Definition and Explanation

Contango

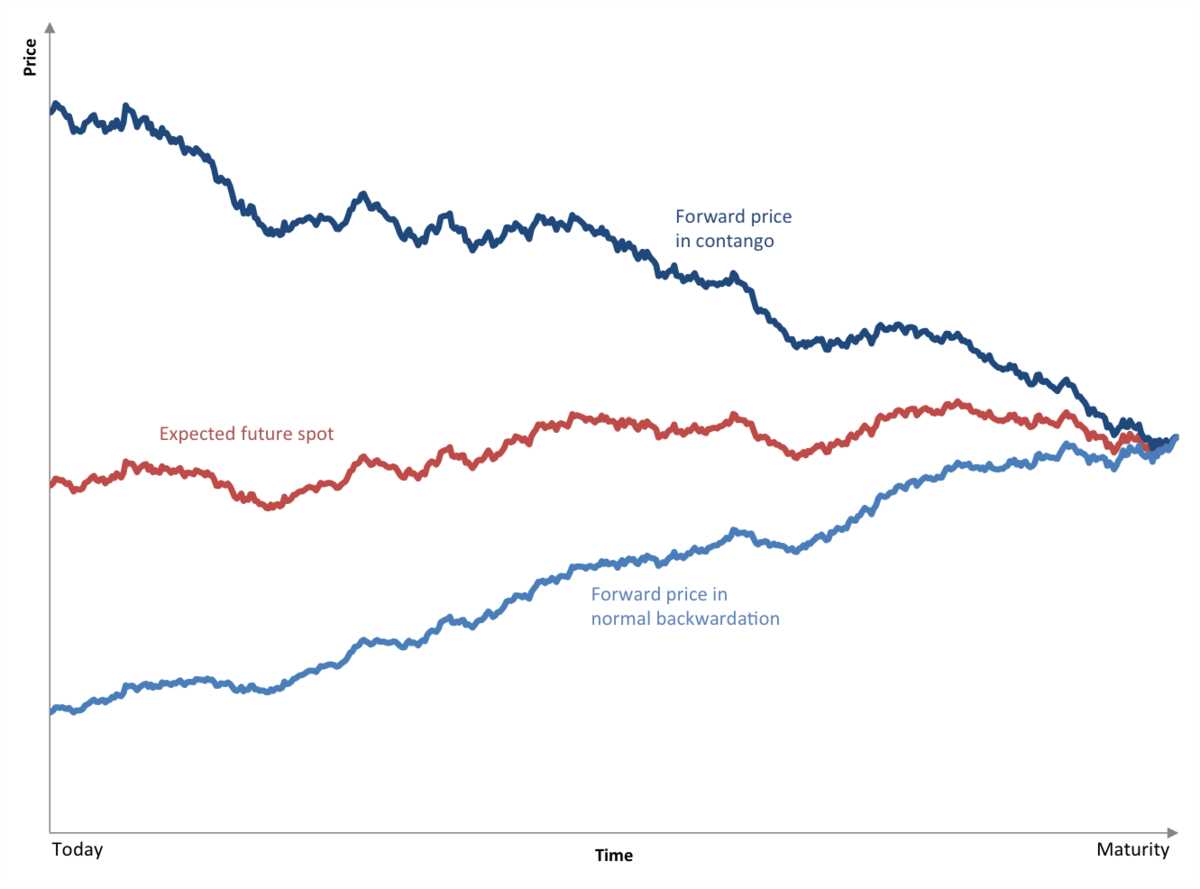

Contango refers to a situation where the futures price of a commodity is higher than the spot price. In other words, it occurs when the price of a commodity for future delivery is higher than the price for immediate delivery. This creates an upward sloping curve on the futures price chart.

There are several factors that can contribute to the occurrence of contango. One of the main reasons is the cost of carry. When investors buy futures contracts, they have to pay for storage, insurance, and financing costs. These costs are factored into the futures price, causing it to be higher than the spot price.

Another factor that can lead to contango is market expectations. If market participants anticipate an increase in the demand or a decrease in the supply of a commodity in the future, they may be willing to pay a premium for the futures contracts, driving up the futures price.

Backwardation

There are several reasons why backwardation may occur. One of the main factors is the expectation of a decrease in the demand or an increase in the supply of a commodity in the future. If market participants believe that the commodity will be more readily available in the future, they may be willing to accept a lower price for immediate delivery, leading to backwardation.

Another factor that can contribute to backwardation is the cost of carry. If the cost of storing and financing a commodity is high, market participants may prefer to sell their holdings in the spot market rather than holding them in futures contracts, leading to a higher spot price compared to the futures price.

| Contango | Backwardation |

|---|---|

| Futures price higher than spot price | Spot price higher than futures price |

| Upward sloping futures price curve | Downward sloping futures price curve |

| Cost of carry and market expectations contribute to contango | Expectations of decreased demand or increased supply contribute to backwardation |

It is important to note that contango and backwardation are not permanent states and can change over time. Market conditions, supply and demand factors, and investor sentiment can all influence the occurrence and duration of these phenomena.

Causes of Contango

Contango is a situation in the futures market where the future price of a commodity is higher than the spot price. This can occur due to several factors:

1. Storage Costs

One of the main causes of contango is the cost of storing the underlying commodity. When the future price is higher than the spot price, it creates an incentive for market participants to store the commodity and sell it in the future at a higher price. This increased demand for storage leads to higher storage costs, which contribute to the contango effect.

2. Financing Costs

3. Market Expectations

Market expectations about the future supply and demand of a commodity can also contribute to contango. If market participants anticipate that the supply of a commodity will increase or the demand will decrease in the future, they may be willing to pay a premium for the commodity in the futures market. This anticipation of future price increases can lead to contango.

4. Market Imbalances

Contango can also occur due to market imbalances between buyers and sellers. If there is a higher demand for futures contracts than there is supply, it can drive up the price of the futures contracts relative to the spot price. This imbalance in supply and demand can contribute to contango.

Causes of Backwardation

Backwardation is a term used in the financial markets to describe a situation where the futures price of a commodity is lower than the spot price. This means that the market expects the price of the commodity to decrease in the future. There are several factors that can cause backwardation:

1. Supply and demand imbalances

One of the main causes of backwardation is when there is a shortage of the commodity in the market. This can occur due to various reasons such as natural disasters, geopolitical tensions, or production disruptions. When the supply of the commodity is limited, and demand remains strong, the futures price can be lower than the spot price.

2. Storage costs

In some cases, the cost of storing the commodity can be high. This is particularly true for commodities that have a limited shelf life or require specialized storage facilities. When the cost of storage exceeds the expected price increase, it can create backwardation in the futures market.

3. Seasonal factors

4. Market sentiment

Market sentiment and investor expectations can also play a role in causing backwardation. If investors believe that the price of a commodity will decline in the future, they may sell futures contracts, pushing the futures price lower than the spot price. This can create a self-fulfilling prophecy, as more investors sell contracts, further driving down the futures price.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.