Definition of New Keynesian Economics

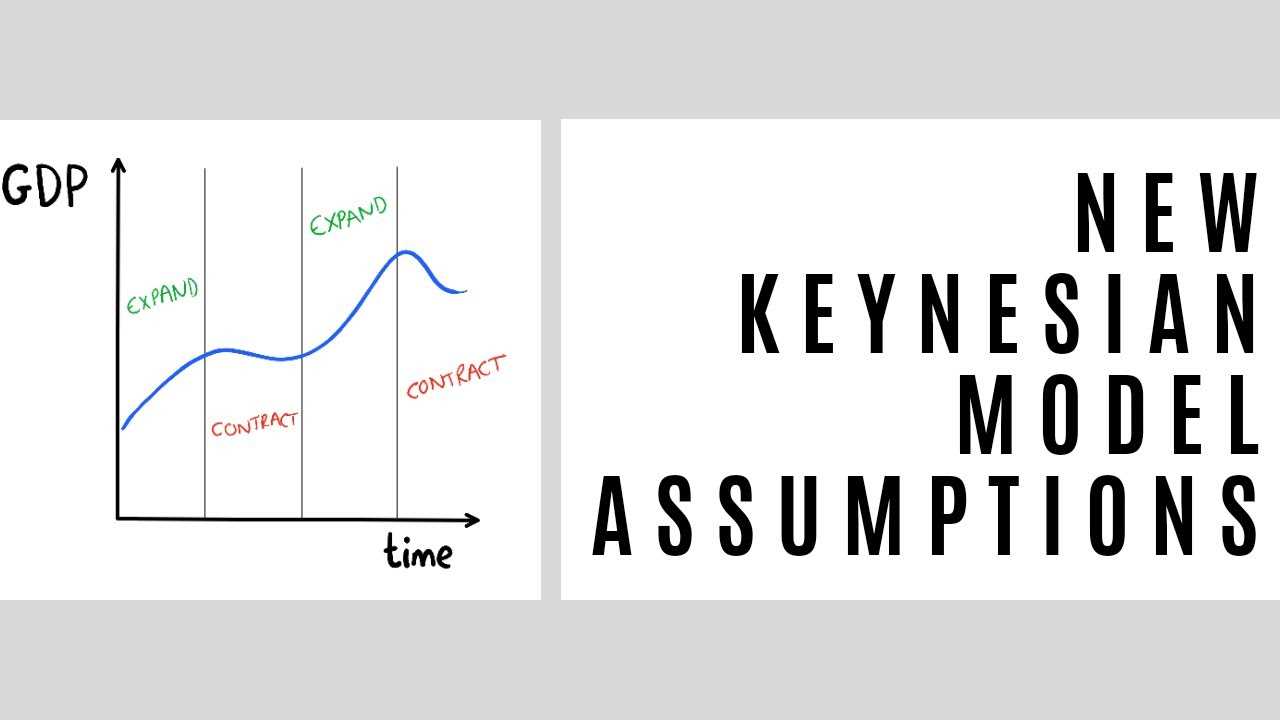

New Keynesian economics is a macroeconomic theory that builds upon the original Keynesian theory developed by John Maynard Keynes in the 1930s. It incorporates elements of neoclassical economics and focuses on the role of market imperfections and rigidities in explaining economic fluctuations.

In contrast to the classical view of the economy as self-regulating, new Keynesian economics emphasizes the presence of nominal rigidities, such as sticky prices and wages, which prevent markets from clearing instantaneously. These rigidities lead to short-term fluctuations in output and employment, and can result in persistent unemployment even in the presence of unused resources.

One of the key concepts in new Keynesian economics is the idea of “menu costs,” which refers to the costs firms incur when changing prices. According to this theory, firms are reluctant to adjust prices frequently due to the costs involved, resulting in price stickiness. This price stickiness, in turn, affects the overall level of aggregate demand and can lead to recessions or inflationary pressures.

Another important concept in new Keynesian economics is the role of expectations and forward-looking behavior. Unlike the original Keynesian theory, which assumed that individuals base their decisions solely on current information, new Keynesian economics recognizes that individuals form expectations about future economic conditions. These expectations can influence their current consumption and investment decisions, and can have significant effects on aggregate demand and economic outcomes.

Key Features of New Keynesian Economics:

1. Market Imperfections: New Keynesian economics acknowledges the presence of market imperfections, such as sticky prices and wages, which can lead to short-term fluctuations in output and employment.

2. Menu Costs: The theory of menu costs suggests that firms are reluctant to change prices frequently due to the costs involved, resulting in price stickiness and affecting aggregate demand.

3. Expectations and Forward-Looking Behavior: New Keynesian economics recognizes the role of expectations in shaping current consumption and investment decisions, and their impact on aggregate demand and economic outcomes.

Key Differences between New Keynesian Economics and Keynesian Theory

New Keynesian economics is a modern interpretation of the original Keynesian theory, which was developed by economist John Maynard Keynes during the Great Depression. While both theories share some similarities, there are key differences that distinguish the two.

1. Microfoundations

One of the main differences between New Keynesian economics and Keynesian theory is the incorporation of microfoundations. New Keynesian economics emphasizes the importance of individual decision-making and behavior in determining aggregate economic outcomes. It recognizes that individuals and firms make rational choices based on their expectations of future economic conditions.

