What is the Exchange Ratio?

The exchange ratio is a financial term that is used to determine the ratio at which one company’s shares will be exchanged for another company’s shares in a merger or acquisition. It is a crucial factor in determining the value of the transaction for both parties involved.

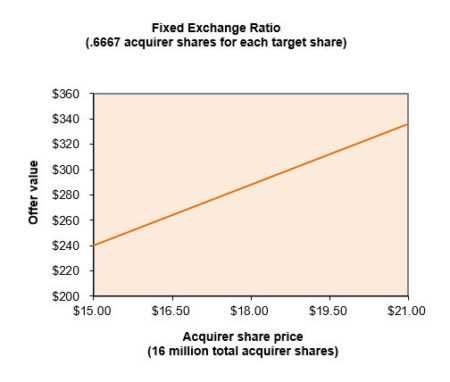

When two companies decide to merge or one company decides to acquire another, they need to determine the exchange ratio to ensure a fair and equitable deal. The exchange ratio is usually expressed as a ratio or a fraction, such as 1:1 or 0.75:1. This ratio represents how many shares of the acquiring company will be given in exchange for each share of the target company.

Factors Affecting the Exchange Ratio

Several factors can influence the determination of the exchange ratio:

- Financial Performance: The financial performance of both companies, including their revenue, profitability, and growth prospects, can play a role in determining the exchange ratio. A company with stronger financials may have a higher exchange ratio compared to a company with weaker financials.

- Market Value: The market value of the companies’ shares can also impact the exchange ratio. If one company’s shares are trading at a higher price compared to the other, the exchange ratio may be adjusted accordingly to reflect the relative value.

- Negotiation: The negotiation between the parties involved can also influence the exchange ratio. Each company may have its own objectives and priorities, which can be reflected in the final exchange ratio.

It is important for both companies to carefully consider these factors and conduct a thorough analysis before determining the exchange ratio. The goal is to ensure a fair and mutually beneficial deal for all parties involved.

Impact of the Exchange Ratio

The exchange ratio can have a significant impact on the ownership structure of the merged or acquired company. A higher exchange ratio means that the acquiring company will issue more shares, resulting in a dilution of ownership for its existing shareholders. On the other hand, a lower exchange ratio means that the acquiring company will issue fewer shares, resulting in a higher ownership stake for its existing shareholders.

Furthermore, the exchange ratio can also affect the voting rights and control of the merged or acquired company. If the exchange ratio results in a significant change in ownership, it may lead to a shift in control and decision-making power.

How to Calculate the Exchange Ratio

The exchange ratio is a key factor in determining the value of a transaction involving the exchange of securities or assets. It represents the number of shares or units of one security or asset that will be exchanged for each share or unit of another security or asset.

Calculating the exchange ratio involves considering various factors, including the market value of the securities or assets being exchanged, the terms of the transaction, and any other relevant considerations. Here are the steps to calculate the exchange ratio:

1. Determine the market value of the securities or assets: The first step is to determine the market value of the securities or assets that will be exchanged. This can be done by looking at the current market price or using other valuation methods.

2. Consider the terms of the transaction: Next, consider the terms of the transaction, including any premiums or discounts that may be applied. For example, if one company is acquiring another, there may be a premium or discount applied to the exchange ratio based on the perceived value of the target company.

4. Calculate the exchange ratio: Once all the relevant factors have been considered, calculate the exchange ratio by dividing the market value of the securities or assets being exchanged by the market value of the securities or assets being received. For example, if Company A is acquiring Company B and the market value of Company A’s shares is $10 and the market value of Company B’s shares is $5, the exchange ratio would be 2:1, meaning that Company A will exchange 2 shares for every 1 share of Company B.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.