Liquidator Examples Powers and Duties

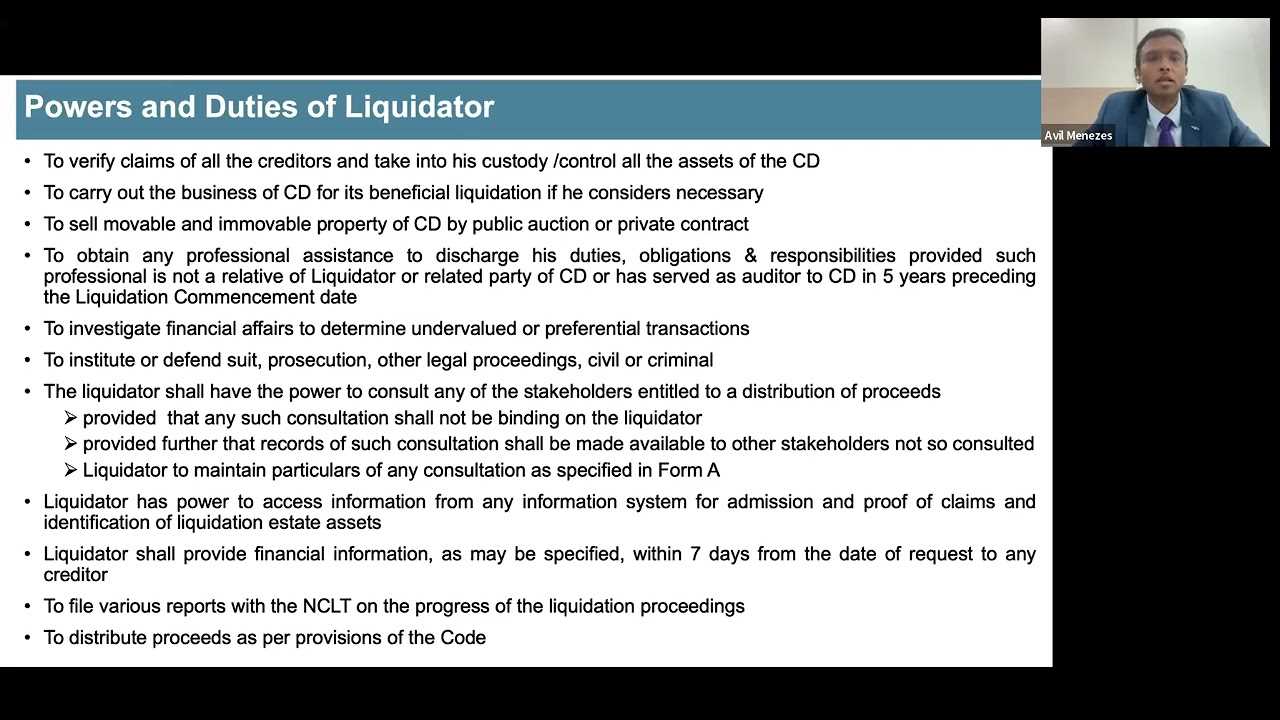

A liquidator is an individual or a company appointed to wind up the affairs of a company that is insolvent or no longer able to continue its operations. The liquidator has various powers and duties to ensure the orderly liquidation of the company’s assets and the fair distribution of proceeds to creditors.

Powers of a Liquidator

In addition to selling assets, a liquidator may also have the power to investigate the affairs of the company and its directors. This includes the power to examine the company’s financial records, interview employees, and obtain any necessary information to determine the company’s financial position and the reasons for its failure.

Duties of a Liquidator

One of the main duties of a liquidator is to collect and distribute the company’s assets to its creditors. This involves identifying and valuing the company’s assets, including any debts owed to the company, and ensuring that they are distributed in accordance with the law and the company’s constitution.

The liquidator is also responsible for notifying creditors of the liquidation and for dealing with any claims made by creditors. This includes reviewing and verifying claims, negotiating with creditors, and making distributions to them based on the priority of their claims.

Another important duty of a liquidator is to prepare and file the necessary reports and documents with the relevant authorities. This includes filing a notice of the liquidation with the appropriate government agency, as well as preparing and filing financial statements and other reports as required by law.

Overall, the role of a liquidator is to ensure that the liquidation process is carried out in a fair and transparent manner, and that the interests of all stakeholders, including creditors, employees, and shareholders, are protected.

A liquidator plays a crucial role in the process of winding up a company. When a company becomes insolvent or decides to close down, a liquidator is appointed to oversee the liquidation process and ensure that the company’s assets are distributed fairly among its creditors.

One of the primary responsibilities of a liquidator is to collect and sell the company’s assets. This involves identifying and valuing the assets, organizing auctions or sales, and ensuring that the proceeds are used to pay off the company’s debts. The liquidator must act in the best interests of the company’s creditors and ensure that the assets are sold at fair market value.

In addition to asset liquidation, a liquidator is also responsible for investigating the company’s financial affairs. This includes reviewing the company’s books and records, conducting interviews with key personnel, and identifying any instances of fraud or misconduct. The liquidator must ensure that all financial transactions are properly recorded and accounted for, and take appropriate legal action if necessary.

Another important duty of a liquidator is to communicate with the company’s creditors and shareholders. The liquidator must provide regular updates on the progress of the liquidation process, answer any questions or concerns, and provide a final report detailing the distribution of assets. It is essential for the liquidator to maintain transparency and keep all stakeholders informed throughout the process.

Key Responsibilities of a Liquidator

1. Conducting Investigations

One of the key responsibilities of a liquidator is to conduct thorough investigations into the affairs of the company. This includes reviewing financial records, contracts, and other relevant documents to determine the financial position of the company and the reasons for its insolvency. The liquidator may also interview key personnel and stakeholders to gather additional information.

2. Realizing Assets

Another important duty of a liquidator is to realize the assets of the company. This involves identifying and valuing the assets, such as property, equipment, and inventory, and then selling them to generate funds to repay the company’s creditors. The liquidator must ensure that the assets are sold at fair market value and in a transparent manner.

3. Distributing Funds

Once the assets have been realized, the liquidator is responsible for distributing the funds to the creditors of the company. This is done in accordance with the priority set out in the relevant legislation or court order. The liquidator must ensure that the funds are distributed fairly and that all creditors receive their due share.

4. Reporting to Stakeholders

A liquidator is also required to provide regular reports to the stakeholders of the company, including the creditors and shareholders. These reports outline the progress of the liquidation process, the financial position of the company, and any significant developments. The liquidator must keep the stakeholders informed and address any concerns or questions they may have.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.