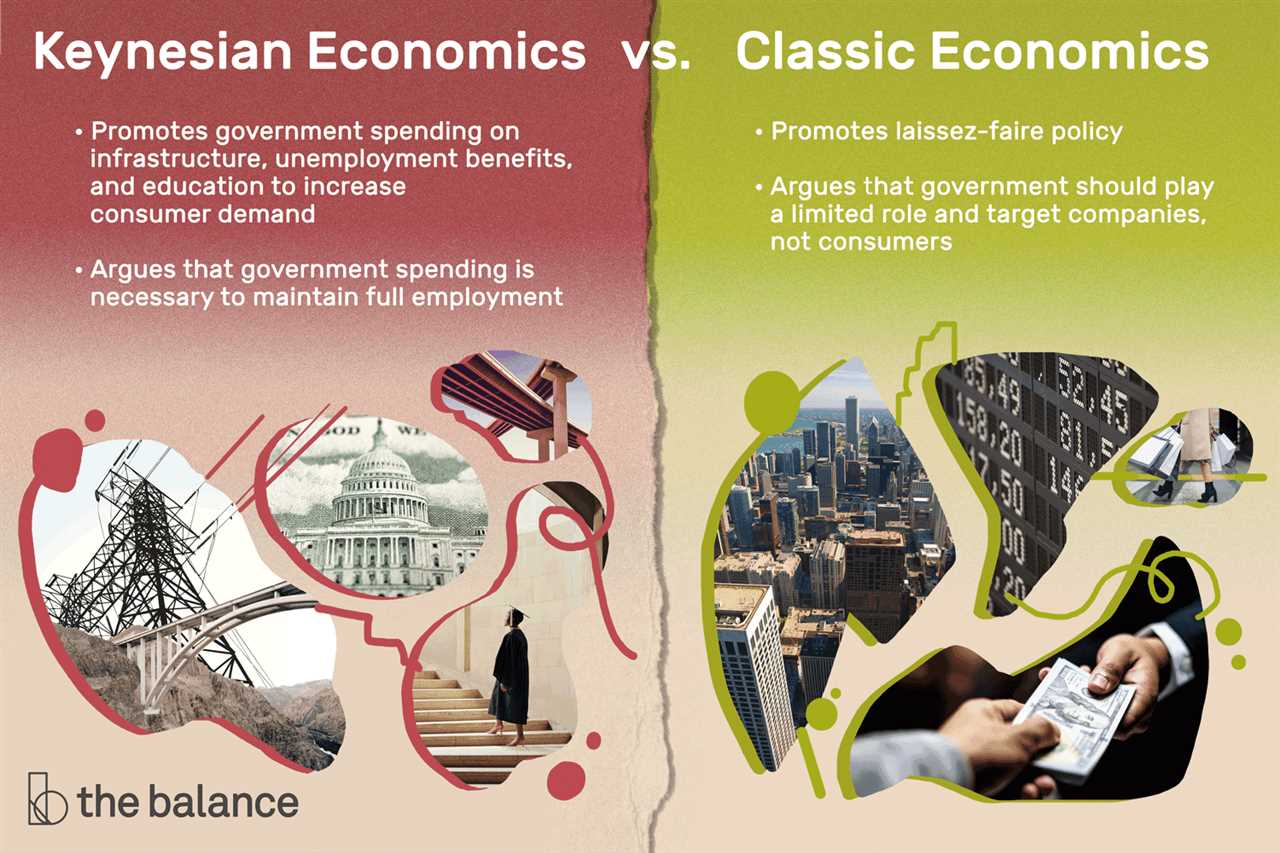

On the other hand, Keynesian theory focuses more on aggregate demand and the role of government intervention in stabilizing the economy. It does not place as much emphasis on individual decision-making and assumes that people are not always rational in their economic choices.

2. Price Stickiness

Another key difference between New Keynesian economics and Keynesian theory is the treatment of price stickiness. New Keynesian economics acknowledges that prices are sticky in the short run, meaning they do not adjust immediately to changes in supply and demand. This stickiness can lead to market inefficiencies and fluctuations in output and employment.

In contrast, Keynesian theory does not explicitly address price stickiness. It focuses more on the role of aggregate demand in determining economic outcomes, without delving into the specific mechanisms of price adjustment.

3. Rational Expectations

Rational expectations play a significant role in New Keynesian economics but are not as prominent in Keynesian theory. New Keynesian economics assumes that individuals and firms have rational expectations about future economic conditions and adjust their behavior accordingly.

Keynesian theory, on the other hand, does not assume rational expectations. It suggests that people may have adaptive expectations, meaning they base their decisions on past experiences rather than making rational predictions about the future.

4. Policy Implications

The differences between New Keynesian economics and Keynesian theory also have implications for economic policy. New Keynesian economics suggests that monetary policy can be effective in stabilizing the economy, as central banks can influence aggregate demand through interest rate adjustments.

Keynesian theory, on the other hand, emphasizes the role of fiscal policy in stabilizing the economy. It argues that government spending and taxation policies can directly impact aggregate demand and help to mitigate economic downturns.

| New Keynesian Economics | Keynesian Theory |

|---|---|

| Microfoundations | Aggregate demand |

| Price stickiness | No explicit treatment |

| Rational expectations | No assumption of rational expectations |

| Monetary policy | Fiscal policy |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.