What is Net Worth?

Net worth is a financial term that represents the value of an individual’s or entity’s assets minus their liabilities. It is a measure of an individual’s or entity’s financial health and can be used to assess their overall financial position.

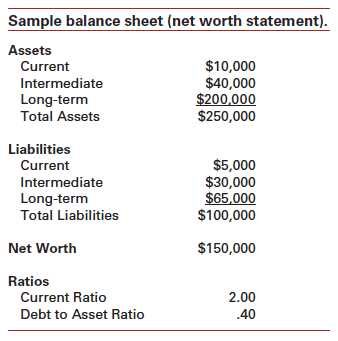

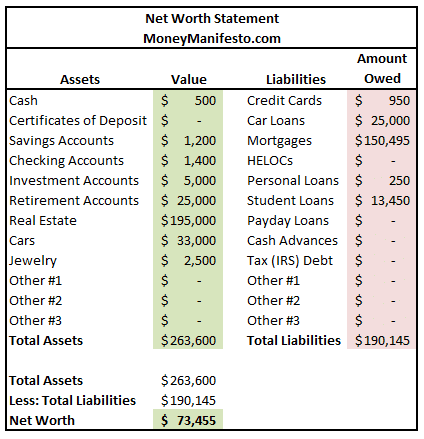

Assets include everything of value that an individual or entity owns, such as cash, investments, real estate, vehicles, and personal belongings. Liabilities, on the other hand, include debts and obligations, such as mortgages, loans, credit card debt, and other financial obligations.

Calculating net worth is important because it provides a snapshot of an individual’s or entity’s financial situation at a specific point in time. It can help determine their ability to meet financial goals, manage debt, and plan for the future.

Net worth can be positive or negative. A positive net worth means that an individual’s or entity’s assets exceed their liabilities, indicating a healthy financial position. A negative net worth, on the other hand, means that an individual’s or entity’s liabilities exceed their assets, indicating financial difficulties.

How to Calculate Net Worth

Step 1: Determine Your Assets

Start by making a list of all your assets. This includes your cash, savings accounts, investments, real estate, vehicles, and any other valuable possessions you own. Be sure to include both tangible and intangible assets.

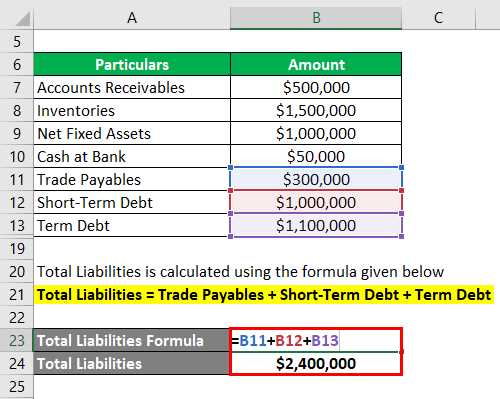

Step 2: Determine Your Liabilities

Step 3: Calculate Your Net Worth

Once you have your list of assets and liabilities, it’s time to calculate your net worth. Simply subtract the total value of your liabilities from the total value of your assets. The result is your net worth.

Step 4: Review and Update Regularly

By calculating your net worth and keeping track of it over time, you can gain valuable insights into your financial well-being and make informed decisions about your money. It’s a helpful tool for setting financial goals, monitoring your progress, and planning for the future.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.