Definition of Liability Insurance

Liability insurance is a type of insurance coverage that protects individuals or businesses from financial loss in the event that they are held legally liable for injuries or damages to another person or property. It provides coverage for legal costs, medical expenses, and damages that may result from a covered incident.

Liability insurance is designed to protect policyholders from the financial burden that can arise from lawsuits and legal claims. It is an essential form of protection for individuals and businesses, as it helps to safeguard their assets and provide financial security in case of unforeseen accidents or incidents.

Liability insurance typically covers three main types of liability: bodily injury liability, property damage liability, and personal and advertising injury liability. Bodily injury liability covers medical expenses, lost wages, and other damages resulting from injuries to another person. Property damage liability covers damages to another person’s property, such as a vehicle or building. Personal and advertising injury liability covers claims of slander, libel, copyright infringement, and other similar offenses.

Liability insurance policies may have limits on the amount of coverage provided, as well as deductibles and exclusions. It is important for individuals and businesses to carefully review their policy terms and conditions to ensure they have adequate coverage for their specific needs.

Function of Liability Insurance

Liability insurance serves a crucial function in protecting individuals and businesses from financial loss in the event of a liability claim. This type of insurance provides coverage for legal costs, settlements, and judgments that may arise from accidents, injuries, or property damage caused by the insured party.

Protection from Legal Expenses

One of the primary functions of liability insurance is to provide coverage for legal expenses. In the event of a liability claim, the insurance company will typically cover the costs of hiring a lawyer, court fees, and other legal expenses. This can be particularly important for individuals and small businesses who may not have the financial resources to handle such expenses on their own.

Financial Protection

Liability insurance also offers financial protection by covering settlements and judgments that may be awarded against the insured party. If the insured is found legally liable for causing harm or damage to another person or their property, the insurance company will pay the agreed-upon amount, up to the policy limits. This can help protect the insured’s personal assets or business finances from being depleted in the event of a large settlement or judgment.

Additionally, liability insurance can provide coverage for medical expenses incurred by third parties as a result of an accident or injury caused by the insured. This can include costs such as hospital bills, rehabilitation expenses, and ongoing medical treatments.

Peace of Mind

Having liability insurance can provide individuals and businesses with peace of mind, knowing that they are protected from the financial consequences of a liability claim. Accidents and unexpected events can happen at any time, and without adequate insurance coverage, the costs associated with a liability claim can be devastating. By having liability insurance in place, individuals and businesses can focus on their daily activities and operations, knowing that they have a safety net in place.

