Cum Dividend: Definition, Meaning, How It Works, and Example

Definition:

Cum dividend is a Latin term that translates to “with dividend.” It is used to indicate that a stock is trading with the right to receive the next dividend payment. In other words, if you purchase a cum dividend stock before the ex-dividend date, you will be eligible to receive the dividend.

Let’s say a company announces a dividend of $0.50 per share and sets an ex-dividend date of June 1st. If you purchase the stock on or before May 31st, you will be considered a cum dividend shareholder and will receive the $0.50 dividend per share. However, if you buy the stock on or after June 1st, you will not be entitled to the dividend payment.

Example:

Suppose you decide to invest in Company XYZ, which has declared a dividend of $1 per share. The ex-dividend date is set for July 15th. You purchase 100 shares of Company XYZ on July 10th, which means you are a cum dividend shareholder. On the dividend payment date, you will receive $100 ($1 per share x 100 shares) as a dividend payment.

Conclusion:

What is Cum Dividend?

Cum Dividend is a term used in finance to describe the status of a stock that is eligible to receive a dividend payment. When a stock is cum dividend, it means that the buyer of the stock is entitled to receive the upcoming dividend payment. This is in contrast to ex-dividend, which means that the buyer of the stock is not entitled to the dividend payment.

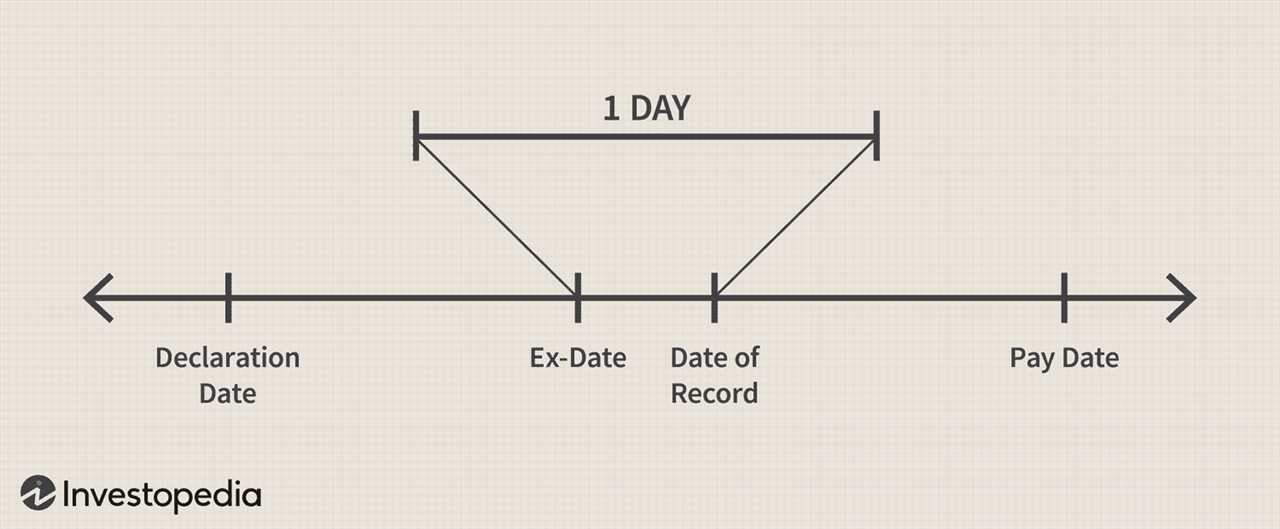

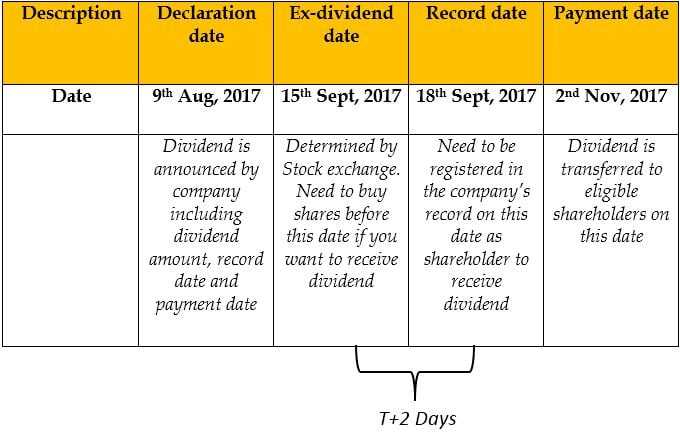

When a company declares a dividend, it sets a record date, which is the date on which the company determines who is eligible to receive the dividend. The stock is said to be cum dividend up until the record date. After the record date, the stock becomes ex-dividend, and anyone who buys the stock after that date will not receive the dividend payment.

