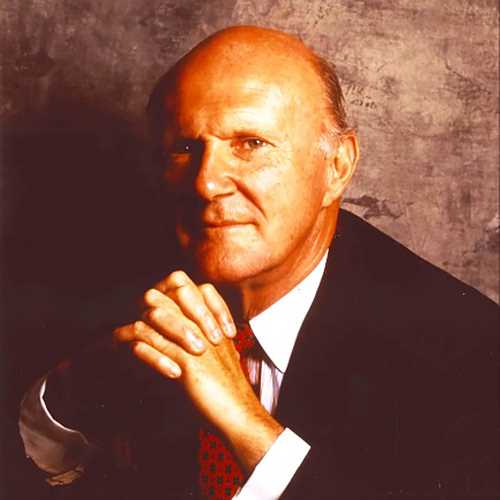

Julian Robertson: A Look into His Education, Accomplishments, and Philanthropy

Julian Robertson is a renowned figure in the world of finance and investing. With a career spanning several decades, he has made a significant impact on the industry and has become one of the most successful hedge fund managers of all time.

Robertson’s education played a crucial role in shaping his career. He graduated from the University of North Carolina at Chapel Hill with a Bachelor of Arts degree in Philosophy. Although his degree may not seem directly related to finance, it provided him with a strong foundation in critical thinking and problem-solving skills, which proved to be invaluable in his investment career.

After completing his education, Robertson began his career in finance as a stockbroker. He quickly realized that he had a knack for identifying undervalued stocks and making profitable investments. This led him to establish his own hedge fund, Tiger Management, in 1980.

Under Robertson’s leadership, Tiger Management became one of the most successful hedge funds in the industry. The fund consistently outperformed the market and achieved impressive returns for its investors. Robertson’s investment strategies, which focused on long-term value investing and rigorous research, became widely respected and emulated by other investors.

One of Robertson’s most notable accomplishments is his role in popularizing the concept of hedge fund “seeding.” He was one of the first investors to provide capital to emerging hedge fund managers, helping them get started and grow their businesses. This approach not only benefited the managers but also allowed Robertson to gain exposure to new and innovative investment strategies.

Aside from his investment career, Robertson is also known for his philanthropic endeavors. He has donated significant amounts of his wealth to various causes, including education, healthcare, and environmental conservation. One of his notable contributions is the establishment of the Robertson Scholars Program, which provides scholarships to students at Duke University and the University of North Carolina at Chapel Hill.

Robertson’s legacy and influence in the finance industry are undeniable. His success as an investor and his philanthropic efforts have left a lasting impact on the field. Many investors continue to draw inspiration from his investment strategies, and his philanthropy serves as a reminder of the importance of giving back to society.

Early Life and Education

Julian Robertson, born on June 25, 1932, in Salisbury, North Carolina, is a renowned American investor and philanthropist. He grew up in a middle-class family and developed an interest in finance and investing at a young age.

After graduating in 1955, Robertson joined the U.S. Navy and served as a communications officer. His time in the Navy provided him with valuable leadership skills and a strong sense of discipline, which would later contribute to his success in the investment world.

Following his military service, Robertson began his career in finance as a stockbroker at Kidder, Peabody & Co. in New York City. He quickly made a name for himself with his astute investment strategies and ability to identify undervalued stocks.

Despite his early success on Wall Street, Robertson decided to further his education and enrolled in the MBA program at the University of Chicago Booth School of Business. He graduated in 1959 and returned to the world of finance with a newfound knowledge and expertise in investment management.

Robertson’s educational background, combined with his natural talent for investing, laid the foundation for his future accomplishments in the financial industry. His disciplined approach to research and analysis, as well as his willingness to take calculated risks, set him apart from his peers and propelled him to become one of the most successful investors of his time.

Throughout his career, Robertson has credited his education and early experiences for shaping his investment philosophy and guiding his decision-making process. He believes in the importance of continuous learning and staying informed about market trends and economic developments.

