Social Security Benefits: A Comprehensive Guide

What are Social Security benefits?

Social Security benefits are monthly payments made to individuals who have contributed to the Social Security system through payroll taxes. These benefits are based on an individual’s earnings history and the age at which they choose to start receiving benefits. The amount of the benefit is calculated using a formula that takes into account the individual’s average indexed monthly earnings.

Types of Social Security benefits

There are several types of Social Security benefits that individuals may be eligible for:

- Retirement benefits: These are the most common type of Social Security benefits and are available to individuals who have reached the age of 62 or older and have earned enough credits through their work history.

- Disability benefits: These benefits are available to individuals who are unable to work due to a disability and have earned enough credits through their work history.

- Survivor benefits: These benefits are available to the surviving spouse, children, or parents of a deceased worker. The amount of the benefit depends on the deceased worker’s earnings history.

- Dependent benefits: These benefits are available to the dependent children of a retired or disabled worker.

It is important to note that Social Security benefits are not intended to replace an individual’s entire income in retirement. They are designed to supplement other sources of income, such as pensions, savings, and investments.

Eligibility for Social Security Benefits

In order to be eligible for Social Security benefits, individuals must have earned enough credits by paying Social Security taxes. These credits are earned based on the amount of income a person earns and the number of years they have worked. The number of credits required to be eligible for benefits depends on the individual’s age at the time they become disabled or retire.

For retirement benefits, individuals must have earned at least 40 credits, which is equivalent to 10 years of work. However, the age at which individuals can start receiving retirement benefits varies depending on their birth year.

Calculating Social Security Benefits

The amount of Social Security benefits an individual is eligible to receive is based on their average earnings over their lifetime. The Social Security Administration uses a formula to calculate the primary insurance amount (PIA), which is the monthly benefit amount an individual is entitled to at full retirement age.

The PIA is calculated by taking into account the individual’s highest 35 years of earnings, adjusting for inflation, and applying a formula that provides higher benefits for lower-income individuals. The PIA is then adjusted based on the individual’s age at the time they start receiving benefits.

Types of Social Security Benefits

There are several types of Social Security benefits available, including retirement benefits, disability benefits, survivor benefits, and spousal benefits. Retirement benefits are available to individuals who have reached full retirement age, which is typically between 66 and 67 years old, depending on the individual’s birth year.

Disability benefits are available to individuals who are unable to work due to a physical or mental impairment that is expected to last at least one year or result in death. Survivor benefits are available to the surviving spouse and children of a deceased worker. Spousal benefits are available to the spouse of a retired or disabled worker.

It is important to note that the amount of benefits individuals receive may be subject to income taxes, depending on their total income. Additionally, individuals may choose to start receiving benefits as early as age 62, but this will result in a reduced monthly benefit amount.

The Different Types of Benefits

2. Disability Benefits: Social Security disability benefits are available to individuals who are unable to work due to a disability that is expected to last for at least one year or result in death. To qualify for disability benefits, you must have worked and paid Social Security taxes for a certain number of years, depending on your age. The amount of disability benefits you receive will be based on your average lifetime earnings.

3. Survivor Benefits: Survivor benefits are available to the surviving spouse, children, or parents of a deceased individual who worked and paid Social Security taxes. The amount of survivor benefits you receive will depend on the earnings history of the deceased individual. In some cases, divorced spouses may also be eligible for survivor benefits.

4. Spousal Benefits: Spousal benefits are available to individuals who are married to someone who is receiving Social Security retirement or disability benefits. The amount of spousal benefits you receive will depend on your own earnings history and whether you have reached full retirement age. If you start receiving spousal benefits before reaching full retirement age, your monthly benefit amount will be reduced.

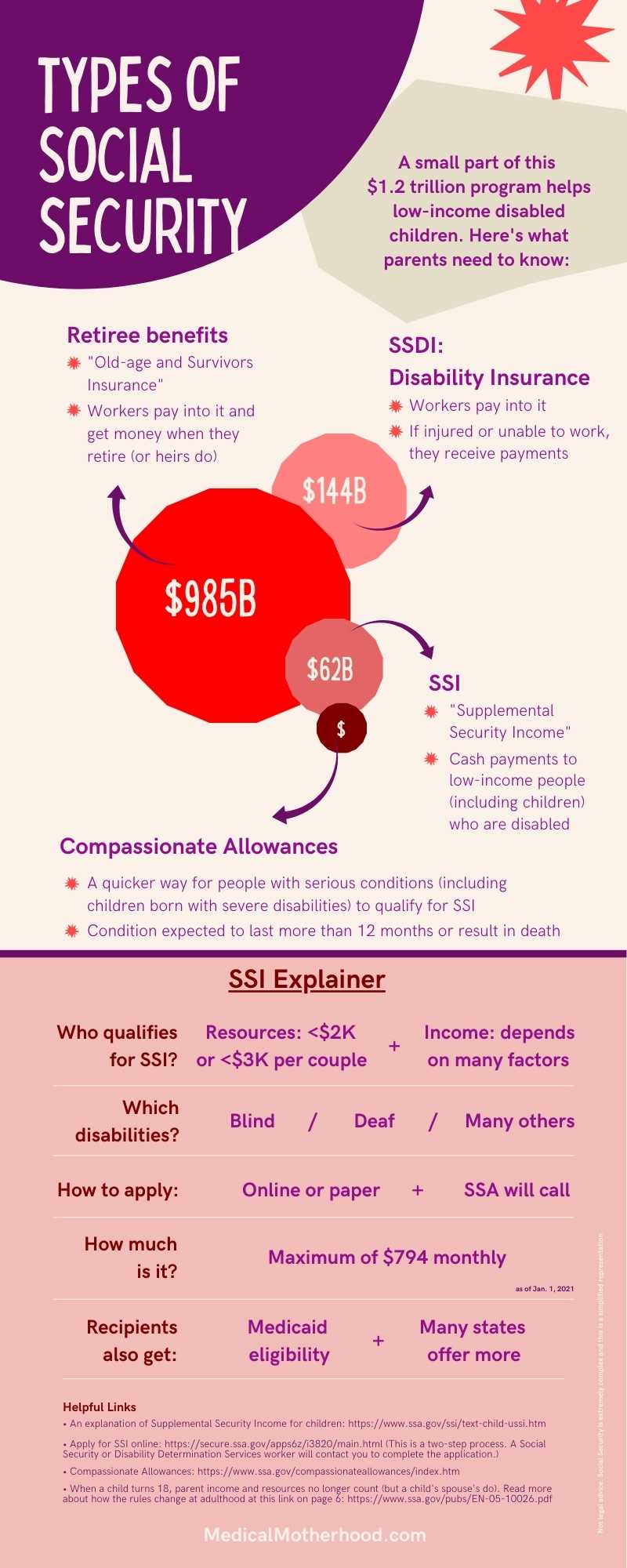

5. Supplemental Security Income (SSI): SSI is a needs-based program that provides financial assistance to individuals who are disabled, blind, or aged and have limited income and resources. Unlike other Social Security benefits, SSI is not based on your work history or earnings. The amount of SSI benefits you receive will depend on your income and living situation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.