Obligor Definition, Responsibilities, Scenarios, and Types

Responsibilities of an Obligor

The responsibilities of an obligor vary depending on the nature of the agreement or contract. In general, an obligor is required to fulfill certain obligations, such as:

- Repaying a loan or debt within a specified timeframe

- Making regular payments towards interest or principal

- Providing collateral or security for the debt

- Complying with any terms and conditions outlined in the agreement

- Notifying the obligee of any changes in financial circumstances

Failure to fulfill these responsibilities can result in legal consequences, such as defaulting on the debt, facing legal action, or damaging the obligor’s credit history.

Scenarios and Types of Obligors

Obligors can be individuals, businesses, or even governments. Here are some common scenarios and types of obligors:

- Individual Obligors: These are individuals who have taken on personal debts, such as mortgages, car loans, or credit card debts.

- Corporate Obligors: These are businesses or corporations that have borrowed money or issued bonds to finance their operations or investments.

- Government Obligors: These are national or local governments that have borrowed money through the issuance of government bonds or loans from international organizations.

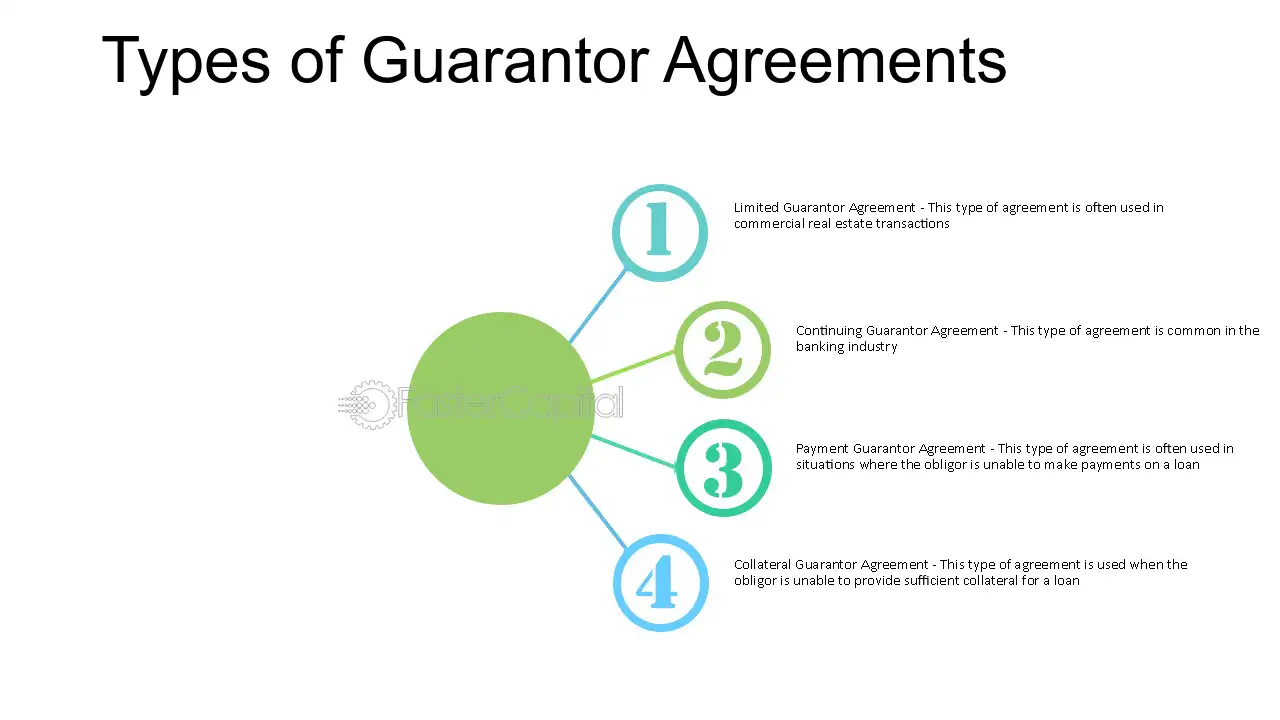

- Guarantors: These are individuals or entities that provide a guarantee or promise to repay the debt of another party if the original obligor fails to do so.

