What are Dutch Auctions?

A Dutch auction is a type of auction in which the price of an item is gradually lowered until a buyer is willing to accept the current price. It is named after the Dutch tulip auctions of the 17th century, where this method was commonly used. In a Dutch auction, the seller starts with a high asking price and then gradually lowers it until a buyer agrees to purchase the item.

Advantages of Dutch Auctions

One of the main advantages of Dutch auctions is that they ensure a fair and transparent pricing mechanism. The auction process allows all potential investors to participate and determine the price at which they are willing to buy the shares. This helps eliminate any potential biases or conflicts of interest that may arise in other pricing methods.

Another advantage is that Dutch auctions can help companies raise more capital. By allowing investors to bid on the shares, the auction process creates competition and can result in a higher price for the shares. This can be beneficial for companies looking to maximize their fundraising efforts.

Disadvantages of Dutch Auctions

One of the main disadvantages of Dutch auctions is that they can be complex and difficult to understand for some investors. The auction process involves multiple rounds of bidding and can be confusing for those who are not familiar with it. This may discourage some potential investors from participating in the auction.

Another disadvantage is that Dutch auctions can result in a lower price for the shares compared to other pricing methods. Since the price is determined by the lowest bid that clears the market, it may not reflect the true value of the shares. This can result in a lower valuation for the company and potentially lower returns for investors.

How do Dutch Auctions work in Public Offerings?

In a Dutch auction, the process starts with the seller setting a high price for the item being auctioned. The price is gradually lowered until a buyer is willing to accept the price and purchase the item. This is in contrast to a traditional auction where the price starts low and increases as buyers bid higher.

In the context of public offerings, a Dutch auction is used to determine the price at which shares of a company will be sold to the public. The auction is conducted by an investment bank acting as an auctioneer.

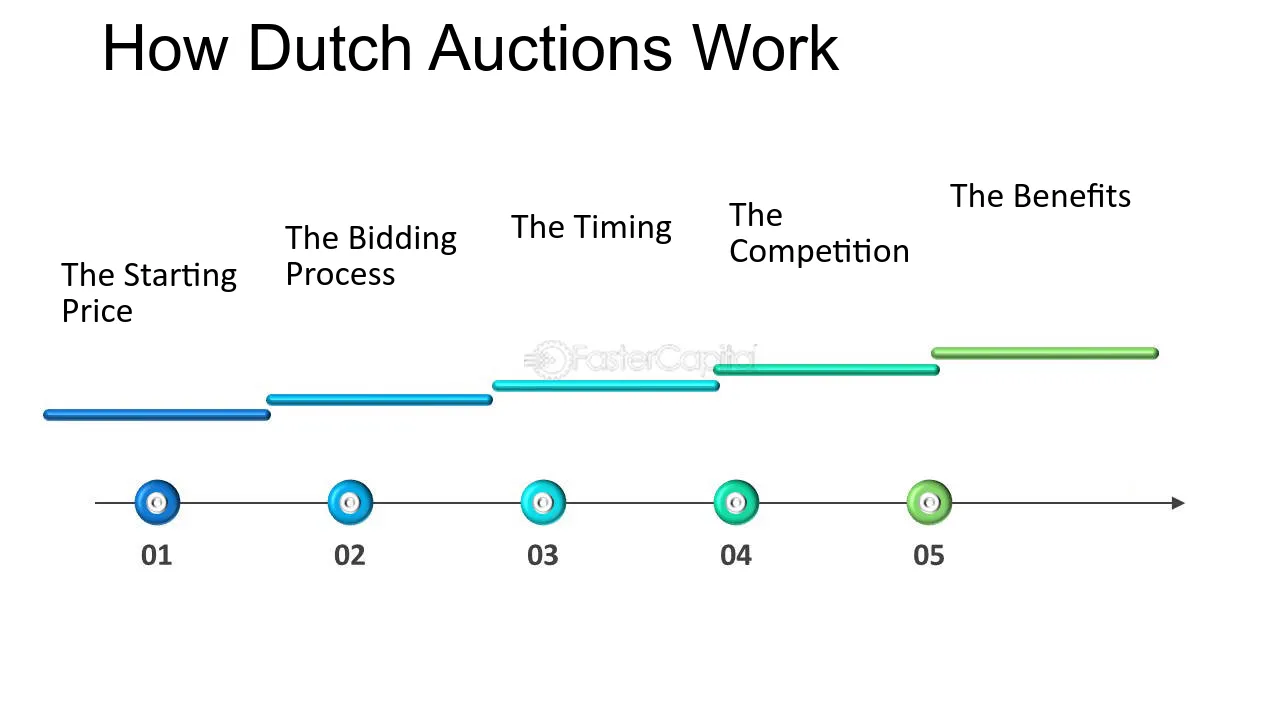

Here is a step-by-step breakdown of how Dutch auctions work in public offerings:

- The company looking to go public hires an investment bank to manage the offering.

- The investment bank determines the number of shares to be sold and sets a price range within which the auction will take place.

- Potential investors submit bids indicating the number of shares they are willing to purchase and the price they are willing to pay.

- The investment bank collects all the bids and determines the clearing price, which is the highest price at which all the shares can be sold.

- All successful bidders pay the clearing price for their shares, regardless of the price they bid.

- If there are more shares available than the total number of shares bid for, the remaining shares are allocated to bidders who bid at or above the clearing price on a pro-rata basis.

- If there are more shares bid for than the total number of shares available, the investment bank may allocate shares based on a predetermined set of criteria or use a random allocation process.

- Once the auction is complete, the shares are allocated and the company receives the proceeds from the sale.

Dutch auctions in public offerings provide a transparent and efficient way to determine the price at which shares are sold to the public. They allow for broad participation from investors and can result in a fair market price for the shares.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.