Definition of High Ratio Loans

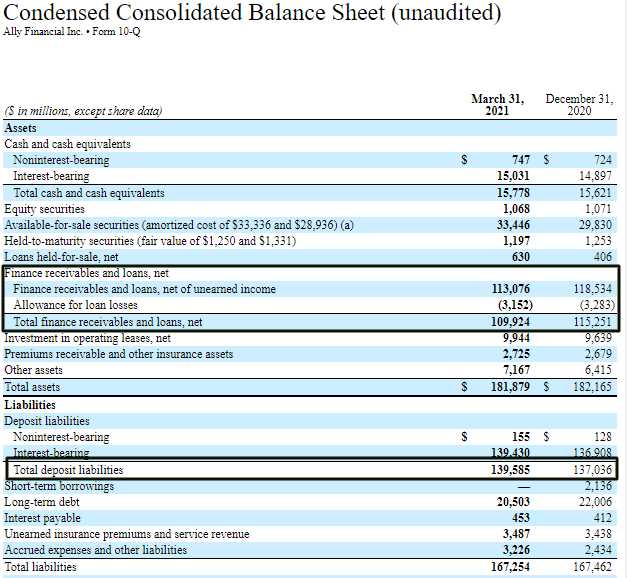

A high ratio loan refers to a type of loan where the borrower provides a smaller down payment, typically less than 20% of the total purchase price of the property. In other words, it is a loan that has a high loan-to-value ratio (LTV).

Why are high ratio loans used?

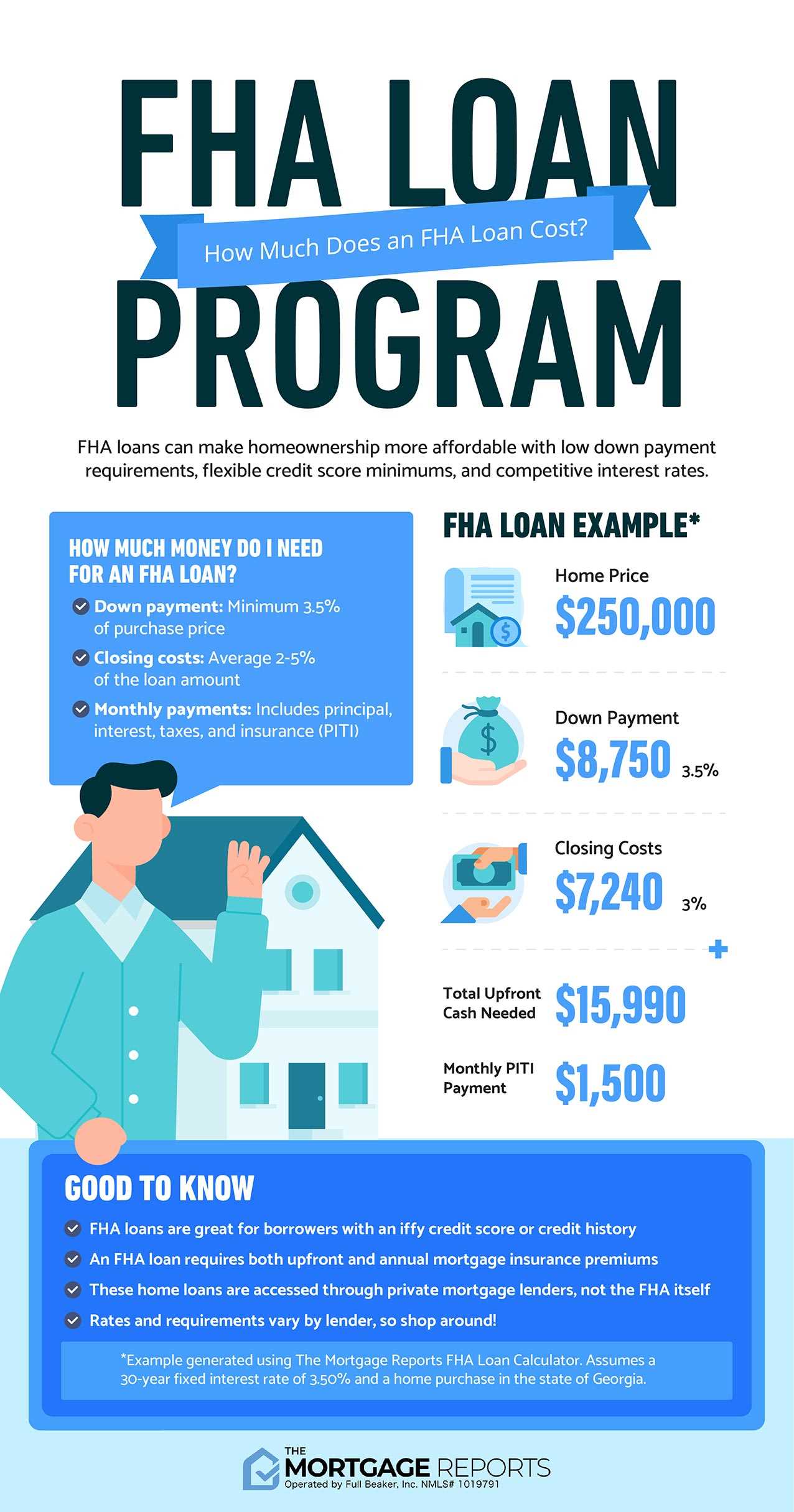

High ratio loans are commonly used by borrowers who do not have enough funds for a larger down payment. This type of loan allows them to enter the housing market and purchase a property without having to save a significant amount of money upfront.

High ratio loans are also popular among first-time homebuyers who may not have a substantial savings or established credit history. These loans provide an opportunity for individuals or families to become homeowners and start building equity.

Insurance for high ratio loans

Since high ratio loans carry a higher risk for lenders, mortgage insurance is typically required. Mortgage insurance protects the lender in case the borrower defaults on the loan. The cost of mortgage insurance is usually added to the monthly mortgage payments.

Conclusion

Calculation and Example of High Ratio Loans

High ratio loans are typically calculated by dividing the loan amount by the appraised value of the property. This ratio is expressed as a percentage and is used by lenders to determine the level of risk associated with the loan.

Here is an example to illustrate the calculation of a high ratio loan:

- Loan amount: $200,000

- Appraised value of the property: $250,000

To calculate the high ratio loan, divide the loan amount by the appraised value and multiply by 100:

High ratio loan = ($200,000 / $250,000) * 100 = 80%

High ratio loans are commonly used when the borrower has a down payment of less than 20% of the property’s value. These loans often require mortgage insurance to protect the lender in case of default.

Overall, high ratio loans can provide an opportunity for borrowers to purchase a home with a smaller down payment, but it’s crucial to carefully consider the financial implications and ensure that the loan is manageable within the borrower’s budget.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.