The Importance of Data Analytics in Financial Analysis

1. Enhanced Decision Making

Data analytics provides financial analysts with valuable insights that can significantly improve decision-making processes. By analyzing large datasets, financial professionals can identify patterns, trends, and correlations that may not be apparent through traditional analysis methods. This enables them to make more accurate predictions and informed decisions, leading to better financial outcomes for businesses.

2. Risk Management

Data analytics is instrumental in identifying and managing risks in the financial sector. By analyzing historical data and market trends, financial analysts can identify potential risks and take proactive measures to mitigate them. This helps businesses to minimize losses, optimize investments, and ensure long-term sustainability.

Furthermore, data analytics can help in detecting fraudulent activities and identifying anomalies in financial transactions, which is crucial for maintaining the integrity of financial systems.

3. Cost Optimization

Data analytics can also play a significant role in optimizing costs for businesses. By analyzing financial data, companies can identify areas of inefficiency and implement cost-saving measures. This can include streamlining operations, identifying unnecessary expenses, and optimizing resource allocation. By leveraging data analytics, businesses can achieve cost savings and improve overall financial performance.

4. Competitive Advantage

Essential Techniques for Data Analytics

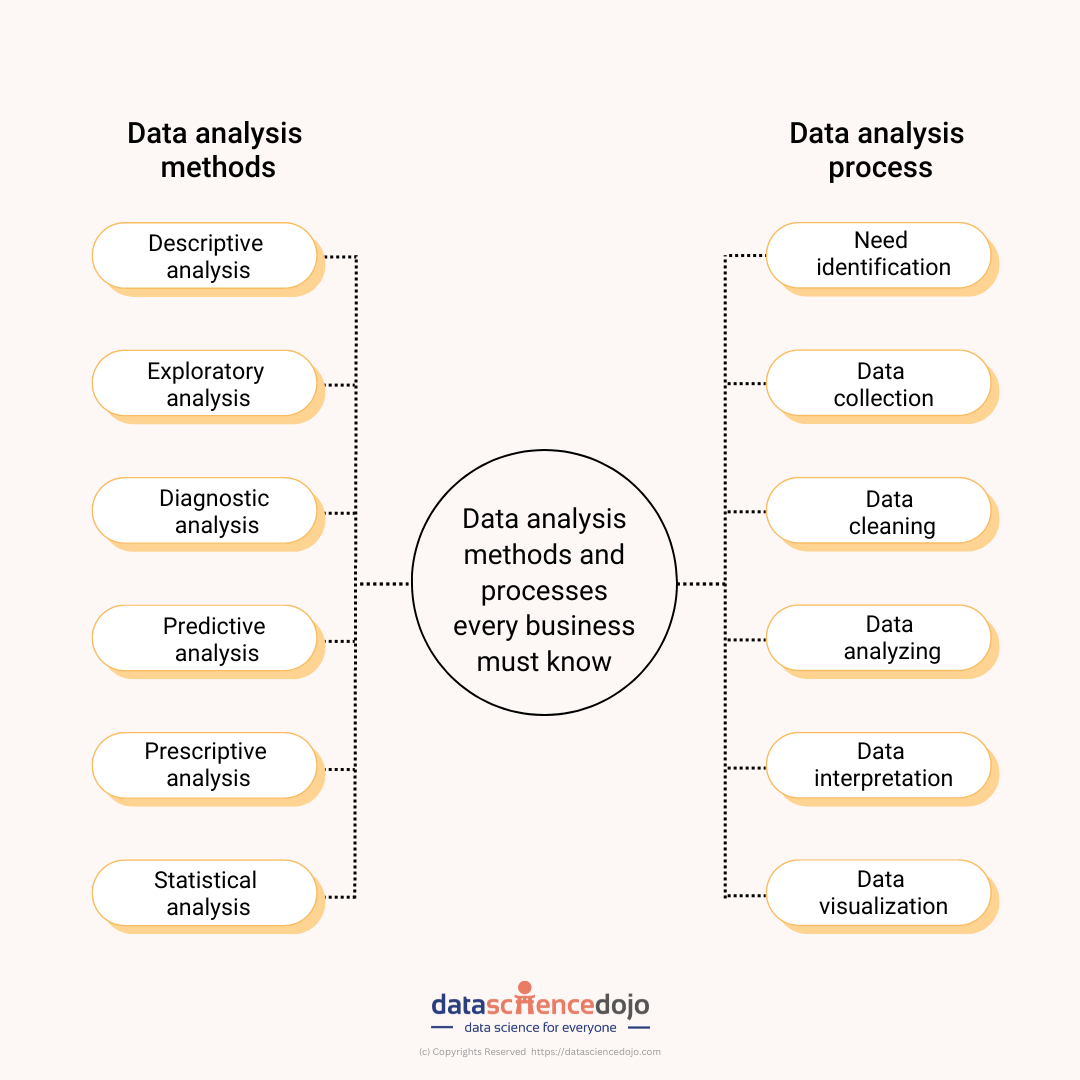

Data analytics is a powerful tool that can provide valuable insights and drive informed decision-making in financial analysis. To effectively utilize data analytics, it is important to understand and apply essential techniques. Here are four key techniques that are commonly used in data analytics:

1. Data Cleaning and Preprocessing:

Before diving into data analysis, it is crucial to ensure that the data is clean and ready for analysis. This involves removing any duplicate or irrelevant data, handling missing values, and standardizing the data format. By cleaning and preprocessing the data, analysts can eliminate errors and inconsistencies that may affect the accuracy of the analysis.

2. Data Visualization:

Data visualization is the process of presenting data in a visual format, such as charts, graphs, or maps. This technique allows analysts to easily identify patterns, trends, and relationships within the data. By visualizing the data, complex information can be communicated more effectively, making it easier for stakeholders to understand and interpret the analysis results.

3. Statistical Analysis:

