Exploring the Link Between Psychology and Investor Behavior

Freudian Motivation Theory, developed by Sigmund Freud, posits that human behavior is driven by unconscious desires and motivations. According to this theory, individuals are motivated by three main factors: the id, the ego, and the superego.

The id represents the primitive and instinctual desires of an individual, seeking immediate gratification without considering the consequences. In the context of investing, the id may drive individuals to make impulsive and risky investment decisions, driven by the desire for quick profits.

The ego, on the other hand, represents the rational and logical part of an individual’s psyche. It balances the desires of the id with the realities of the external world. In the context of investing, the ego may lead individuals to carefully analyze investment opportunities, considering the potential risks and rewards before making a decision.

The superego represents the moral and ethical values of an individual, internalized from society and upbringing. It acts as a conscience, guiding individuals to make decisions that align with societal norms and values. In the context of investing, the superego may lead individuals to prioritize socially responsible investments, considering the impact on the environment or society.

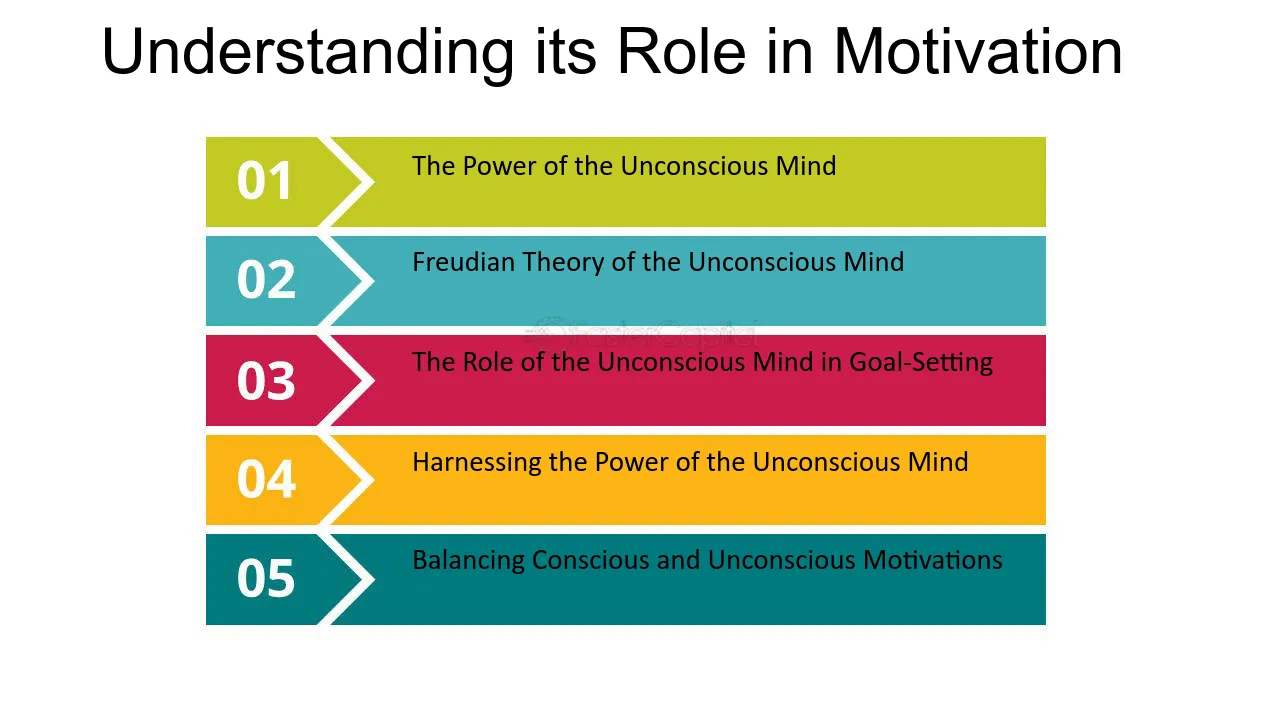

Key Concepts of Freudian Motivation Theory

Freudian motivation theory, developed by Sigmund Freud, is a psychological framework that seeks to understand human behavior and motivation. It is based on the idea that unconscious desires and conflicts drive our actions and shape our personality. In the context of investor behavior, Freudian motivation theory provides insights into the psychological factors that influence investment decisions.

One key concept of Freudian motivation theory is the role of the unconscious mind. According to Freud, the unconscious mind contains thoughts, memories, and desires that are hidden from conscious awareness but still influence our behavior. In the context of investing, this means that investors may be driven by unconscious fears, desires, or biases that can impact their decision-making process.

Another important concept is the role of defense mechanisms. Freud proposed that individuals use defense mechanisms to protect themselves from anxiety or discomfort. These defense mechanisms, such as denial, projection, or rationalization, can also be observed in investor behavior. For example, investors may deny the possibility of a market downturn or rationalize their investment decisions to avoid facing the potential loss.

Freudian motivation theory also emphasizes the importance of early childhood experiences in shaping personality and behavior. According to Freud, unresolved conflicts or traumas from childhood can influence adult behavior. In the context of investing, this suggests that past experiences, such as financial losses or gains, can impact an individual’s risk tolerance or decision-making process.

Implications for Investors and Financial Markets

One key implication is the recognition of the role of emotions in investment decisions. Freudian Motivation Theory suggests that emotions such as fear, greed, and anxiety can significantly impact investment choices. Investors who are aware of these emotions can take steps to manage them and make more rational decisions based on objective analysis rather than being driven solely by their emotions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.