Definition of Tax Incidence

Tax incidence refers to the distribution of the burden of a tax among different groups in an economy. It examines who ultimately bears the economic cost of a tax, whether it is the consumers, producers, or both.

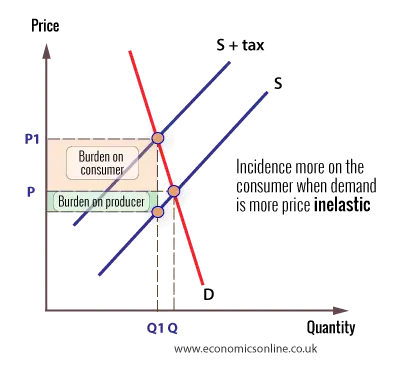

When a government imposes a tax on a particular good or service, it affects the price of that good or service. The tax can be levied on either the producers or the consumers, or it can be shared between them. The incidence of the tax depends on the relative price elasticity of demand and supply.

On the other hand, if the supply of a good is relatively inelastic, meaning that producers are not very responsive to changes in price, the burden of the tax will fall primarily on the producers. They will have to absorb a larger share of the tax burden by reducing their profit margins or passing on the tax to consumers in the form of higher prices.

In some cases, the burden of the tax can be shared between consumers and producers. This happens when both demand and supply are relatively elastic, meaning that both consumers and producers are responsive to changes in price. In such cases, the tax burden is distributed between the two parties depending on the specific elasticity of demand and supply.

Example of Tax Incidence

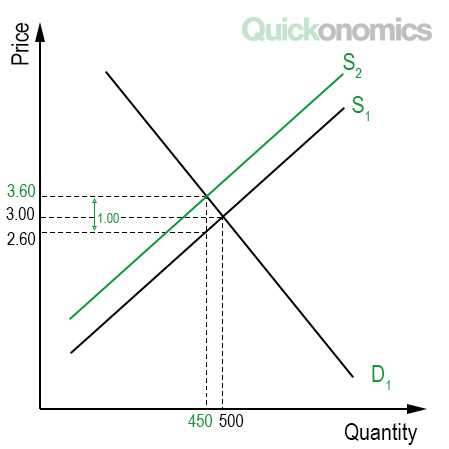

Initially, let’s assume that the market for cigarettes is in equilibrium, with a certain quantity demanded and supplied at a specific price. When the tax is introduced, it increases the cost of production for cigarette producers. As a result, they may choose to increase the price of cigarettes to maintain their profit margins.

Mechanism of Tax Incidence

When analyzing the mechanism of tax incidence, it is important to understand how taxes are distributed between buyers and sellers in a market. The incidence of a tax refers to who bears the burden of the tax, whether it is the buyers, sellers, or both.

There are two main factors that determine the incidence of a tax: the elasticity of demand and the elasticity of supply. The elasticity of demand measures how responsive buyers are to changes in price, while the elasticity of supply measures how responsive sellers are to changes in price.

Elasticity of Demand

If the demand for a good is relatively inelastic, meaning that buyers are not very responsive to changes in price, then the burden of the tax is likely to fall more on the buyers. This is because even if the price of the good increases due to the tax, buyers will still continue to purchase the good at a relatively high quantity.

On the other hand, if the demand for a good is relatively elastic, meaning that buyers are very responsive to changes in price, then the burden of the tax is likely to fall more on the sellers. This is because if the price of the good increases due to the tax, buyers will decrease their quantity demanded, leading to a decrease in sales for the sellers.

Elasticity of Supply

If the supply of a good is relatively inelastic, meaning that sellers are not very responsive to changes in price, then the burden of the tax is likely to fall more on the sellers. This is because even if the price of the good decreases due to the tax, sellers will still continue to supply the good at a relatively high quantity.

On the other hand, if the supply of a good is relatively elastic, meaning that sellers are very responsive to changes in price, then the burden of the tax is likely to fall more on the buyers. This is because if the price of the good decreases due to the tax, sellers will decrease their quantity supplied, leading to a decrease in availability of the good for the buyers.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.