What is a Counteroffer?

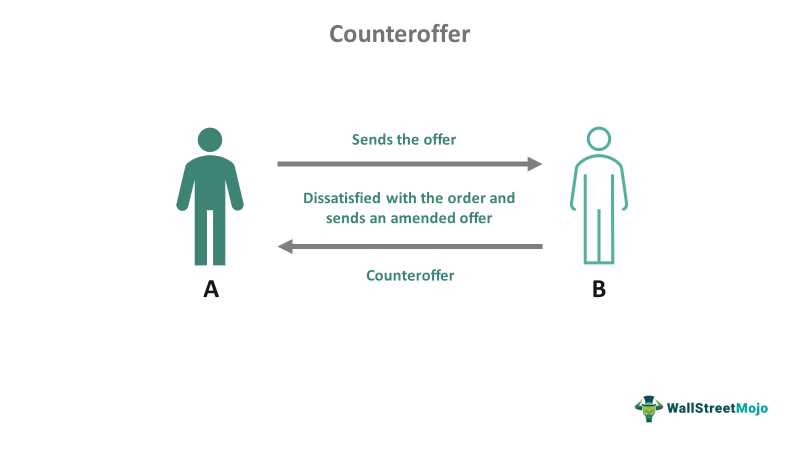

A counteroffer is a response made by the recipient of an initial offer in a negotiation. It is a rejection of the original offer, accompanied by a new proposal that modifies some or all of the terms and conditions. In the context of mergers and acquisitions (M&A), a counteroffer is a common occurrence during negotiations between buyers and sellers.

Importance of Counteroffers in M&A Negotiations

Counteroffers also help in establishing a fair and competitive market value for the target company. By receiving multiple counteroffers from different buyers, the seller can compare and assess the offers to determine the best possible deal. This competitive bidding process can drive up the purchase price and create a favorable outcome for the seller.

Additionally, counteroffers enable buyers to understand the seller’s priorities and preferences. By analyzing the counteroffer, buyers can gain insights into the seller’s motivations, concerns, and areas of flexibility. This information can be valuable in structuring a revised offer that addresses the seller’s needs while still aligning with the buyer’s acquisition strategy.

Examples of Counteroffers in M&A Deals

Counteroffers in M&A deals can take various forms, depending on the specific circumstances and objectives of the parties involved. Here are a few examples:

| Example | Description |

|---|---|

| Increased Purchase Price | The seller proposes a higher price than the initial offer to maximize their financial gain. |

| Modified Payment Structure | The seller suggests alternative payment terms, such as a higher upfront payment or staggered payments over time. |

| Additional Conditions | The seller includes additional conditions, such as non-compete agreements or employment contracts for key employees. |

These examples demonstrate the flexibility and creativity that can be employed in making counteroffers to achieve the desired outcome in an M&A transaction.

Examples of Counteroffers in M&A Deals

1. Price Adjustment Counteroffer:

2. Earnout Counteroffer:

3. Non-Financial Counteroffer:

Counteroffers in M&A deals are not limited to financial terms. Non-financial counteroffers can include changes to governance structure, management roles, or post-merger integration plans. For example, the target company may propose a counteroffer to maintain its existing management team or to have a say in the decision-making process post-merger.

4. Asset Exclusion Counteroffer:

In some cases, the acquiring company may propose a counteroffer to exclude certain assets or liabilities from the deal. This can be done to reduce the financial burden or to address regulatory concerns. For instance, if the target company has a legal dispute or a non-performing asset, the acquiring company may propose excluding it from the deal or adjusting the purchase price accordingly.

These are just a few examples of counteroffers in M&A deals. Each counteroffer is unique and tailored to the specific circumstances of the deal. It is important for both parties to carefully consider and negotiate counteroffers to ensure a mutually beneficial outcome.

Effective Strategies for Making Counteroffers

1. Understand the other party’s motivations: Before making a counteroffer, it is crucial to understand the motivations and priorities of the other party. This will help you tailor your counteroffer in a way that appeals to their interests and increases the likelihood of acceptance.

2. Research market trends and benchmarks: Conduct thorough research on market trends and benchmarks to support your counteroffer. This will provide you with valuable data and insights that can strengthen your position and justify your proposed terms.

3. Be realistic: While it is important to negotiate for favorable terms, it is also important to be realistic. Setting unrealistic expectations may lead to a breakdown in negotiations. Consider the current market conditions and the other party’s position when formulating your counteroffer.

4. Communicate clearly and confidently: When presenting your counteroffer, it is important to communicate clearly and confidently. Clearly articulate your proposed terms and the rationale behind them. Confidence in your position can help sway the other party and increase the chances of acceptance.

5. Be prepared to compromise: Negotiations often involve a certain degree of compromise. Be prepared to make concessions and find common ground with the other party. This shows a willingness to work towards a mutually beneficial agreement and can help build trust and rapport.

6. Seek professional advice: If you are unsure about the negotiation process or need assistance in formulating your counteroffer, consider seeking professional advice. Experienced M&A advisors or legal professionals can provide valuable guidance and help you navigate the complexities of the negotiation process.

By employing these effective strategies, you can increase your chances of success when making counteroffers in M&A negotiations. Remember to approach negotiations with a collaborative mindset and a focus on achieving a mutually beneficial outcome.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.