Applying the Model in Business Analysis

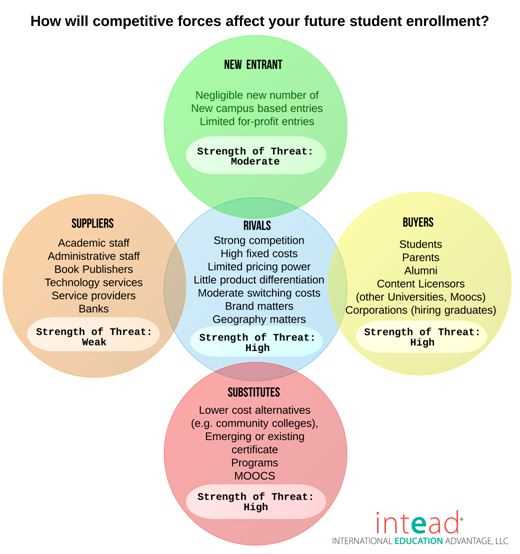

When applying the model in business analysis, it is important to consider each of the five forces individually and assess their impact on the industry and the business itself. Here is a breakdown of how each force can be analyzed:

| Force | Description | Analysis |

|---|---|---|

| 1. Threat of New Entrants | The potential for new competitors to enter the market | Assess barriers to entry, such as capital requirements, economies of scale, and government regulations. Determine the likelihood of new entrants and their potential impact on market share. |

| 2. Bargaining Power of Suppliers | The ability of suppliers to influence pricing and terms | Evaluate the number of suppliers, their concentration, and the availability of substitute inputs. Analyze the supplier’s bargaining power and their ability to pass on cost increases. |

| 3. Bargaining Power of Buyers | The ability of buyers to influence pricing and terms | Examine the number of buyers, their concentration, and their purchasing power. Determine the sensitivity of buyers to price changes and their ability to switch suppliers. |

| 4. Threat of Substitute Products | The availability of alternative products or services | Analyze the ease of substitution and the attractiveness of substitutes. Consider the potential impact of substitutes on market share and profitability. |

| 5. Intensity of Competitive Rivalry | The degree of competition among existing firms | Assess the number of competitors, their size, and their competitive strategies. Evaluate the industry growth rate and the level of product differentiation. Consider the impact of competitive rivalry on pricing and profitability. |

It is important to note that the results of the analysis may vary depending on the specific industry and market conditions. Therefore, businesses should regularly update their analysis to stay ahead of changes in the competitive landscape.

Benefits and Limitations of Porter’s 5 Forces Model

Benefits:

2. Assessing industry attractiveness: The model allows businesses to evaluate the overall attractiveness of an industry. By analyzing the intensity of competition, the threat of new entrants, the power of suppliers and buyers, and the threat of substitutes, businesses can determine whether an industry is worth entering or investing in.

4. Facilitating strategic decision-making: The model provides a structured framework for making strategic decisions. By considering the five forces, businesses can assess the potential impact of different strategies and make informed decisions about pricing, product development, market entry, and other key aspects of their business.

Limitations:

1. Static analysis: The model provides a snapshot of the competitive dynamics at a specific point in time. It does not account for changes in the industry or external factors that may impact competition. Businesses need to regularly update their analysis to account for these changes.

2. Subjectivity: The model requires subjective judgment in assessing the intensity of competition and the power of suppliers and buyers. Different individuals may have different perspectives, leading to variations in the analysis.

3. Focus on industry-level analysis: The model primarily focuses on analyzing competition within an industry. It may not capture the broader macroeconomic factors or global trends that can impact competition.

4. Limited scope: The model does not consider other important factors that can influence competition, such as technological advancements, regulatory changes, and social factors. Businesses need to consider these factors in conjunction with the five forces analysis.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.