How Does Cum Dividend Work?

Let’s say Company XYZ declares a dividend of $0.50 per share and sets a record date of June 1st. If you own shares of Company XYZ on or before June 1st, you are considered cum dividend and will receive the $0.50 dividend payment for each share you own. However, if you buy shares of Company XYZ on or after June 2nd, you will be considered ex-dividend and will not receive the dividend payment.

Example of Cum Dividend

Let’s use an example to illustrate how cum dividend works. Company ABC declares a dividend of $1 per share and sets a record date of July 15th. John owns 100 shares of Company ABC on July 15th, so he is considered cum dividend and will receive a dividend payment of $100 ($1 per share x 100 shares).

On July 16th, Susan decides to buy 50 shares of Company ABC. However, since she bought the shares after the record date, she is considered ex-dividend and will not receive the dividend payment.

In summary, cum dividend refers to the status of a stock that is eligible to receive a dividend payment. It is important for investors to be aware of the record date when buying or selling stocks, as it determines whether they will be entitled to the dividend payment.

How Does Cum Dividend Work?

Cum dividend is a term used in finance to describe the status of a stock when it is eligible to receive a dividend payment. When a stock is cum dividend, it means that the buyer of the stock is entitled to receive the upcoming dividend payment. This is in contrast to ex dividend, which means that the buyer of the stock is not entitled to receive the dividend payment.

When a company declares a dividend, it sets a record date, which is the date on which shareholders must be on the company’s books in order to receive the dividend. The record date is usually a few days before the payment date. If an investor purchases a stock before the record date, they are considered to be buying the stock cum dividend and will be eligible to receive the dividend payment.

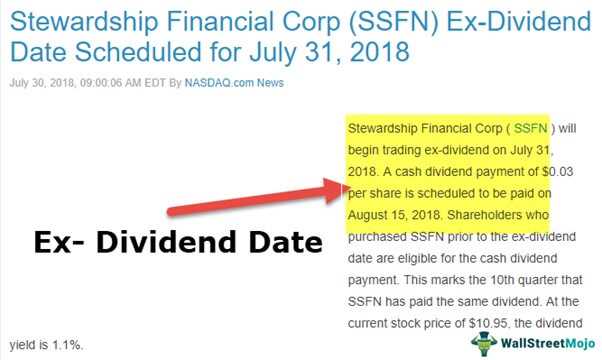

On the other hand, if an investor purchases a stock on or after the ex dividend date, they are considered to be buying the stock ex dividend and will not be eligible to receive the dividend payment. This is because the seller of the stock has already been entitled to receive the dividend payment.

It is important for investors to be aware of the cum dividend and ex dividend dates when buying or selling stocks, as it can affect their eligibility to receive dividend payments. Additionally, the price of a stock may be affected by whether it is cum dividend or ex dividend, as investors may be willing to pay a higher price for a stock that is cum dividend and eligible to receive a dividend payment.

In summary, cum dividend refers to the status of a stock when it is eligible to receive a dividend payment. Investors who purchase a stock before the record date are considered to be buying the stock cum dividend and will be entitled to receive the dividend payment. On the other hand, investors who purchase a stock on or after the ex dividend date are considered to be buying the stock ex dividend and will not be eligible to receive the dividend payment.

Example of Cum Dividend

Let’s say Company XYZ declares a dividend of $1 per share to be paid to its shareholders on June 1st. The company sets a record date of May 15th, which means that shareholders who own the stock on or before May 15th will be eligible to receive the dividend.

Let’s say you bought the shares on May 10th. On June 1st, when the dividend is paid, you will receive $100 ($1 per share multiplied by 100 shares) in dividend income. However, if you bought the shares on May 20th, you would not be entitled to receive the dividend.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.