- Co-Obligors: These are multiple obligors who share the responsibility of repaying a debt. Each co-obligor is individually liable for the full amount of the debt.

It is important for obligors to fully understand their responsibilities and obligations before entering into any agreement or contract. They should carefully review the terms and conditions, seek legal advice if necessary, and ensure that they have the means to fulfill their obligations.

Definition of Obligor

As an obligor, the individual or entity is legally bound to fulfill the terms and conditions outlined in the agreement. This includes making timely payments, providing collateral if required, and complying with any other obligations specified in the contract. Failure to meet these obligations can result in legal consequences, such as penalties, fines, or even legal action.

Responsibilities of an Obligor

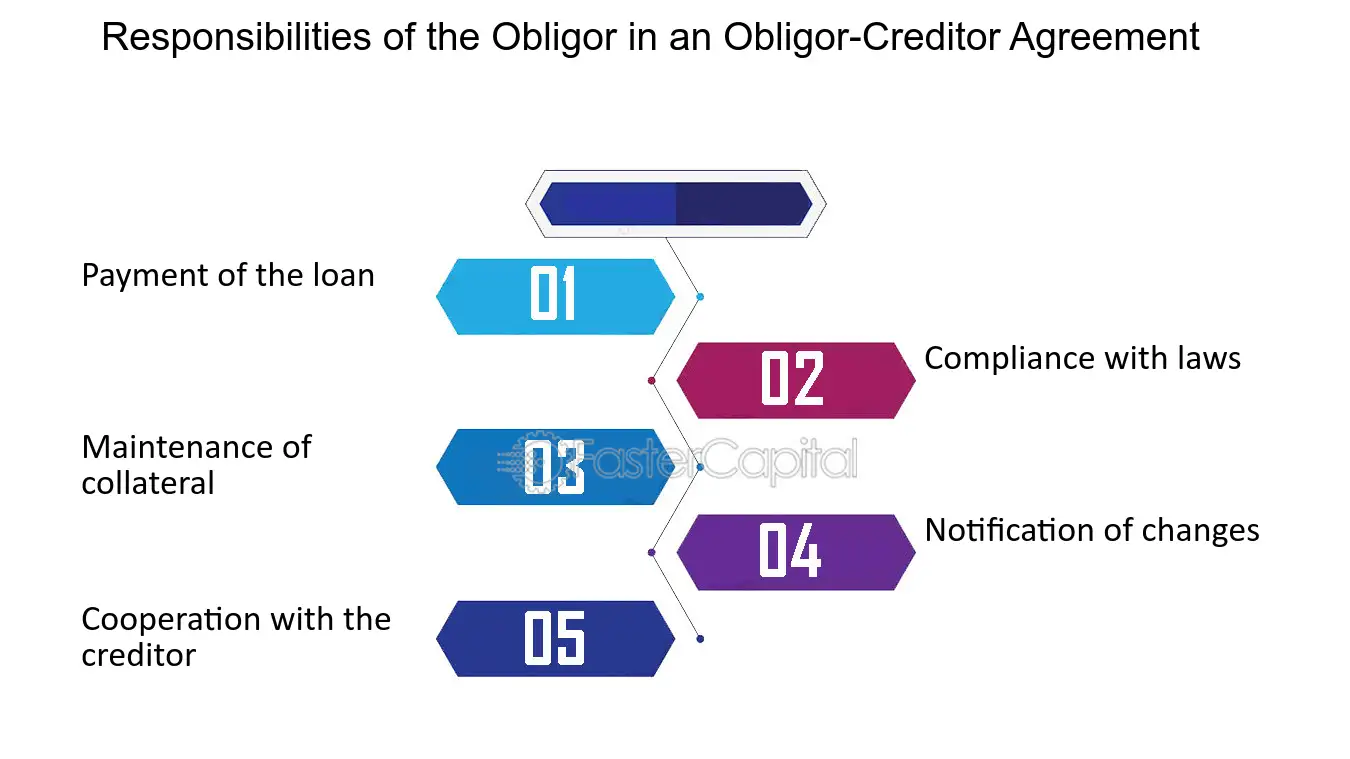

The responsibilities of an obligor may vary depending on the specific agreement or contract. However, some common responsibilities include:

- Making regular and timely payments: The obligor is responsible for making payments as agreed upon in the contract. This may include monthly installments, interest payments, or principal repayments.

