What is Realization Multiple?

Realization multiple is a financial metric used in the private equity and venture capital industry to measure the return on investment (ROI) for a particular investment. It is a ratio that compares the total amount of money returned to investors to the amount of money initially invested.

The realization multiple is calculated by dividing the total amount of money returned to investors, including both capital and profits, by the amount of money initially invested. It provides a measure of how much money investors have made on their investment, relative to the amount of money they initially put in.

For example, if an investor initially invests $1 million and receives a total of $3 million in return, the realization multiple would be 3x. This means that the investor has made three times their initial investment.

Importance of Realization Multiple

The realization multiple is an important metric for investors as it helps them assess the success of their investments. A higher realization multiple indicates a higher return on investment and a more successful investment. It also provides a way for investors to compare the performance of different investments and make informed decisions about future investments.

Additionally, the realization multiple is used by fund managers and investment professionals to evaluate the performance of their investment portfolios. It helps them determine the effectiveness of their investment strategies and identify areas for improvement.

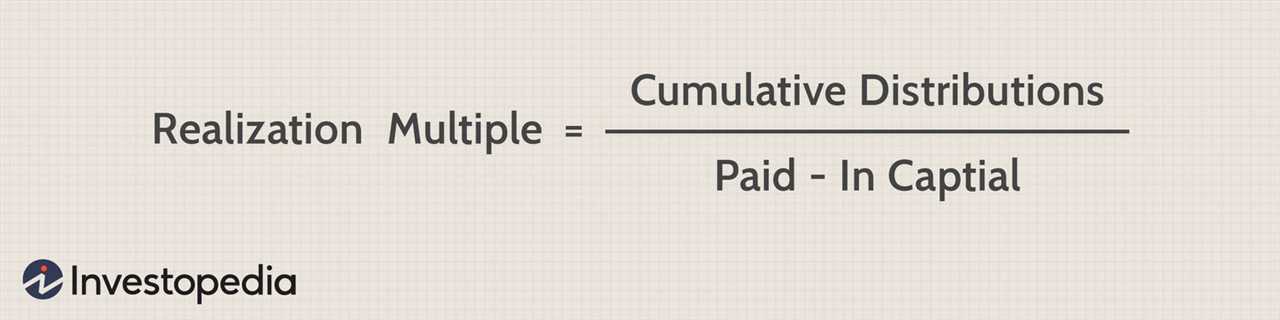

Calculation of Realization Multiple

The calculation of the realization multiple is relatively straightforward. It involves dividing the total amount of money returned to investors by the amount of money initially invested. The formula for calculating the realization multiple is as follows:

| Total Amount Returned to Investors | Realization Multiple |

|---|---|

| Amount Initially Invested |

By plugging in the appropriate values, investors can easily calculate the realization multiple for their investments.

Mechanics and Calculation of Realization Multiple

The realization multiple is a key metric used in the private equity and venture capital industry to assess the success and profitability of an investment. It is a measure of how much money an investor has made or lost on their investment, expressed as a multiple of the original investment amount.

Calculation

The calculation of the realization multiple is relatively straightforward. It is calculated by dividing the total amount of money returned to the investor, including both capital and any profits, by the original investment amount. The formula for calculating the realization multiple is as follows:

Realization Multiple = Total Cash Returned / Original Investment

For example, if an investor initially invested $1 million in a company and received a total of $3 million in cash returns, the realization multiple would be 3x ($3 million / $1 million).

Mechanics

The mechanics of the realization multiple calculation can vary depending on the specific terms of the investment. In some cases, the total cash returned may include dividends, interest, or other distributions received during the holding period. In other cases, it may only include the proceeds from the sale or exit of the investment.

The realization multiple is often used by investors and fund managers to evaluate the performance of their investments and compare them to industry benchmarks. A higher realization multiple indicates a more successful investment, while a lower multiple may indicate a less successful investment.

Additionally, the realization multiple can be used to assess the overall performance of a fund or portfolio of investments. By calculating the weighted average realization multiple of all the investments in a fund or portfolio, investors can get a sense of the overall profitability and success of their investment strategy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.