Supply and Demand

In classical economics, the concept of supply and demand plays a crucial role in determining prices and quantities in the market. Supply refers to the quantity of a good or service that producers are willing and able to offer for sale at a given price, while demand refers to the quantity of a good or service that consumers are willing and able to purchase at a given price.

The interaction between supply and demand ultimately determines the equilibrium price and quantity in the market. When the demand for a product exceeds its supply, a shortage occurs, leading to an increase in price. On the other hand, when the supply of a product exceeds its demand, a surplus occurs, leading to a decrease in price.

Classical economists believe that markets are self-regulating and tend to naturally move towards equilibrium. They argue that prices and quantities adjust to balance supply and demand, ensuring that resources are allocated efficiently.

Additionally, classical economists emphasize the role of competition in shaping supply and demand. They argue that competition among producers leads to lower prices and increased efficiency, as firms strive to offer better products at competitive prices. Similarly, competition among consumers leads to higher prices and increased efficiency, as individuals compete for limited resources.

Invisible Hand

In classical economics, the concept of the “invisible hand” is a key principle that explains how the market economy operates. The term was coined by the Scottish economist Adam Smith in his book “The Wealth of Nations” in 1776.

The invisible hand refers to the unintended social benefits that result from individuals pursuing their own self-interests. According to Smith, when individuals act in their own self-interest, they are led by an invisible hand to promote the general welfare of society as a whole.

This concept is based on the idea that individuals are motivated by their own self-interest and seek to maximize their own profits or well-being. In doing so, they engage in voluntary exchanges in the marketplace, which leads to the efficient allocation of resources and the production of goods and services that meet the needs and wants of consumers.

The invisible hand operates through the mechanism of supply and demand. When individuals pursue their own self-interest, they respond to market signals such as prices and competition. As a result, resources are allocated to the production of goods and services that are in high demand, while those that are less in demand are gradually phased out.

Through this process, the invisible hand ensures that resources are allocated efficiently and that the economy operates at its full potential. It also encourages innovation and entrepreneurship, as individuals are incentivized to find new ways to meet the needs and wants of consumers in order to maximize their own profits.

However, it is important to note that the invisible hand does not guarantee perfect outcomes or eliminate all market failures. There are instances where government intervention may be necessary to correct market failures and ensure the well-being of society.

Classical economics is a school of economic thought that emerged in the 18th century and dominated economic thinking until the early 20th century. It is based on the belief that markets are self-regulating and that individuals act in their own self-interest.

There are several key principles of classical economics that are important to understand:

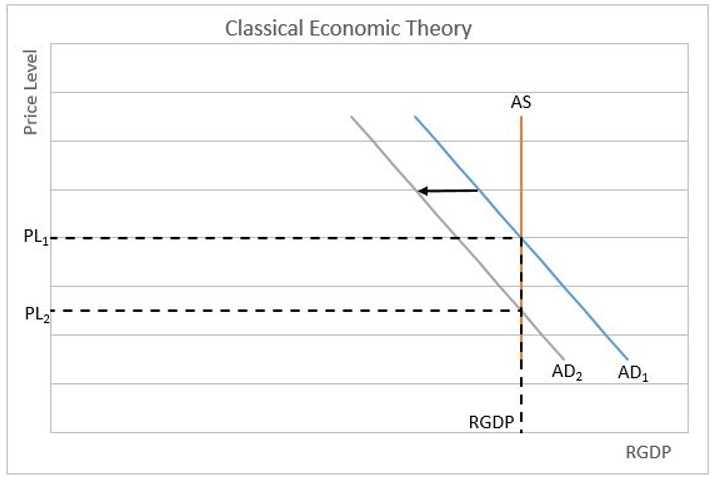

- Market equilibrium: Classical economists believe that markets tend to reach a state of equilibrium, where the supply of goods and services matches the demand. This equilibrium is achieved through the interaction of supply and demand forces.

- Free markets: Classical economists argue that markets should be free from government intervention and regulation. They believe that free markets allow for efficient allocation of resources and promote economic growth.

- Division of labor: Classical economists emphasize the importance of division of labor in increasing productivity. They argue that when individuals specialize in a particular task, they become more skilled and efficient, leading to higher overall productivity.

- Profit motive: Classical economics recognizes the profit motive as a key driver of economic activity. Individuals are motivated to engage in economic activities in order to maximize their profits.

- Say’s Law: Say’s Law, named after the French economist Jean-Baptiste Say, states that supply creates its own demand. Classical economists believe that production of goods and services generates income, which in turn creates demand for those goods and services.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.