Uncovering the Strategy and Education Behind Uncovered Options

Uncovered options are typically used by traders who have a high tolerance for risk and are looking to profit from the premiums received from selling options contracts. When selling uncovered options, the trader is essentially taking on the obligation to buy or sell the underlying asset at a predetermined price (the strike price) if the option is exercised by the buyer.

Unlike covered options, where the trader owns the underlying asset and sells options contracts against it, uncovered options are not backed by any ownership of the underlying asset. This means that if the option is exercised, the trader must either buy or sell the asset on the open market to fulfill their obligation.

The Risks and Rewards

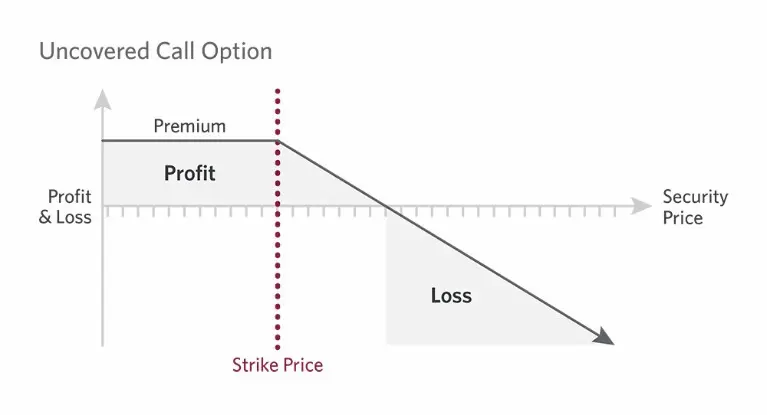

Uncovered options can be a high-risk strategy because the potential losses are unlimited. If the price of the underlying asset moves significantly against the trader’s position, they may be forced to buy or sell the asset at a much higher or lower price than anticipated, resulting in substantial losses.

However, this strategy also offers potential rewards. If the price of the underlying asset remains relatively stable or moves in the trader’s favor, they can keep the premium received from selling the options contract as profit without having to fulfill their obligation.

- Uncovered options involve selling options contracts without owning the underlying asset.

- This strategy can be risky, as potential losses are unlimited.

- A well-defined risk management strategy is essential when trading uncovered options.

Overall, uncovered options can be a powerful strategy for experienced traders who are willing to take on the associated risks. However, it is crucial to approach this strategy with caution and to thoroughly understand the market dynamics and potential outcomes before engaging in uncovered options trading.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.