- Providing collateral: In some cases, the obligor may be required to provide collateral, such as property or assets, to secure the debt. This collateral serves as a form of security for the obligee in case the obligor fails to fulfill their obligations.

- Complying with terms and conditions: The obligor must adhere to all terms and conditions specified in the agreement. This may include restrictions on the use of funds, maintaining certain financial ratios, or meeting specific performance criteria.

- Notifying changes in circumstances: If there are any significant changes in the obligor’s financial situation or ability to fulfill the obligations, they must inform the obligee promptly. This allows both parties to assess the situation and potentially make necessary adjustments to the agreement.

Scenarios and Types of Obligors

Obligors can be individuals, businesses, or even governments. Some common scenarios and types of obligors include:

- Individual borrowers: These are individuals who borrow money from banks, financial institutions, or other lenders to finance personal expenses, such as buying a house, car, or funding education.

- Corporate borrowers: Businesses often borrow money to fund their operations, invest in new projects, or expand their operations. These obligors may issue bonds or take loans from banks or other financial institutions.

- Government obligors: Governments may borrow money by issuing bonds or taking loans from international organizations or other governments to finance infrastructure projects, social programs, or to manage budget deficits.

- Guarantors: In some cases, a third party may act as a guarantor for the obligor. The guarantor assumes the responsibility of fulfilling the obligations if the obligor fails to do so.

Obligor Responsibilities and Scenarios

1. Repayment

The primary responsibility of an obligor is to repay the debt or financial obligation in a timely manner. This includes making regular payments according to the agreed-upon schedule. Failure to make payments can result in penalties, increased interest rates, and even legal action.

2. Interest and Fees

In addition to the principal amount borrowed, an obligor is also responsible for paying any accrued interest and fees associated with the debt. Interest is the cost of borrowing money, and it is typically calculated as a percentage of the outstanding balance. Fees may include origination fees, late payment fees, or other charges specified in the loan agreement.

3. Compliance with Terms and Conditions

An obligor must comply with all the terms and conditions outlined in the loan agreement or financial contract. This includes maintaining a certain credit score, providing updated financial information if requested, and refraining from any actions that could negatively impact their ability to repay the debt.

4. Communication with Lender

If an obligor encounters any financial difficulties or anticipates problems in making payments, it is important to communicate with the lender or creditor. Open and honest communication can help in finding a solution, such as adjusting the repayment schedule or exploring alternative payment options.

5. Collateral and Security

In some cases, an obligor may be required to provide collateral or security for the debt. This can include assets such as real estate, vehicles, or other valuable possessions. If the obligor fails to repay the debt, the lender may have the right to seize and sell the collateral to recover their losses.

6. Default and Consequences

If an obligor consistently fails to meet their repayment obligations or breaches the terms of the loan agreement, they may be considered in default. Defaulting on a loan can have serious consequences, including damage to credit scores, legal action, and difficulty obtaining future credit.

It is important for obligors to understand their responsibilities and obligations before entering into any financial agreement. By fulfilling these responsibilities, they can maintain a positive financial reputation and avoid potential negative consequences.

| Responsibility | Description |

|---|---|

| Repayment | Make regular payments according to the agreed-upon schedule. |

| Interest and Fees | Pay any accrued interest and fees associated with the debt. |

| Compliance with Terms and Conditions | Follow all the terms and conditions outlined in the loan agreement or financial contract. |

| Communication with Lender | Communicate with the lender or creditor in case of financial difficulties. |

| Collateral and Security | Provide collateral or security for the debt if required. |

| Default and Consequences | Understand the consequences of defaulting on a loan. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.