Investment Career and Accomplishments

Julian Robertson began his investment career in the late 1960s, working as a stockbroker for Kidder, Peabody & Co. It was during this time that he developed a keen interest in the stock market and honed his skills as an investor.

In 1980, Robertson founded Tiger Management, a hedge fund that would go on to become one of the most successful and influential funds of its time. Under Robertson’s leadership, Tiger Management consistently delivered impressive returns, with an average annual return of 31% from 1980 to 1998.

Robertson was known for his unique investment strategy, which involved identifying undervalued stocks and holding them for the long term. He believed in thorough research and analysis, and was not afraid to take contrarian positions. This approach allowed him to generate significant alpha and outperform the market consistently.

One of Robertson’s most notable investment successes was his bet against the British pound in the early 1990s. He correctly predicted that the pound was overvalued and took a massive short position, earning Tiger Management a profit of over $1 billion when the pound crashed.

| Year | Event |

|---|---|

| 1980 | Julian Robertson founds Tiger Management |

| 1990s | Robertson makes successful bet against the British pound |

| 1998 | Tiger Management closes its doors |

Since his retirement, Robertson has remained active in the investment community and has continued to share his insights and wisdom. He has also been involved in various philanthropic endeavors, using his wealth to make a positive impact on society.

Overall, Julian Robertson’s investment career is a testament to his exceptional skill as an investor and his ability to adapt to changing market conditions. His legacy lives on through the success of his proteges and his contributions to the field of finance.

Philanthropic Endeavors

Julian Robertson is not only known for his successful career in the investment world, but also for his extensive philanthropic endeavors. Throughout his life, he has been dedicated to giving back to society and making a positive impact on the world.

One of Robertson’s most notable philanthropic efforts is his support for education. He has donated millions of dollars to various educational institutions, including his alma mater, the University of North Carolina at Chapel Hill. His contributions have helped fund scholarships, faculty positions, and research initiatives, allowing students to pursue their academic goals and furthering the advancement of knowledge.

Robertson’s philanthropic efforts extend beyond education and environmental conservation. He has also been a strong advocate for healthcare and medical research. He has made substantial donations to hospitals and medical research institutions, supporting advancements in healthcare and the development of new treatments for various diseases.

Furthermore, Robertson has been actively involved in supporting the arts and culture. He has made generous donations to museums, theaters, and cultural organizations, promoting the preservation and appreciation of art and heritage.

Overall, Julian Robertson’s philanthropic endeavors have had a significant impact on various aspects of society. Through his donations and support, he has helped improve education, preserve the environment, advance healthcare, and promote the arts. His commitment to giving back serves as an inspiration to others, demonstrating the importance of using wealth and influence for the betterment of society.

Legacy and Influence

Julian Robertson’s legacy in the world of finance and philanthropy is undeniable. Throughout his career, he has made a significant impact on the investment industry and has inspired countless individuals to pursue their own success. His innovative investment strategies and keen eye for talent have paved the way for many successful hedge fund managers.

Robertson’s influence can be seen in the numerous successful investors who have worked for him or been mentored by him. Many of his former employees have gone on to start their own successful hedge funds, carrying on his legacy of excellence and innovation. His investment philosophy, which emphasizes thorough research and a focus on long-term value, continues to be influential in the financial world.

Aside from his contributions to the investment industry, Robertson’s philanthropic endeavors have also left a lasting impact. Through his foundation, he has supported various causes, including education, healthcare, and environmental conservation. His generous donations have helped improve the lives of countless individuals and have made a significant difference in communities around the world.

Furthermore, Robertson’s commitment to education is evident in his support for educational institutions and programs. He has donated to universities and schools, providing scholarships and resources to students who may not have had access to quality education otherwise. By investing in education, Robertson has helped empower individuals and create opportunities for future generations.

Overall, Julian Robertson’s legacy is one of success, innovation, and philanthropy. His impact on the investment industry and his dedication to giving back have made him a highly respected figure. Through his accomplishments and generosity, he has set an example for others to follow and has left a lasting legacy that will continue to inspire and benefit others for years to come.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.