Criteria for HCE Classification

Highly Compensated Employee (HCE) classification is determined based on certain criteria that an individual must meet. These criteria are set by the Internal Revenue Service (IRS) and are used to identify employees who earn a high level of income and may have different retirement savings options.

1. Income Threshold

The primary criterion for HCE classification is the income threshold. To be considered an HCE, an individual must have earned a certain level of compensation in the previous year. The income threshold is set annually by the IRS and may vary from year to year.

2. Ownership or Control

In addition to meeting the income threshold, an individual may also be classified as an HCE if they own a significant percentage of the company or have control over its operations. This criterion is important as it identifies individuals who have a greater influence on the company’s financial decisions.

3. Family Attribution

The IRS also considers family attribution when determining HCE classification. This means that if an individual’s family members, such as a spouse or children, also meet the income threshold or have ownership or control over the company, they may be classified as HCEs.

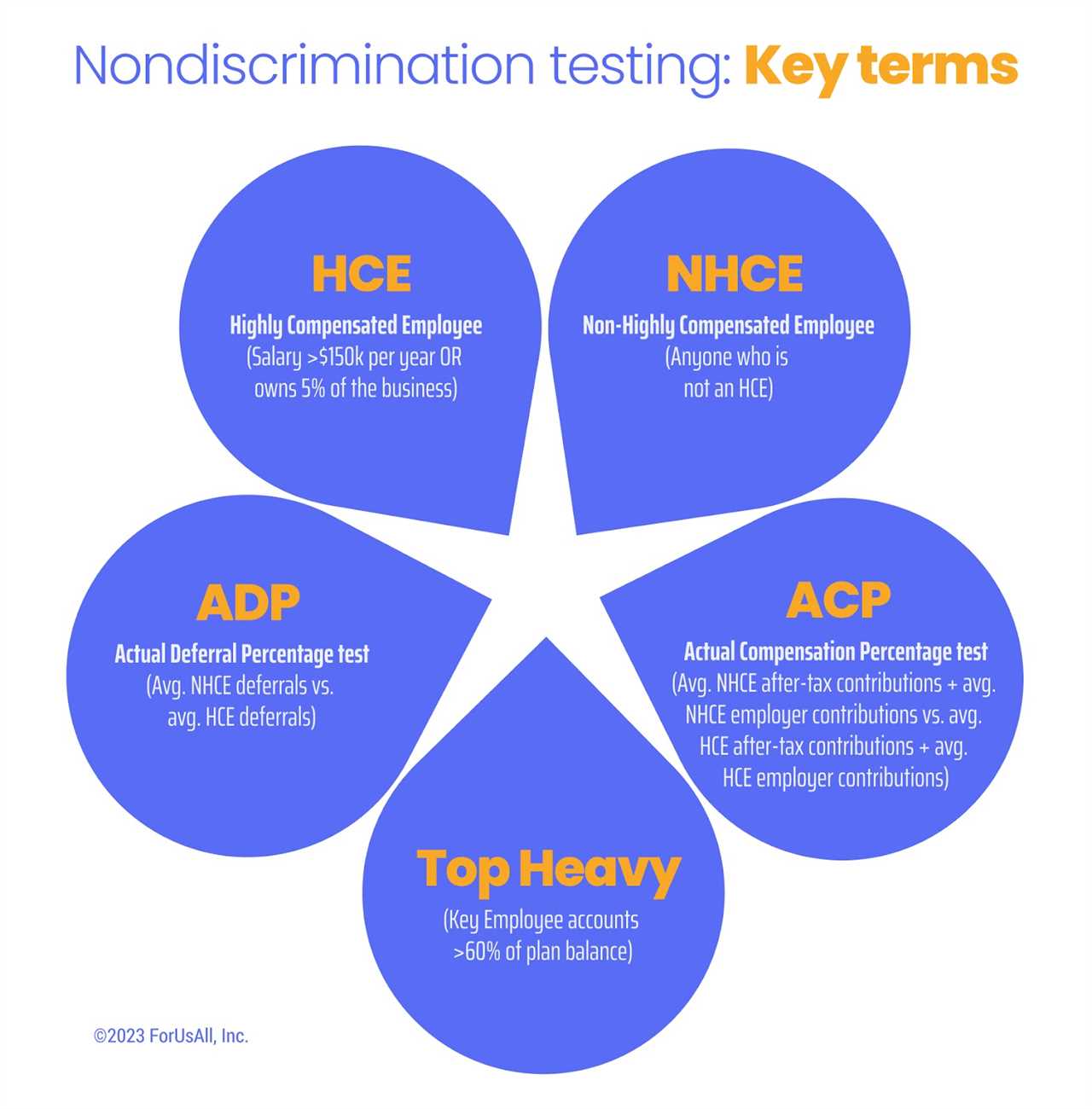

4. Non-Discrimination Testing

Another criterion for HCE classification is non-discrimination testing. This testing ensures that the retirement savings plan offered by the company does not disproportionately benefit HCEs compared to non-HCEs. If the plan fails this testing, certain corrective measures may need to be taken.

5. Annual Recalculation

HCE classification is recalculated annually based on the individual’s income and other relevant factors. This ensures that employees who may have been classified as HCEs in the previous year but no longer meet the criteria are not unfairly excluded from certain retirement savings options.

| Criteria | Description |

|---|---|

| Income Threshold | An individual must earn a certain level of compensation in the previous year. |

| Ownership or Control | An individual must own a significant percentage of the company or have control over its operations. |

| Family Attribution | If an individual’s family members also meet the income threshold or have ownership or control over the company, they may be classified as HCEs. |

| Non-Discrimination Testing | The retirement savings plan offered by the company must not disproportionately benefit HCEs compared to non-HCEs. |

| Annual Recalculation | HCE classification is recalculated annually based on the individual’s income and other relevant factors. |

Compensation Threshold

One of the key factors in determining if an employee is classified as a Highly Compensated Employee (HCE) is the compensation threshold. This threshold is an annual dollar amount that serves as a benchmark to determine if an employee’s compensation is considered high enough to meet the HCE criteria.

