What is an Income Annuity?

An income annuity is a financial product that provides a guaranteed stream of income for a specific period of time or for the rest of your life. It is commonly used as a retirement planning tool to ensure a steady income during the retirement years.

How does an Income Annuity work?

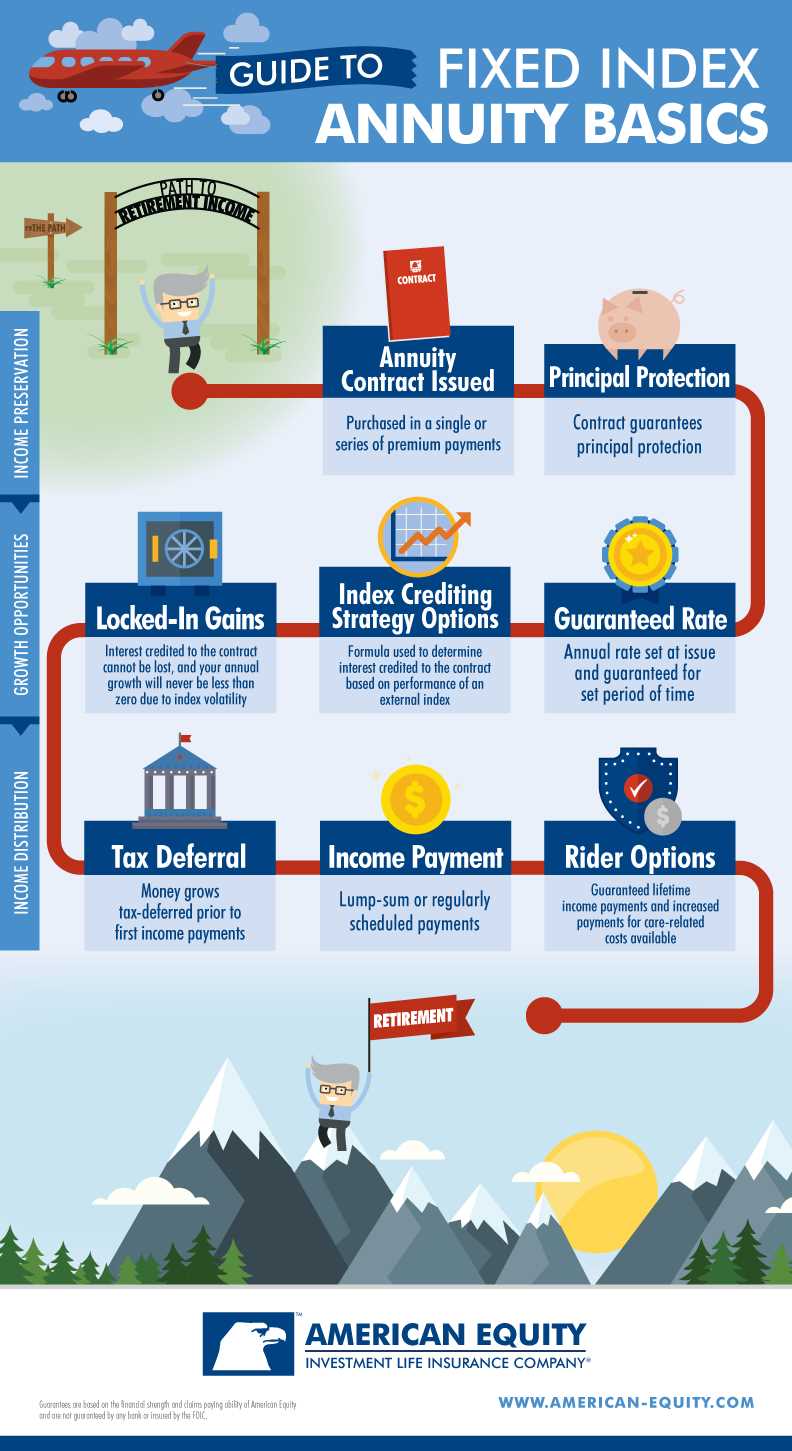

When you purchase an income annuity, you make a lump sum payment to an insurance company. In return, the insurance company promises to pay you a regular income for a predetermined period of time or for the rest of your life, depending on the type of annuity you choose.

