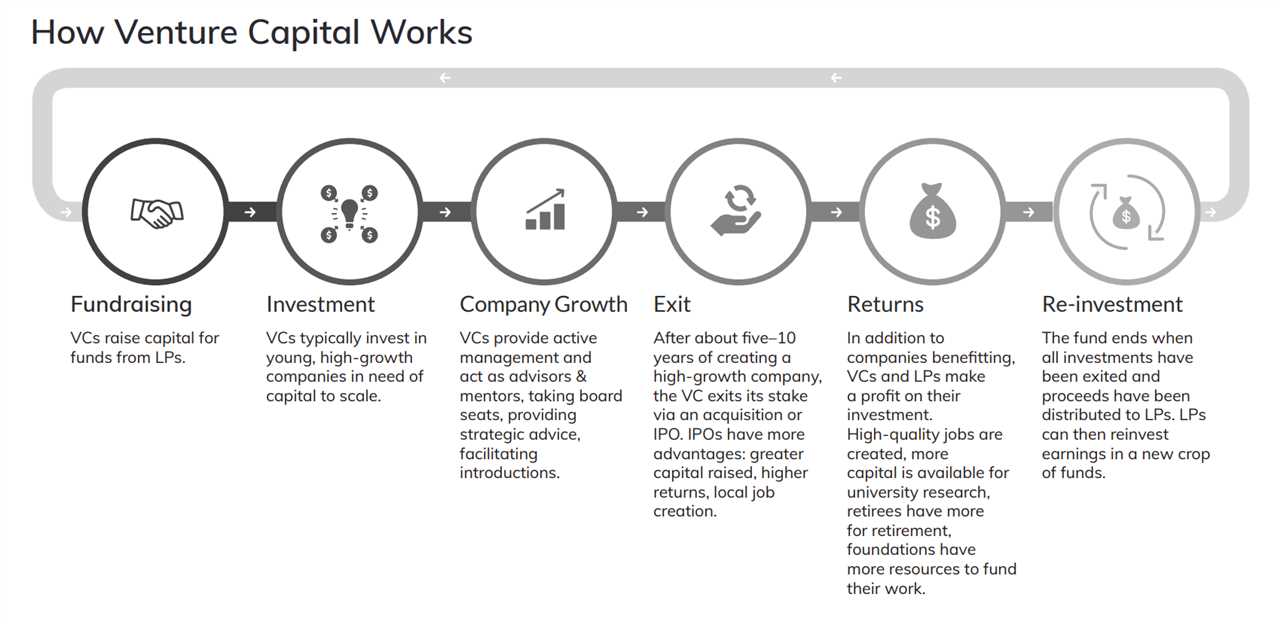

Unlike traditional bank loans or other forms of financing, venture capital involves investors taking an equity stake in the company in exchange for funding. This means that venture capitalists become partial owners of the company and share in its success or failure.

One of the key characteristics of venture capital is its focus on high-growth companies in emerging industries such as technology, biotechnology, and clean energy. These companies often have innovative business models or disruptive technologies that have the potential to generate substantial returns.

Venture capital funding can be crucial for startups and early-stage companies that may not have access to traditional sources of financing. It provides them with the necessary capital to develop their products or services, scale their operations, and attract additional investment.

However, venture capital is not without risks. As early-stage companies are inherently risky, venture capitalists often face a high rate of failure in their investments. They must carefully evaluate potential investments, conduct due diligence, and actively support portfolio companies to increase their chances of success.

One of the key aspects of venture capital is that it is not just about providing funding. Venture capitalists also provide expertise, guidance, and support to the companies they invest in. They often take an active role in the management and strategic decision-making of the companies.

There are different stages of venture capital funding, including seed funding, early-stage funding, and later-stage funding. Seed funding is the initial capital provided to a startup to help it get off the ground. Early-stage funding is provided to startups that have already shown some promise and have a viable business model. Later-stage funding is provided to companies that are already established and looking to expand.

One of the key benefits of venture capital is that it allows startups and small businesses to access the funding they need to grow and scale their operations. It can be difficult for these companies to secure traditional bank loans or other forms of financing, so venture capital provides an alternative source of funding.

| Key Points |

|---|

| Venture capital is a form of private equity financing provided to startups and small businesses with high growth potential. |

| Venture capitalists provide funding, expertise, and support to the companies they invest in. |

| There are different stages of venture capital funding, including seed funding, early-stage funding, and later-stage funding. |

| Venture capital allows startups and small businesses to access funding they may not be able to secure through traditional means. |

| Investing in startups and small businesses carries a high level of risk. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.