Overview of Life-Cycle Funds

Benefits of Life-Cycle Funds

One of the main benefits of life-cycle funds is their simplicity. Investors do not need to actively manage their asset allocation or make frequent adjustments to their portfolio. The fund manager takes care of the asset allocation decisions based on the predetermined glide path. This makes life-cycle funds a popular choice for investors who prefer a hands-off approach to investing.

Considerations for Investing in Life-Cycle Funds

Examples of Life-Cycle Funds

Here are a few examples of life-cycle funds:

1. Vanguard Target Retirement 2050 Fund

2. Fidelity Freedom 2035 Fund

3. T. Rowe Price Retirement 2040 Fund

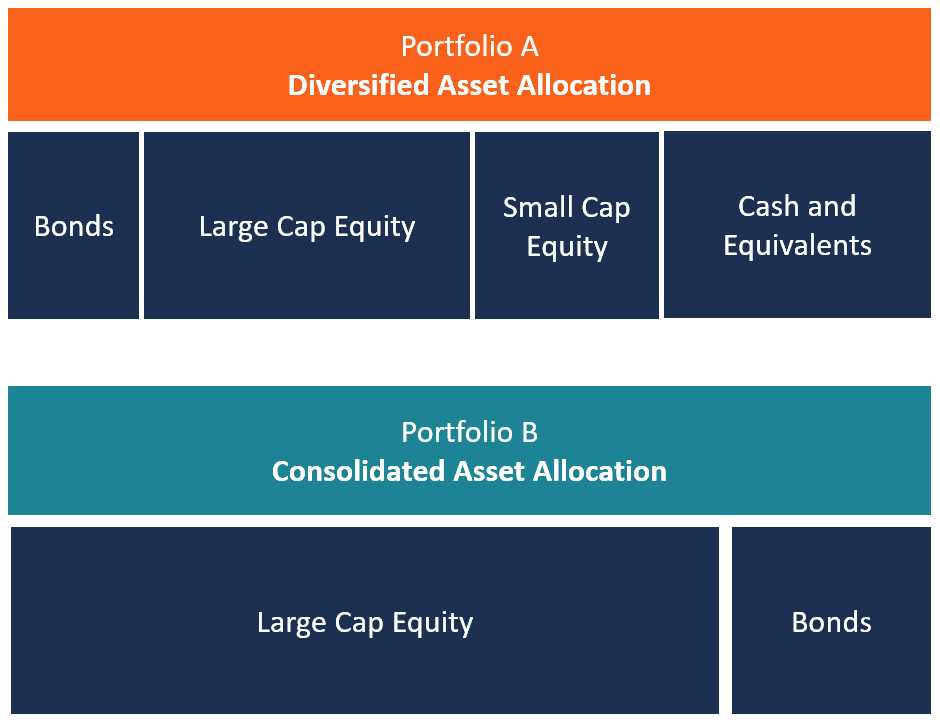

These examples illustrate how life-cycle funds work by adjusting their asset allocation based on the investor’s target retirement date. By automatically rebalancing the portfolio, these funds aim to provide a suitable risk-return profile for investors at different stages of their lives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.