Price-to-Rent Ratio: Buy or Rent?

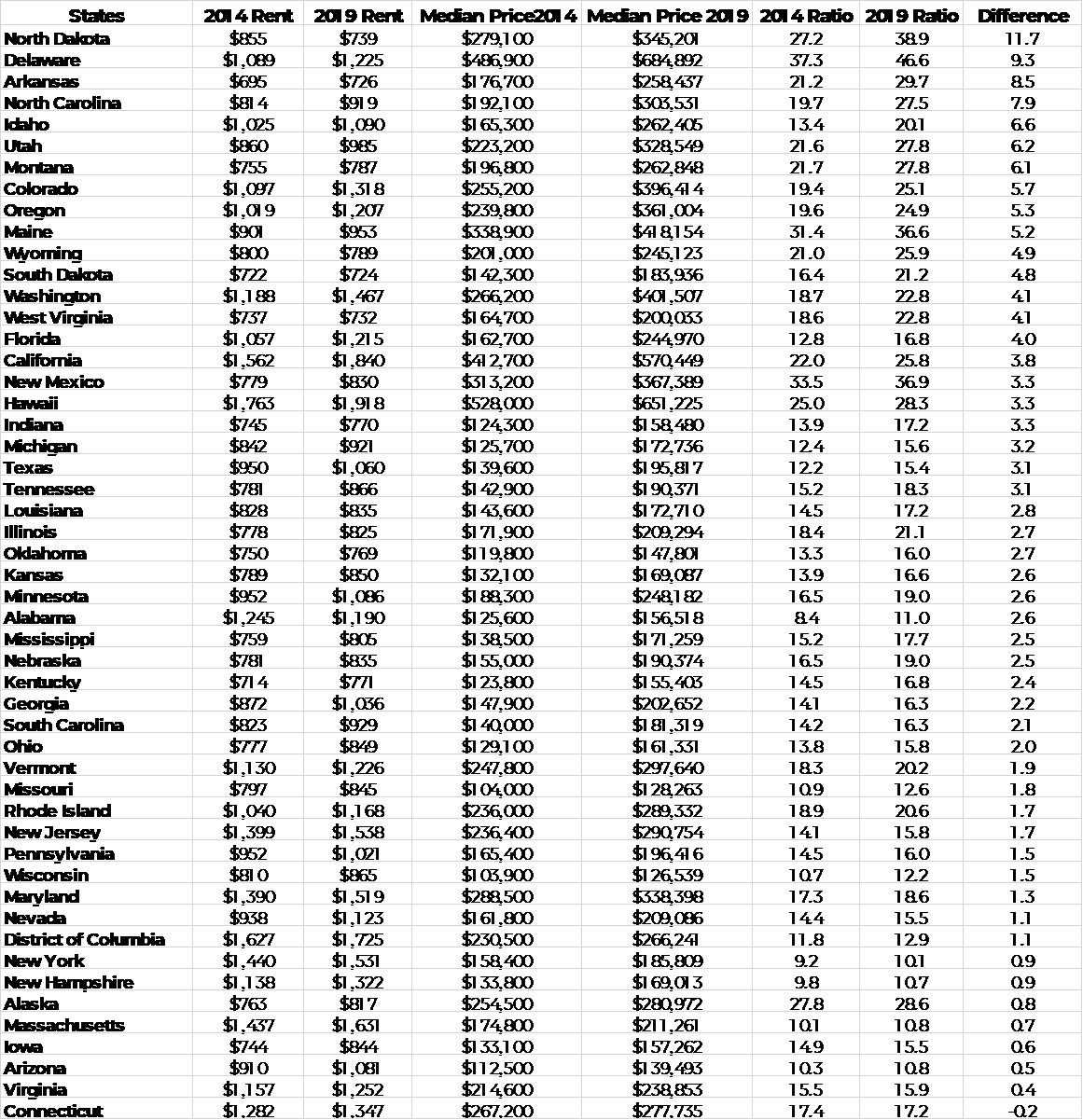

To calculate the price-to-rent ratio, you divide the purchase price of a property by the annual rent. For example, if a property costs $200,000 to buy and the annual rent is $20,000, the price-to-rent ratio would be 10. This means that it would take 10 years of renting to equal the cost of buying the property.

There are several other factors to consider when deciding whether to buy or rent, such as your financial situation, your long-term plans, and the local real estate market. For example, if you plan to stay in an area for a long time and have the financial means to buy a property, it may make more sense to buy. On the other hand, if you’re not sure how long you’ll be in an area or if you don’t have the financial stability to buy, renting may be a better option.

How to Decide [REAL ESTATE INVESTING catname]

The price-to-rent ratio is calculated by dividing the average home price in a particular area by the average annual rent for similar properties in that area. The resulting ratio can help potential buyers determine whether it is more cost-effective to buy or rent a property.

Factors to Consider

While the price-to-rent ratio provides a useful starting point, there are other factors to consider when making a decision between buying and renting:

- Long-Term Plans: Think about your long-term plans. If you anticipate moving frequently or have uncertainty about your future living situation, renting may provide more flexibility.

- Market Conditions: Evaluate the current real estate market conditions. If property prices are high and rental demand is low, renting may be a more affordable option.

- Personal Preferences: Consider your personal preferences and lifestyle. Some individuals may prefer the stability and control of owning a property, while others may prefer the flexibility and convenience of renting.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.