Domicile Definition and Types

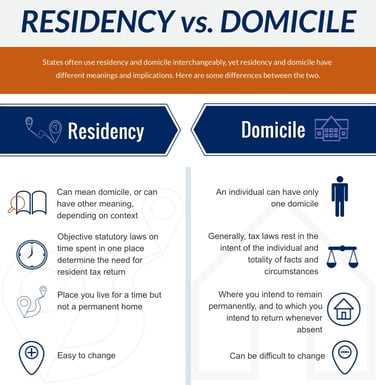

Domicile refers to the permanent legal residence of an individual. It is the place where a person has a long-term intention to reside and return to, even if they are temporarily living elsewhere. Domicile is an important concept in various legal and tax matters, as it determines an individual’s rights, obligations, and tax liabilities.

There are two main types of domicile: domicile of origin and domicile of choice.

Domicile of Origin:

Domicile of origin is acquired at birth and is initially based on the domicile of the individual’s parents. It is typically the domicile of the country where the individual is born. For example, if someone is born in the United States to parents who are U.S. citizens, their domicile of origin would be the United States.

Domicile of Choice:

Domicile of choice is acquired when an individual voluntarily establishes a new permanent residence in a different country or jurisdiction. It is based on the individual’s intention to reside in that new location indefinitely. To establish a domicile of choice, one must demonstrate a clear intention to make the new location their permanent home.

Importance of Domicile:

Domicile plays a crucial role in determining an individual’s legal and tax status. It affects matters such as inheritance, taxation, voting rights, and eligibility for certain benefits and services. Different countries have different rules regarding domicile, and it is important for individuals to understand the implications of their domicile status in order to comply with the applicable laws and regulations.

Conclusion:

Domicile is a legal concept that determines an individual’s permanent residence for legal and tax purposes. It is important to understand the concept of domicile as it has significant implications on an individual’s tax obligations and legal rights.

Domicile is important because it determines an individual’s tax liabilities. In many jurisdictions, individuals are subject to taxation based on their domicile rather than their residence. This means that even if a person is living and working in a different country, they may still be required to pay taxes in their country of domicile.

There are several factors that are taken into consideration when determining an individual’s domicile. These factors include the individual’s intent to remain in a particular place, their physical presence in that place, and their connections to that place, such as owning property or having family ties.

The Importance of Domicile for Taxation

For example, let’s say John is a citizen of Country A but has been living and working in Country B for the past five years. If John is considered to be domiciled in Country A, he may still be required to pay taxes in Country A on his worldwide income, even though he is physically residing in Country B.

Types of Domicile: Permanent and Temporary

There are two main types of domicile: permanent and temporary. Each type has its own implications and consequences in terms of taxation and legal responsibilities.

1. Permanent Domicile:

For tax purposes, individuals with a permanent domicile are usually subject to the tax laws of that jurisdiction, regardless of their current place of residence. They may be required to report and pay taxes on their worldwide income, assets, and investments to the tax authorities of their permanent domicile.

2. Temporary Domicile:

A temporary domicile, on the other hand, refers to a place where an individual resides temporarily, usually for work, education, or other specific purposes. It is a temporary arrangement and does not indicate a person’s permanent home or intention to establish long-term ties to that jurisdiction.

Individuals with a temporary domicile are generally subject to the tax laws of their permanent domicile, rather than the jurisdiction where they are temporarily residing. However, they may still have certain tax obligations in their temporary domicile, such as reporting and paying taxes on income earned within that jurisdiction.

It is important to note that establishing a temporary domicile does not necessarily exempt individuals from their tax obligations in their permanent domicile. They may still be required to report and pay taxes on their worldwide income and assets to the tax authorities of their permanent domicile.

Domicile Taxation and Its Implications

1. Resident Domicile Taxation: Individuals who are considered residents for tax purposes in a particular jurisdiction are subject to taxation on their worldwide income. This means that they are required to report and pay taxes on income earned both within and outside the jurisdiction. They may also be eligible for various tax deductions, credits, and exemptions offered by the jurisdiction.

2. Non-Resident Domicile Taxation: Non-residents, on the other hand, are only subject to taxation on income earned within the jurisdiction. They are not required to report or pay taxes on income earned outside the jurisdiction. However, they may still be subject to certain taxes, such as withholding taxes on certain types of income.

5. Legal and Financial Implications: Domicile taxation has significant legal and financial implications. Failing to comply with the tax laws and regulations of a jurisdiction can result in penalties, fines, and even legal consequences. It is essential for individuals to seek professional advice from tax experts or legal professionals to ensure they understand and comply with their domicile tax obligations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.