The amount of income you receive from an income annuity is determined by several factors, including your age, gender, the amount of money you invest, and the prevailing interest rates at the time of purchase. Generally, the older you are when you purchase an income annuity, the higher your income payments will be.

There are two main types of income annuities: immediate annuities and deferred annuities. Immediate annuities start paying out income right away, while deferred annuities have a waiting period before the income payments begin.

With an income annuity, you have the option to choose how long you want to receive income payments. You can opt for a fixed period annuity, where payments are made for a specific number of years, or a lifetime annuity, where payments continue for as long as you live.

One of the advantages of an income annuity is that it provides a guaranteed income stream, regardless of market fluctuations. This can provide peace of mind and financial security, especially during retirement when individuals may no longer have a regular paycheck.

How Does an Income Annuity Work?

An income annuity is a financial product that provides a guaranteed stream of income for a specified period of time or for the rest of your life. It works by converting a lump sum of money into a regular income payment, usually on a monthly basis.

When you purchase an income annuity, you are essentially entering into a contract with an insurance company. In exchange for your lump sum payment, the insurance company promises to pay you a fixed amount of income for a specified period of time or for the rest of your life.

The amount of income you receive from an annuity depends on several factors, including your age, gender, and the amount of money you contribute. Generally, the older you are when you purchase an annuity, the higher your income payments will be.

There are two main types of income annuities: immediate annuities and deferred annuities. Immediate annuities start paying out income right away, while deferred annuities allow you to accumulate funds over a period of time before starting the income payments.

How the Income Payments are Calculated

The income payments from an annuity are calculated based on several factors. These factors include:

- Age and gender: Younger individuals and females generally receive lower income payments due to their longer life expectancy.

- Interest rates: Higher interest rates typically result in higher income payments.

- Payment period: The longer the payment period, the lower the income payments will be.

- Payment frequency: Monthly payments are typically lower than annual payments.

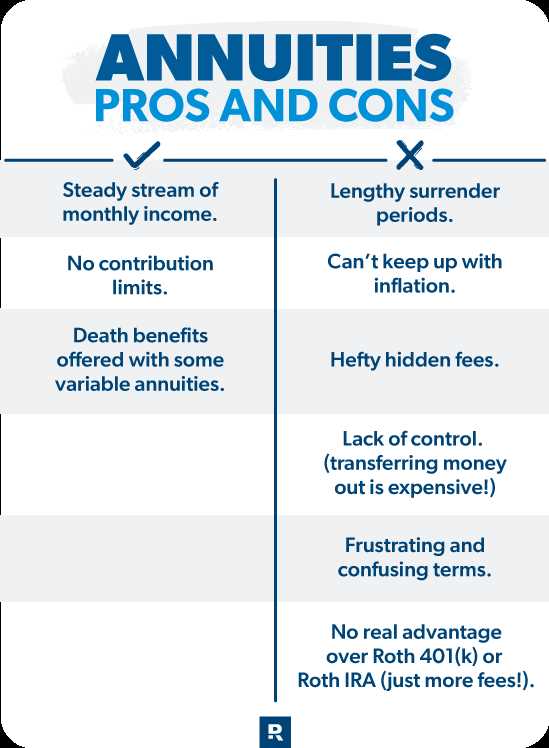

Advantages and Considerations

Income annuities offer several advantages, including:

- Guaranteed income: Annuities provide a reliable source of income that is not affected by market fluctuations.

- Tax advantages: In some cases, the income from annuities may be tax-deferred or taxed at a lower rate.

- Flexibility: Some annuities offer options for inflation protection or the ability to withdraw a lump sum in case of emergencies.

However, there are also considerations to keep in mind when considering an income annuity:

- Loss of control: Once you purchase an annuity, you generally cannot access the lump sum of money you contributed.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.