Exploring the Mechanism of NIFO

Next In, First Out (NIFO) is a method used in inventory management to determine the cost of goods sold (COGS) and the value of remaining inventory. It is based on the principle that the items purchased most recently are the first ones to be sold or used in production.

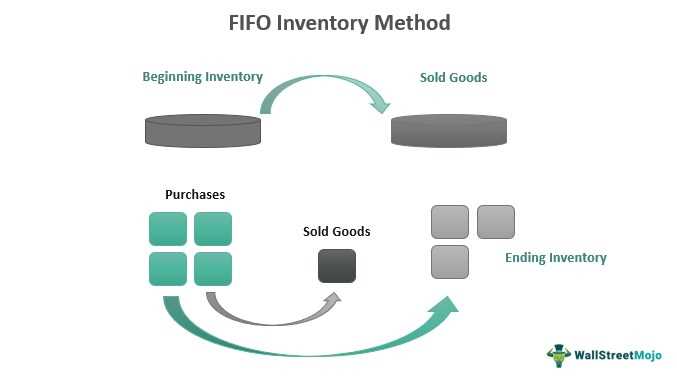

The mechanism of NIFO involves keeping track of the cost of each item in the inventory and using the cost of the most recent purchases to calculate the value of goods sold. This is in contrast to the First In, First Out (FIFO) method, where the cost of the oldest items is used to calculate COGS.

When using NIFO, each time a new item is purchased, its cost is added to the inventory value. When an item is sold or used in production, the cost of the most recently purchased item is used to calculate COGS. This means that the value of remaining inventory is based on the cost of the older items that have not been sold yet.

One advantage of using NIFO is that it can result in a higher COGS and lower taxable income, especially in times of inflation when the cost of goods tends to increase over time. By using the cost of the most recent purchases, the value of COGS is higher, reducing the taxable income for the period.

However, NIFO can also have disadvantages. It may not accurately reflect the actual flow of goods in some industries, especially those with perishable or time-sensitive products. Additionally, it can be more complex to track and calculate compared to other inventory valuation methods.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.