Applications of Autoregressive Models in Advanced Technical Analysis

1. Time Series Forecasting

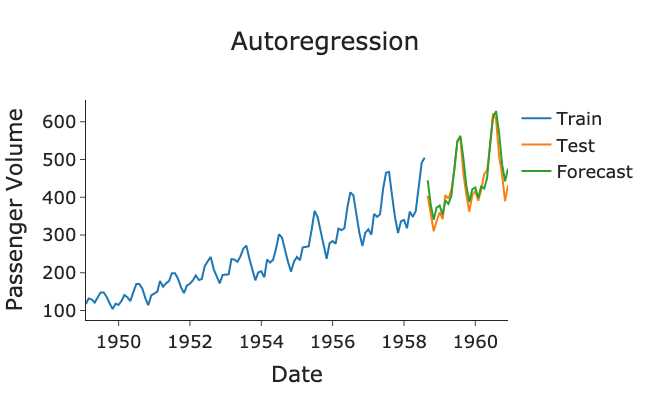

One of the primary applications of autoregressive models is in time series forecasting. By analyzing the historical data of a financial variable, such as stock prices or exchange rates, AR models can be used to predict future values. This information is crucial for investors and traders who want to make informed decisions based on the expected future performance of a financial asset.

2. Pattern Recognition

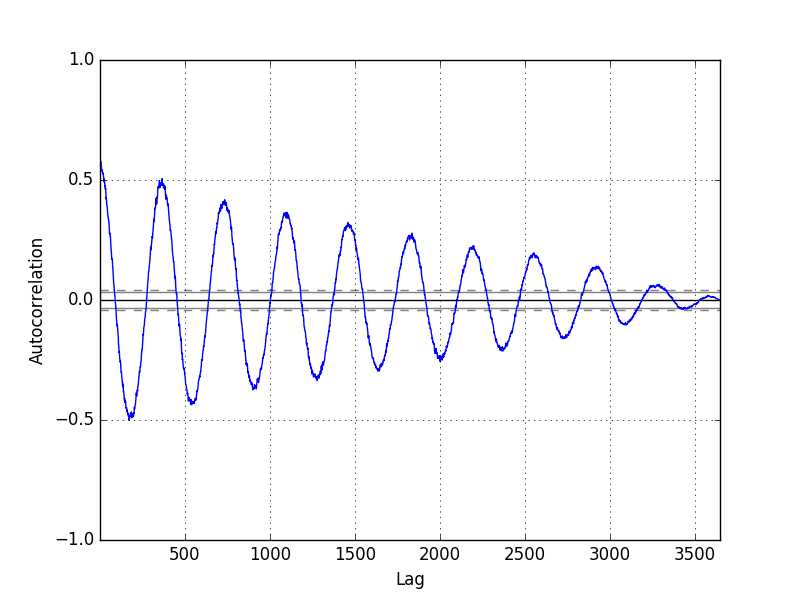

Another application of autoregressive models is in pattern recognition. By analyzing the autocorrelation of a financial variable, AR models can identify recurring patterns and trends in the data. These patterns can then be used to make predictions about future market movements.

For example, AR models can be used to identify and predict stock market cycles, where prices tend to follow certain patterns over time. By recognizing these patterns, traders can make more accurate predictions about future market movements and adjust their investment strategies accordingly.

3. Risk Management

Autoregressive models are also valuable tools for risk management in financial markets. By analyzing the volatility of a financial variable, AR models can help identify and measure the level of risk associated with an investment.

In addition, AR models can be used to model and analyze the correlation between different financial variables. This information is crucial for diversification strategies, as it helps investors understand the relationship between different assets and reduce the overall risk of their portfolio.

