Clawback: Definition, Meaning, How It Works, and Example

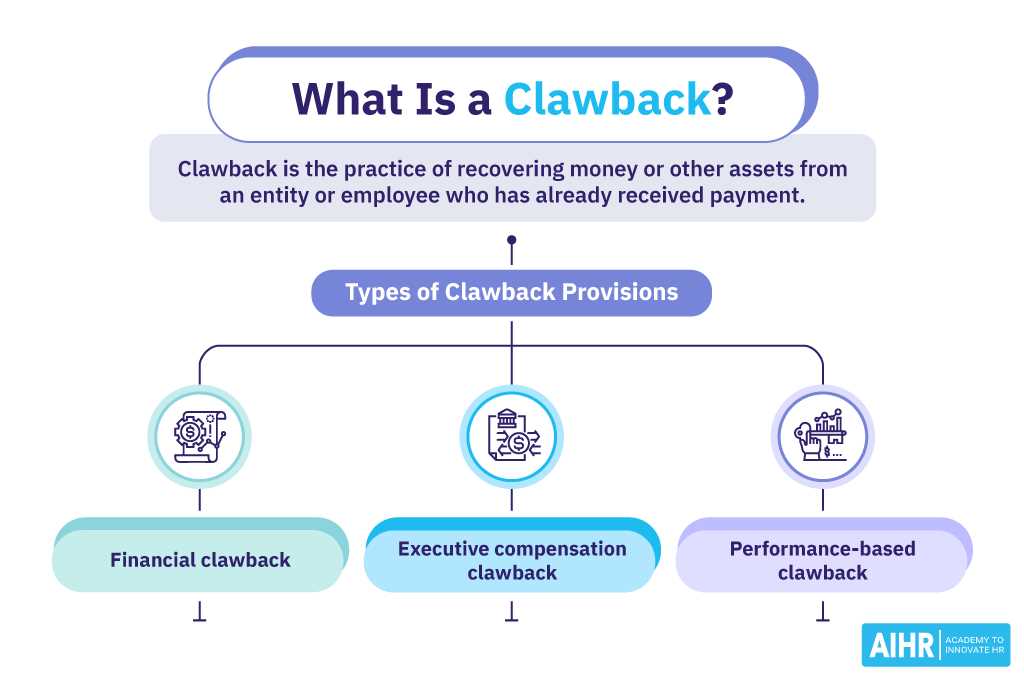

Clawback is a term used in corporate finance to refer to the process of reclaiming money or assets that have been previously distributed or paid out. It is typically done when certain conditions or criteria are not met, or when there has been a violation of an agreement or contract.

Clawbacks are often used as a means of recouping executive compensation in cases where the executive’s performance or conduct has been deemed unsatisfactory or unethical. This can include situations such as financial fraud, misconduct, or failure to meet performance targets.

One example of a clawback is the repayment of bonuses or stock options that were awarded to executives based on certain financial targets that were later found to be manipulated or misrepresented. In such cases, the company may seek to recover the funds or assets that were improperly obtained.

The process of clawback typically involves legal and contractual mechanisms that allow the company to reclaim the funds or assets. This can include provisions in employment contracts, shareholder agreements, or other legal documents that outline the conditions under which clawbacks can be initiated.

Clawbacks are often seen as a way to hold executives accountable for their actions and to align their interests with those of the company and its shareholders. By implementing clawback provisions, companies can discourage unethical behavior and ensure that executives are incentivized to act in the best interests of the organization.

Conclusion

Clawbacks are an important tool in corporate finance that allows companies to reclaim money or assets that have been improperly distributed. They are typically used in cases of executive misconduct or failure to meet performance targets. By implementing clawback provisions, companies can promote accountability and align the interests of executives with those of the organization.

CORPORATE FINANCE BASICS

Corporate finance is a branch of finance that deals with the financial decisions made by corporations. It involves analyzing and managing the financial resources of a company to achieve its financial goals.

One important concept in corporate finance is the clawback. A clawback is a provision in a contract that allows a company to recover money or assets from an employee or executive if certain conditions are not met.

The purpose of a clawback is to align the interests of employees and executives with the long-term success of the company. It provides an incentive for them to make decisions that are in the best interest of the company and its shareholders.

For example, let’s say a company grants stock options to its executives. The stock options have a vesting period of five years, meaning the executives can exercise the options and buy the company’s stock after five years. However, if the company’s stock price declines significantly during that five-year period, the clawback provision may allow the company to cancel or claw back the stock options.

Clawbacks can also be used in cases of financial fraud or misconduct. If an employee or executive engages in fraudulent activities or violates company policies, the company may use the clawback provision to recover any bonuses or incentives that were awarded based on false information.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.