Statistical analysis involves applying various statistical techniques to analyze and interpret the data. This includes calculating descriptive statistics, conducting hypothesis testing, and performing regression analysis. By using statistical analysis, analysts can uncover meaningful insights, identify correlations, and make predictions based on the data.

4. Machine Learning:

Machine learning is a branch of artificial intelligence that focuses on developing algorithms and models that can learn from data and make predictions or decisions. This technique is particularly useful in financial analysis, as it can analyze large volumes of data and identify complex patterns or anomalies. Machine learning algorithms can be trained to predict stock prices, detect fraud, or optimize investment portfolios.

By utilizing these essential techniques, analysts can effectively leverage data analytics to gain valuable insights and improve financial analysis. However, it is important to note that the success of data analytics relies not only on the techniques used but also on the quality and relevance of the data being analyzed.

Benefits of Data Analytics in Financial Analysis

Data analytics plays a crucial role in financial analysis, providing numerous benefits to businesses and organizations. By utilizing data analytics techniques, financial analysts can gain valuable insights and make informed decisions that can significantly impact the success of their operations.

Here are some key benefits of using data analytics in financial analysis:

| 1. Improved Accuracy | Data analytics allows financial analysts to analyze large volumes of data quickly and accurately. By using advanced algorithms and statistical models, analysts can identify patterns, trends, and anomalies in financial data, leading to more accurate predictions and forecasts. |

| 2. Enhanced Decision Making | With the help of data analytics, financial analysts can make more informed decisions. By analyzing historical financial data, market trends, and customer behavior, analysts can identify potential risks and opportunities, enabling them to make strategic decisions that can maximize profitability and minimize risks. |

| 3. Cost Reduction | Data analytics can help businesses reduce costs by identifying areas of inefficiency and waste. By analyzing financial data, analysts can pinpoint areas where expenses can be reduced or eliminated, leading to improved cost management and increased profitability. |

| 4. Fraud Detection | Data analytics techniques can be used to detect and prevent fraudulent activities in financial transactions. By analyzing patterns and anomalies in financial data, analysts can identify potential fraud cases and take appropriate actions to mitigate risks and protect the organization’s financial assets. |

| 5. Competitive Advantage |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.