Conclusion

Examples of Autoregressive Models in Financial Forecasting

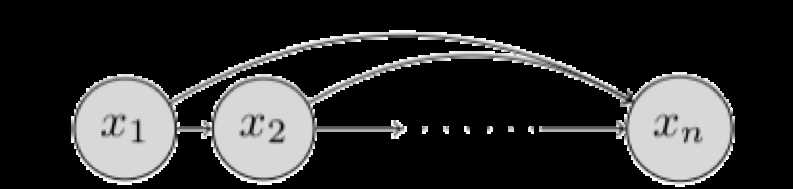

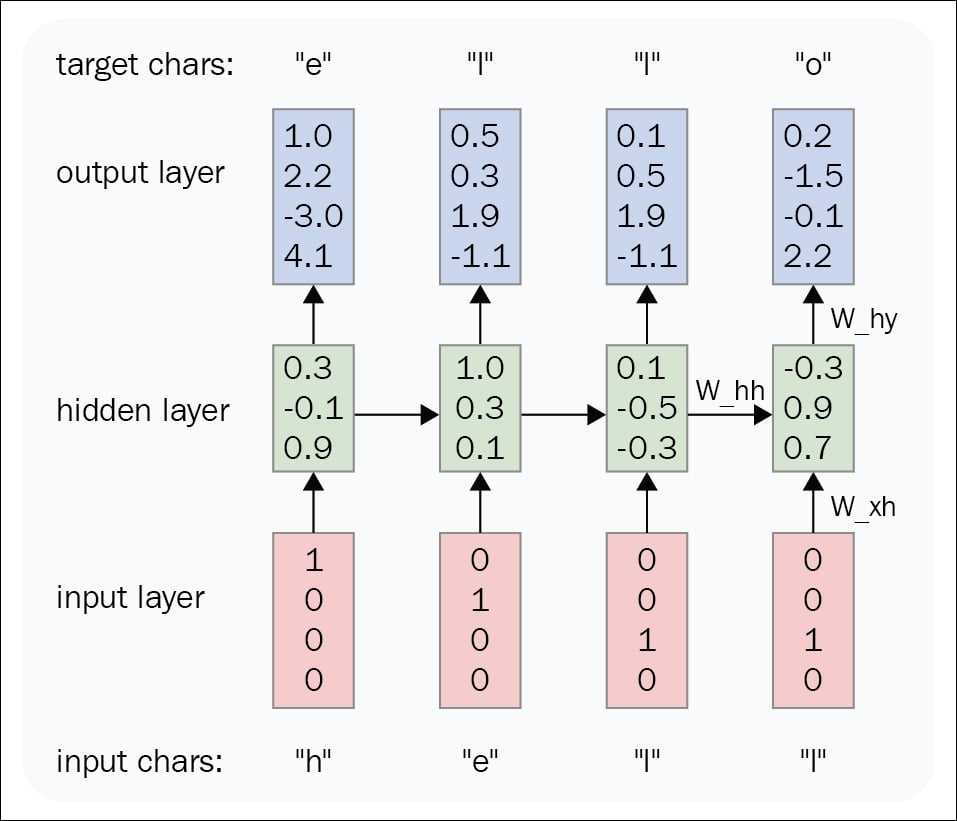

Autoregressive models are widely used in financial forecasting due to their ability to capture the temporal dependencies in time series data. Here are some examples of how autoregressive models can be applied in financial forecasting:

- Predicting Stock Prices: Autoregressive models can be used to predict future stock prices based on historical price data. By analyzing the patterns and trends in the past prices, autoregressive models can provide insights into the potential future movements of stocks.

- Forecasting Exchange Rates: Autoregressive models can also be applied to forecast exchange rates. By analyzing the historical exchange rate data, these models can identify the underlying patterns and relationships that can help predict future exchange rate movements.

- Estimating Volatility: Autoregressive models can be used to estimate the volatility of financial assets, such as stocks or currencies. By modeling the autoregressive structure of the asset’s returns, these models can provide valuable insights into the level of risk associated with the asset.

- Time Series Analysis: Autoregressive models are commonly used in time series analysis to understand the underlying dynamics of financial data. By fitting autoregressive models to the data, analysts can identify the significant factors driving the observed patterns and make informed predictions about future behavior.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.