The compensation threshold is set by the Internal Revenue Service (IRS) and is adjusted annually to account for inflation. It is important for employers to stay updated on the current threshold to ensure accurate classification of their employees.

For the year 2021, the compensation threshold for HCE classification is set at $130,000. This means that any employee who earns a total compensation of $130,000 or more in a calendar year will meet the criteria for HCE classification.

It is important to note that the compensation threshold includes not only the employee’s salary, but also any bonuses, commissions, and other forms of compensation they may receive. This ensures that all forms of compensation are taken into account when determining HCE status.

Employers should carefully review their employees’ compensation packages and consider any potential changes in compensation throughout the year to ensure accurate classification of HCEs. Failure to properly classify employees can result in penalties and legal consequences.

Determining HCE Status

Once you understand the definition and criteria for a Highly Compensated Employee (HCE), the next step is to determine your own HCE status. This is an important step as it will determine your eligibility for certain retirement savings accounts and benefits.

Once you have calculated your compensation, you need to compare it to the compensation threshold set by the Internal Revenue Service (IRS). The threshold is adjusted annually and may vary depending on the year. If your compensation exceeds the threshold, you will be considered a Highly Compensated Employee.

Benefits and Considerations

Benefits:

- Access to Additional Retirement Savings Options: HCEs have the opportunity to contribute more to their retirement savings accounts compared to non-HCEs. This can help them build a larger nest egg for their future.

- Tax Advantages: Contributions made to retirement savings accounts by HCEs may be tax-deductible, reducing their taxable income for the year. This can result in potential tax savings.

- Employer Matching Contributions: Some employers may offer matching contributions to the retirement savings accounts of their HCEs. This can significantly boost the overall savings and provide an additional incentive to save for retirement.

Considerations:

- Complexity of Retirement Planning: With the potential for higher contributions and additional retirement savings options, retirement planning for HCEs can become more complex. Seeking the guidance of a financial advisor or retirement planning professional may be beneficial.

- Risk of Market Volatility: Investing in retirement savings accounts comes with inherent risks, including market volatility. HCEs should consider their risk tolerance and investment strategies when managing their retirement savings.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.