Lapse Insurance: Definition, How It Works, and Consequences

When a policy lapses, the insurance company no longer has an obligation to provide coverage for the policyholder. This means that if an event covered by the policy occurs after the lapse, the policyholder will not receive any benefits or compensation from the insurance company.

There are several reasons why an insurance policy may lapse. One common reason is non-payment of premiums. If a policyholder fails to pay their premiums by the due date, the insurance company may send them a notice of cancellation. If the premiums are not paid within a certain grace period, typically 30 days, the policy will lapse.

The consequences of lapse insurance can be significant. Without insurance coverage, the policyholder may be responsible for any damages or losses that occur. For example, if a policyholder’s car insurance lapses and they get into an accident, they may have to pay for the damages out of pocket. Additionally, if a policyholder’s life insurance lapses and they pass away, their beneficiaries will not receive the death benefit.

To avoid lapse insurance, it is important for policyholders to stay on top of their premium payments and ensure they are paid on time. Setting up automatic payments or reminders can help prevent unintentional lapses. If a policyholder is considering cancelling their policy, they should carefully evaluate their needs and consider alternative options before making a decision.

What is Lapse Insurance?

Importance of Lapse Insurance

Lapse insurance is important because it provides a safety net for policyholders who may forget or be unable to make their premium payments on time. Life can be unpredictable, and unexpected financial hardships or forgetfulness can lead to missed payments. Lapse insurance ensures that policyholders are still protected even if they miss a payment.

Without lapse insurance, policyholders who miss a payment and have their policy lapse would be left without coverage. This can be particularly problematic in the case of life insurance, where the policyholder’s beneficiaries may be left financially vulnerable in the event of the policyholder’s death.

How Lapse Insurance Works

When a policyholder purchases an insurance policy, they have the option to add lapse insurance to their coverage. This additional coverage acts as a safeguard in case the policyholder misses a premium payment and their policy lapses.

If the policyholder fails to make a premium payment within the grace period, the lapse insurance kicks in and ensures that the policy remains in force. The policyholder will still be required to make the missed premium payment, along with any applicable late fees, but they will not lose the coverage provided by the policy.

Lapse insurance can be particularly valuable for individuals who have a history of missing premium payments or who have a high likelihood of forgetting to make their payments on time. It provides peace of mind knowing that even if a payment is missed, the policy will not lapse and coverage will still be in place.

How Does Lapse Insurance Work?

Insurance policies typically require regular premium payments to keep the policy in force. These premiums can be paid monthly, quarterly, semi-annually, or annually, depending on the terms of the policy. If the policyholder fails to make the required premium payments within a certain grace period, the insurance company may choose to terminate the policy.

There are several reasons why a policyholder might let their insurance policy lapse. Financial difficulties, forgetfulness, or a change in insurance needs are common factors. Regardless of the reason, the consequences of a lapsed insurance policy can be significant.

Consequences of Lapse Insurance

When an insurance policy lapses, the policyholder loses the protection and benefits provided by the policy. This means that if an insured event occurs after the policy has lapsed, the policyholder will not receive any financial compensation or assistance from the insurance company.

In addition, if the policyholder decides to reinstate the lapsed policy, they may be required to pay any missed premiums, along with any interest or penalties imposed by the insurance company. The reinstatement process may also involve additional paperwork and requirements.

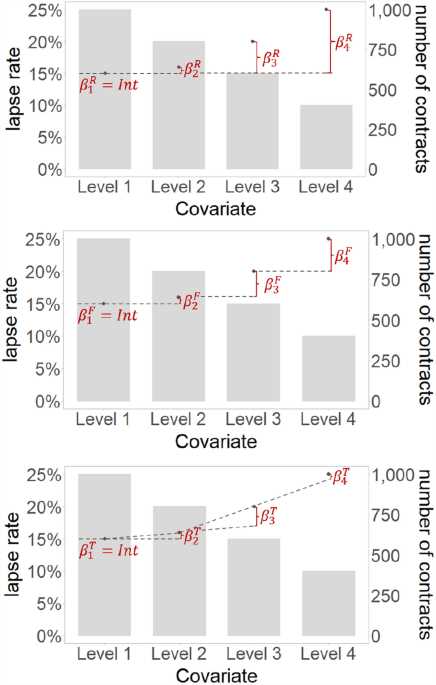

Furthermore, a lapsed insurance policy can have long-term consequences for the policyholder. If the policyholder decides to apply for a new insurance policy in the future, the lapse in coverage may result in higher premiums or limited coverage options. Insurance companies consider lapses in coverage as a higher risk, and therefore may charge higher premiums to compensate for that risk.

It is important for policyholders to be aware of the consequences of letting their insurance policy lapse and to make timely premium payments to avoid any disruptions in coverage. If financial difficulties arise, it may be beneficial to contact the insurance company to discuss possible solutions, such as adjusting the premium payment schedule or exploring alternative payment options.

Consequences of Lapse Insurance

When a policyholder allows their insurance policy to lapse, there can be significant consequences. These consequences can vary depending on the type of insurance and the specific circumstances, but generally, they can include:

1. Loss of Coverage

The most obvious consequence of lapse insurance is the loss of coverage. Once a policy lapses, the policyholder is no longer protected by the insurance policy. This means that if an event covered by the policy occurs, the policyholder will not receive any benefits or financial support from the insurance company.

2. Financial Risk

Without insurance coverage, the policyholder is exposed to financial risk. They may be responsible for covering the costs of any damages, losses, or liabilities that occur. This can be particularly problematic if the event is significant and results in substantial financial burdens.

3. Difficulty in Obtaining New Coverage

Allowing an insurance policy to lapse can make it more difficult to obtain new coverage in the future. Insurance companies view policyholders with a lapse in coverage as higher risk, and may either deny coverage or charge higher premiums. This can make it more challenging and expensive for the policyholder to secure the insurance protection they need.

4. Negative Impact on Credit Score

In some cases, a lapse in insurance can have a negative impact on the policyholder’s credit score. Insurance companies may report the lapse to credit bureaus, which can result in a lower credit score. This can affect the policyholder’s ability to obtain credit or loans in the future.

5. Legal Consequences

In certain situations, allowing insurance to lapse can have legal consequences. For example, in some jurisdictions, driving without auto insurance is illegal. If a policyholder allows their auto insurance to lapse and is caught driving without coverage, they may face fines, penalties, or even the suspension of their driver’s license.

Overall, allowing insurance to lapse can have serious consequences for policyholders. It is important to maintain active coverage and ensure that premiums are paid on time to avoid these potential negative outcomes.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.