Introduction

Demand Draft

Checks

A check, on the other hand, is a negotiable instrument issued by an individual or a business entity. It instructs the bank to pay a specific amount to the recipient mentioned on the check. Unlike demand drafts, checks are not prepaid and rely on the availability of funds in the issuer’s account. When a check is presented for payment, the bank verifies the availability of funds and then processes the payment.

Differences and Considerations

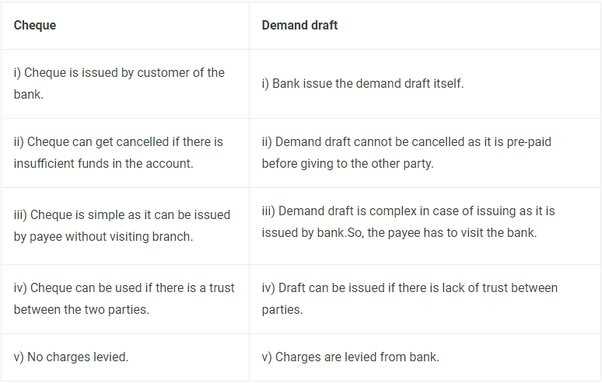

While both demand drafts and checks serve the purpose of making payments, there are some key differences to consider:

- Demand drafts are prepaid and guaranteed by the issuing bank, while checks rely on the availability of funds in the issuer’s account.

- Demand drafts are widely accepted for both domestic and international transactions, whereas checks are primarily used for domestic payments.

- Checks offer more convenience and flexibility for day-to-day transactions, while demand drafts are preferred for larger or cross-border transactions.

Conclusion

Demand Draft

When a customer requests a demand draft, they provide the bank with the necessary details, including the recipient’s name, address, and the amount to be paid. The bank then issues the demand draft, which is a physical document that contains all the relevant information. The customer can then deliver the demand draft to the recipient, who can deposit it into their bank account or encash it.

One of the advantages of using a demand draft is that it provides a secure method of payment. Since the funds are prepaid, there is no risk of the demand draft bouncing or being returned due to insufficient funds. Additionally, demand drafts can be easily tracked, as each draft is assigned a unique identification number.

Check

A check, on the other hand, is a payment instrument that allows the account holder to transfer funds to another party. Unlike a demand draft, a check is not prepaid, meaning that the funds are deducted from the account only when the check is presented for payment. Checks are commonly used for everyday transactions, such as paying bills or making purchases.

When a person writes a check, they fill in the necessary details, including the recipient’s name, the date, and the amount to be paid. The check is then signed by the account holder and handed over to the recipient. The recipient can then deposit the check into their bank account and receive the funds.

One advantage of using checks is that they provide a convenient method of payment. They can be easily carried and used for various transactions. However, checks also come with some disadvantages. There is a risk of the check bouncing if there are insufficient funds in the account. Additionally, checks can be forged or altered, leading to potential fraud.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.