Days Sales of Inventory (DSI): Definition, Formula, Importance

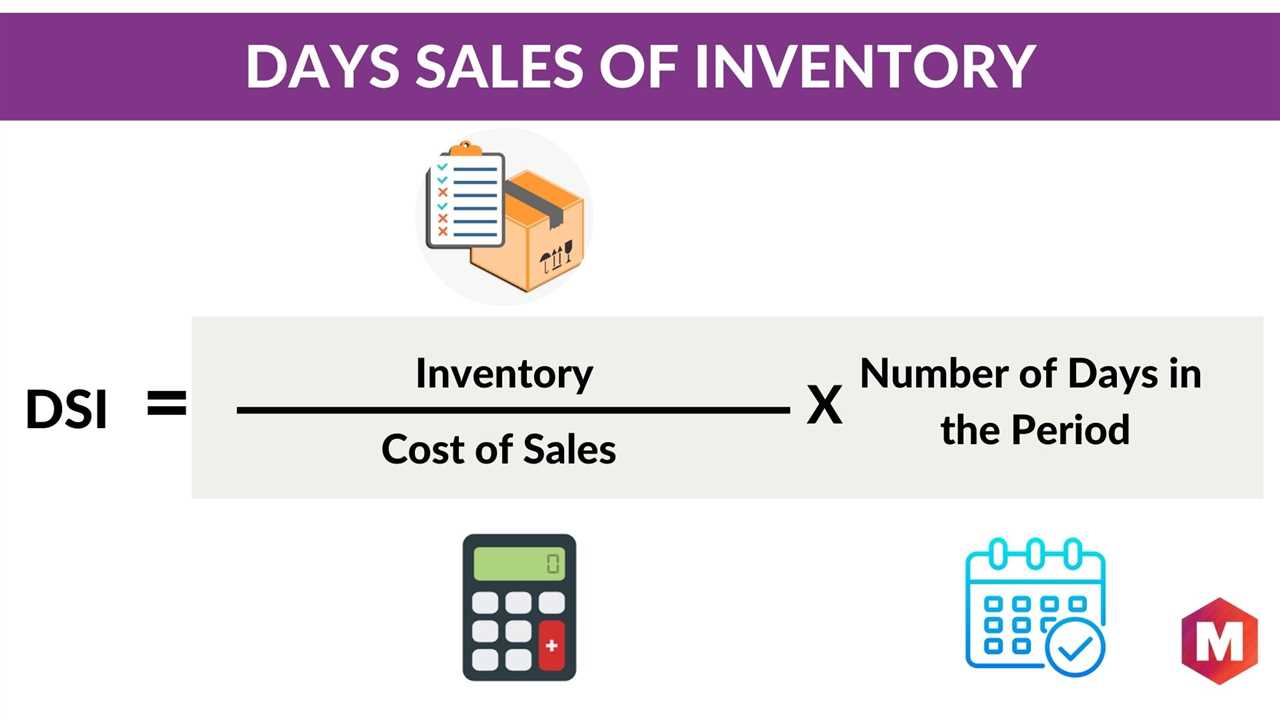

The formula to calculate DSI is:

| DSI = | (Average Inventory / Cost of Goods Sold) x 365 |

|---|

The average inventory is calculated by adding the beginning and ending inventory for a specific period and dividing it by two. The cost of goods sold (COGS) represents the direct costs incurred in producing or purchasing the goods that are sold during the same period.

The DSI metric is crucial for businesses as it provides insights into their inventory management efficiency. A high DSI indicates that a company is holding inventory for a longer period, which can lead to increased carrying costs, obsolescence, and reduced cash flow. On the other hand, a low DSI suggests that a company is selling its inventory quickly, which can be a positive sign of efficient operations and strong sales.

By monitoring DSI, businesses can identify potential issues in their inventory management and take necessary actions to optimize their inventory levels. This can include implementing just-in-time inventory systems, improving demand forecasting, and streamlining supply chain processes.

In addition, DSI can be compared to industry benchmarks or historical data to evaluate a company’s performance relative to its peers or its own past performance. This analysis can help identify areas for improvement and set realistic targets for inventory turnover.

What is Days Sales of Inventory (DSI)?

DSI is calculated by dividing the average inventory by the cost of goods sold (COGS) per day. The formula is:

DSI = (Average Inventory / COGS) x 365

The average inventory is calculated by adding the beginning and ending inventory and dividing it by 2. COGS represents the cost of producing or purchasing the goods that were sold during a specific period.

DSI is an important metric for businesses as it helps them understand how efficiently they are managing their inventory. A low DSI indicates that a company is selling its inventory quickly, which can be a positive sign. On the other hand, a high DSI suggests that a company is holding onto its inventory for a longer period, which may indicate potential issues such as slow sales, overstocking, or poor inventory management.

By monitoring and analyzing DSI, businesses can make informed decisions regarding their inventory levels, production planning, and sales strategies. They can identify trends, optimize their supply chain, and improve their cash flow by reducing carrying costs associated with excess inventory.

Overall, DSI provides valuable insights into a company’s inventory management and can help drive operational efficiency and profitability.

Importance of Days Sales of Inventory (DSI)

The Days Sales of Inventory (DSI) is a financial metric that measures the average number of days it takes for a company to sell its inventory. It is an important indicator of a company’s efficiency in managing its inventory and generating sales.

DSI is calculated by dividing the average inventory by the cost of goods sold per day. A lower DSI indicates that a company is able to sell its inventory quickly, which is generally seen as a positive sign. On the other hand, a higher DSI may indicate that a company is struggling to sell its inventory, which could lead to increased holding costs and potentially lower profitability.

1. Inventory Management: DSI helps companies assess their inventory management practices. By monitoring DSI, companies can identify inefficiencies in their inventory management processes and take necessary actions to optimize inventory levels. This can help reduce holding costs, minimize the risk of obsolescence, and improve cash flow.

2. Sales Performance: DSI is closely linked to a company’s sales performance. A low DSI indicates that a company is able to convert its inventory into sales quickly, which suggests strong demand for its products. On the other hand, a high DSI may indicate sluggish sales or excess inventory, which could be a sign of poor sales performance or ineffective marketing strategies.

3. Cash Flow Management: DSI is an important metric for managing cash flow. A low DSI means that a company can generate cash from sales more quickly, which can improve its liquidity position. Conversely, a high DSI may tie up cash in inventory, potentially leading to cash flow constraints. By monitoring DSI, companies can make informed decisions about inventory levels and adjust their cash flow management strategies accordingly.

4. Financial Analysis: DSI is a key component of financial analysis. It provides insights into a company’s operational efficiency, profitability, and liquidity. Investors and analysts often use DSI as a benchmark to compare companies within the same industry or sector. A company with a lower DSI compared to its peers may be considered more efficient in managing its inventory and generating sales.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.