Types of Liability Insurance

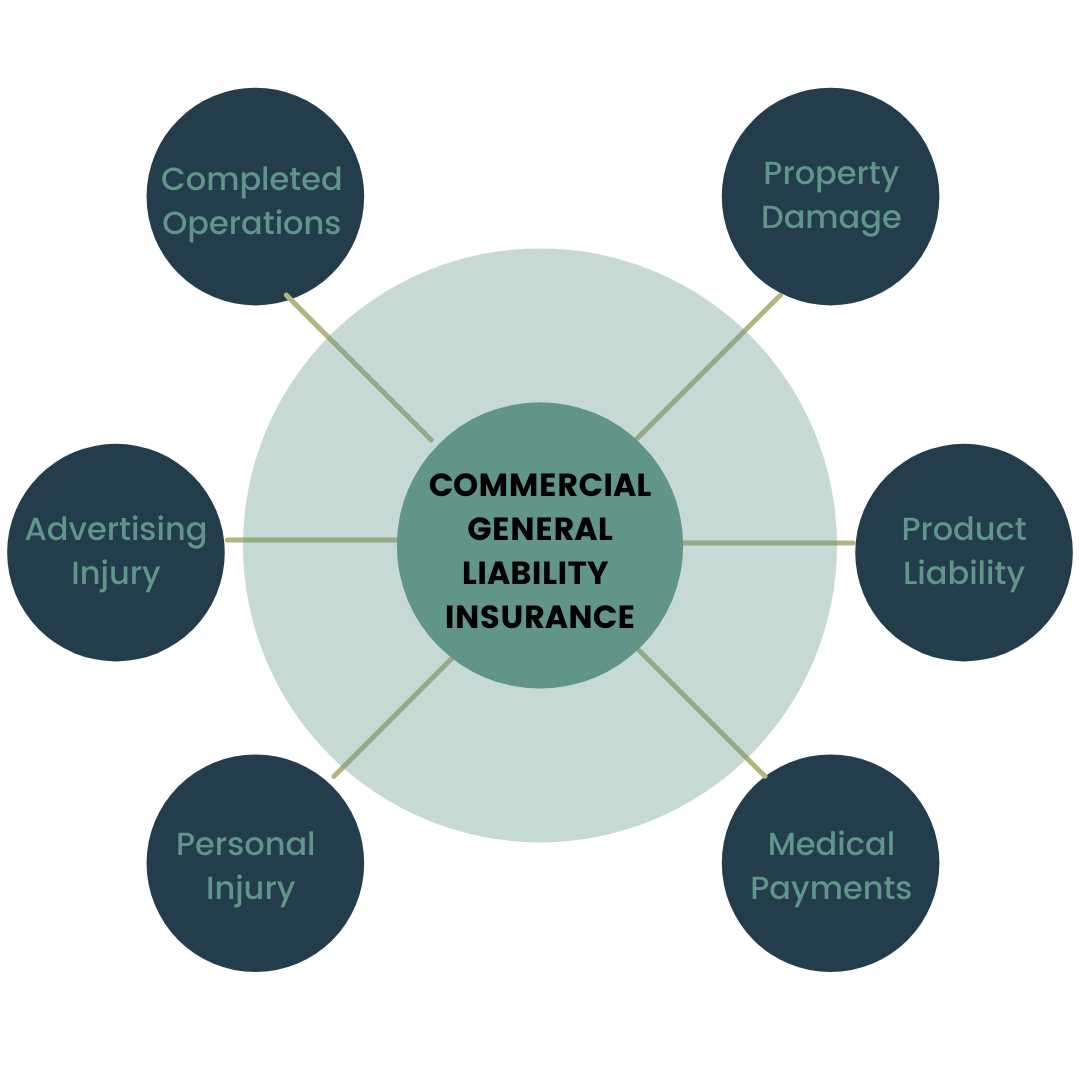

1. General Liability Insurance

General liability insurance is designed to protect businesses from a variety of claims, including bodily injury, property damage, and personal injury. It provides coverage for accidents that occur on the business premises or as a result of the business operations. This type of insurance is essential for any business, as it helps protect against costly lawsuits and financial losses.

2. Professional Liability Insurance

3. Product Liability Insurance

Product liability insurance is essential for businesses that manufacture or sell products. It provides coverage for claims related to injuries or damages caused by a defective product. Product liability insurance helps protect businesses from the financial consequences of lawsuits and can cover legal defense costs, settlements, and judgments.

4. Directors and Officers Liability Insurance

5. Cyber Liability Insurance

Cyber liability insurance is designed to protect businesses from the financial consequences of cyberattacks and data breaches. It provides coverage for claims related to data breaches, network security failures, and other cyber risks. This type of insurance helps businesses recover from cyber incidents by covering costs such as legal fees, notification expenses, and credit monitoring services.

| Type of Liability Insurance | Coverage |

|---|---|

| General Liability Insurance | Bodily injury, property damage, personal injury |

| Professional Liability Insurance | Claims of negligence or inadequate work |

| Product Liability Insurance | Injuries or damages caused by a defective product |

| Directors and Officers Liability Insurance | Wrongful acts in their capacity as directors or officers |

| Cyber Liability Insurance | Data breaches, network security failures, cyber risks |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.